How to Calculate Your Future Airbnb Returns

Is Buying a Tiny House a Good Investment in 2021?

Investing in short-term rentals can be a lucrative move. In fact, vacation rentals can generate up to three times more revenue than traditional long-term rentals. (Check out some of the numbers here to see for yourself!) However, not everyone that becomes an Airbnb host generates a good return. If you want to get a good Airbnb return on investment, you need to learn how to find profitable Airbnb rentals for sale. The key to finding a profitable Airbnb investment is to run the numbers.

In this blog, we discuss how to evaluate your future Airbnb returns. But before we get into that, let’s first understand the key calculations used to project Airbnb returns.

3 Key Metrics Used to Project Airbnb Returns

Before buying an Airbnb property, you should determine how much you can make. Calculating Airbnb returns can help you analyze whether putting your money into an Airbnb rental for sale makes financial sense or not. With the right Airbnb metrics, you can compare the profitability of several Airbnb investment properties for sale and make an informed investment decision.

Here are the key calculations you need to keep in mind when conducting your Airbnb investment analysis:

Related: 4 Key Airbnb Investment Metrics You Should Know

1. Airbnb Cash Flow

The first key metric that real estate investors use to estimate Airbnb returns is Airbnb cash flow. This is the difference between the rental income and the rental expenses of an investment property. By calculating the Airbnb cash flow, you’ll get a more accurate value of the vacation rental’s profit margin.

It’s recommended that you only invest in Airbnb investment properties with positive cash flow, especially if you are a beginner real estate investor. With positive cash flow properties, you will be making money every month as your income will be higher than your expenses. Having access to a monthly stream of income can help you grow your portfolio faster. Apart from enabling you to save for a down payment, positive cash flow properties are also more attractive to lenders.

2. Airbnb Cash on Cash Return

Airbnb cash on cash return is a metric used to forecast ROI when an Airbnb rental property is paid for using a mortgage. It is the ratio of the annual pre-tax cash flow of a vacation rental to the total cash invested. While the value of a good cash on cash return tends to vary with different factors such as location and investment property type, a good Airbnb cash on cash return should be above 8%.

3. Airbnb Cap Rate

Another key metric you should use in calculating your Airbnb returns is the Airbnb capitalization rate. This is an ROI metric that measures the net operating income of an Airbnb rental property relative to its fair market value or property price. This metric is used to calculate Airbnb return on investment without taking into consideration the investment property financing method. Although this metric is not as complete as the Airbnb cash on cash return, real estate investors can use it to quickly compare the profitability potential of multiple Airbnb properties for sale.

Related: What Is a Good Cap Rate for an Airbnb Rental Property?

Key Metrics: Average Airbnb Daily Rate Explained

The Easiest Way to Calculate Your Airbnb Returns

So, how much can you really make with Airbnb? Calculating future Airbnb returns is easier said than done. One main reason for this is because it’s not easy to get accurate data on rental income and rental expenses. Collecting Airbnb data manually and using Airbnb investment analysis spreadsheets to project future Airbnb returns can take several months.

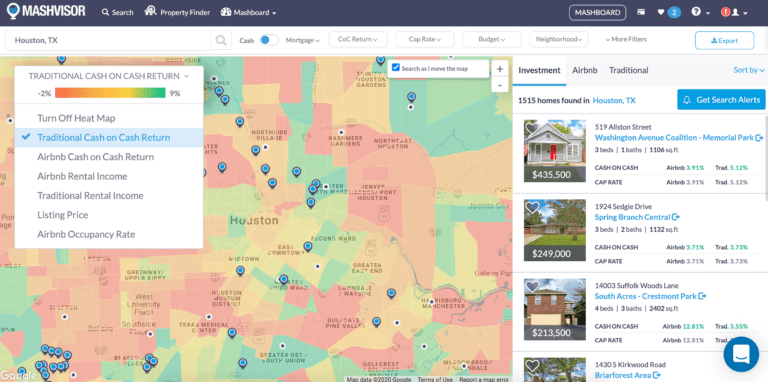

To get the answer to this important question quickly and efficiently, you need a single real estate investment tool –Mashvisor’s Airbnb calculator. Until now, projecting the potential returns of an Airbnb rental property has been a guessing game. Fortunately, the Airbnb calculator now makes it possible for any investor to accurately determine how profitable a vacation rental is. This is a special type of investment property calculator that conducts investment property analysis for short-term rentals in the US housing market.

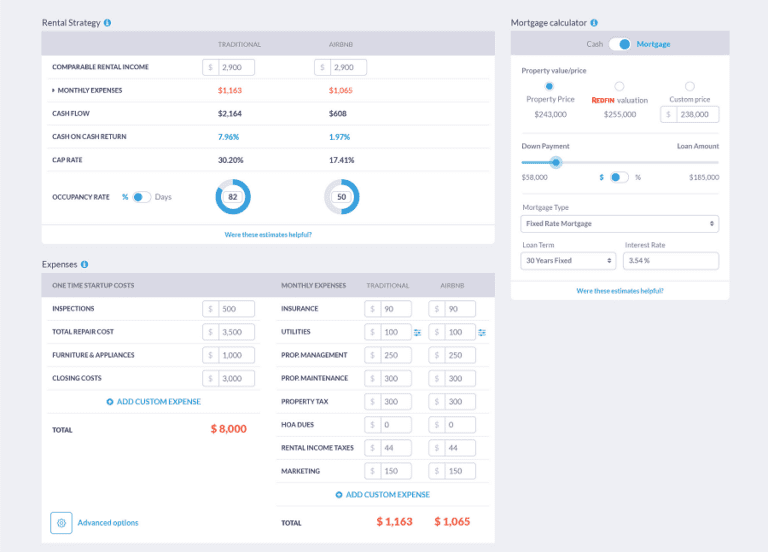

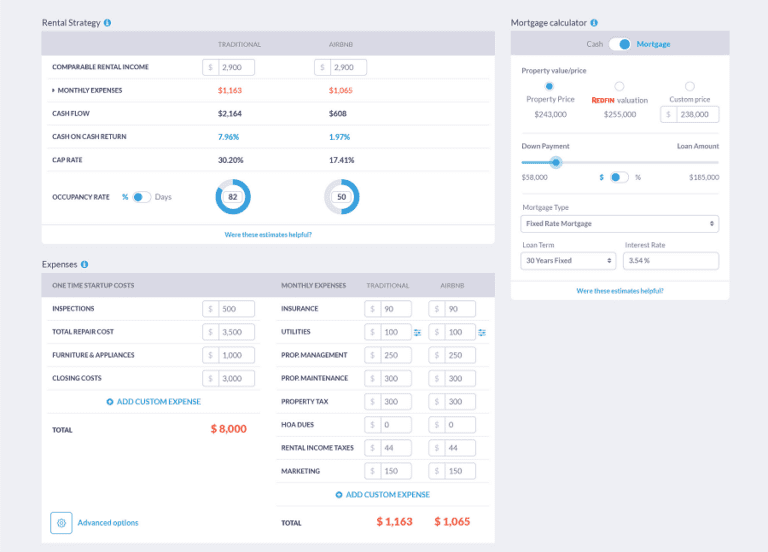

Mashvisor’s calculator is the go-to tool for figuring out future Airbnb returns.

The Airbnb calculator uses the most up-to-date Airbnb data from the homesharing site itself and machine-learning algorithms to quickly and accurately calculate key Airbnb metrics. And active hosts verify Mashvisor’s calculations.

Mashvisor’s Airbnb calculator will estimate Airbnb income based on the performance of comparable Airbnb listings in the area. This is a product of the daily rate and the Airbnb occupancy rate of the rental comps. The Airbnb calculator also provides estimates of rental expenses. Being an interactive tool, investors can add and adjust rental expenses to get accurate projections of future Airbnb cash flow.

Apart from Airbnb cash flow, the Airbnb calculator also provides you with pre-calculated data on Airbnb cap rate and Airbnb cash on cash return. Calculating these ROI metrics is complicated and that’s why the Airbnb calculator is essential.

Find a Profitable Airbnb Investment Property

Related: Airbnb Data: What Real Estate Investors Need and Where to Get It

The Bottom Line

When done right, the Airbnb investment strategy can be a lucrative one. The good thing is that making money with Airbnb rentals is not as hard as it used to be in the past. It boils down to how well you can project your Airbnb returns before making a purchase. The easiest and most accurate way to do it is to use Mashvisor’s Airbnb calculator to estimate key Airbnb metrics like cash flow, cash on cash return, and cap rate. With Mashvisor, owning an Airbnb can be profitable for anyone.

Start out your 7-day free trial with Mashvisor now.

Start Your Investment Property Search!

Cap RateCash FlowCash on Cash ReturnInvestment CalculatorInvestment Property AnalysisReturn on Investment

7 Real Estate Tax Benefits to Take Advantage Of

Recent Comments