Crowdstreet Review 2022: An Honest Review of the Largest Online Real Estate Investment Marketplace

Founded in 2013, Crowdstreet has become a leading platform connecting accredited investors with various real estate investments through its crowdfunding platform shortly after the JOBS Act allowed this business model.

I have personally invested in two brand new construction projects through Crowdstreet. The first is a student housing project in Texas in late 2019, and the second is a workforce housing project in another part of Texas in early 2021. Both expect annual returns (measured by internal rate of return) of more than 20% per year. This is slightly higher than the average realized return of 17.3% on the 63 trades completed on the platform, which should be to be expected for an investment considered to be on the higher end of the risk spectrum in the types of trades it offers.

Having invested through Crowdstreet and many other real estate investment firms for about 4 years, I can compare and contrast Crowdstreet and my experience with them well with other options for your real estate dollars. I can’t say I’m not biased; Crowdstreet is an advertiser and referral partner for Physician on FIRE.

Crowdstreet Transaction Process

While being the biggest doesn’t automatically make it the best, I feel that Crowdstreet stands out in both the variety and number of deals it offers.

Some real estate companies, such as Origin Investments and DLP, only provide funding to accredited investors. Others, including Fundrise, Groundfloor and Diversyfund, specialize in funds for non-accredited investors. These funds are a great way to get instant diversification in passive real estate, but you have little control over what types of investments you make and where.

Other platforms focus on different niches. PeerStreet lets you invest in personal loans for fixed and flip properties. Roofstock offers turnkey single-family rental properties for sale. Acretrader focuses on farmland.

The platforms most similar to Crowdstreet are probably EquityMultiple, Alpha Investing, and RealtyMogul. All three offer individual transactions and the occasional real estate fund.

What sets Crowdstreet apart is the number and breadth of deal types on offer.

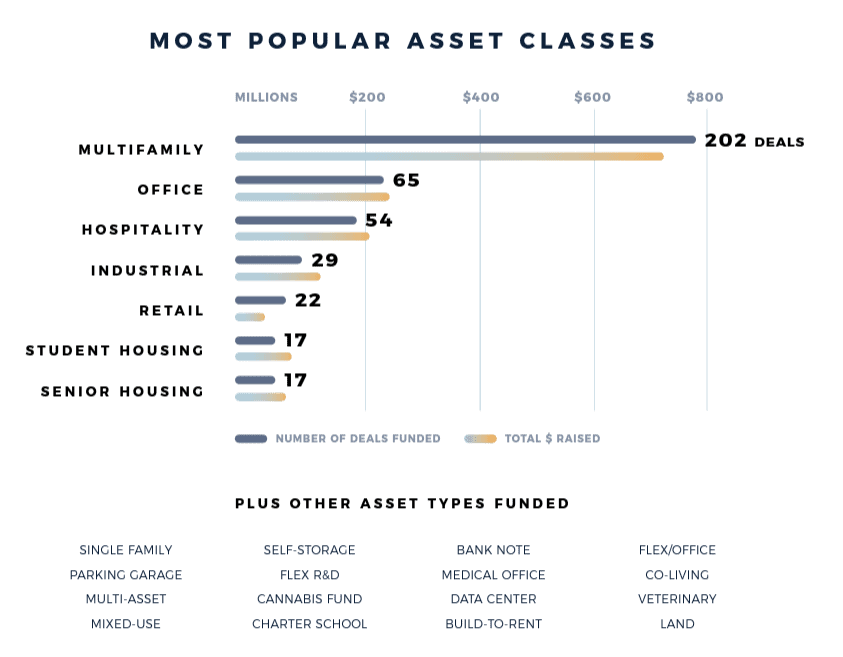

In terms of variety, they offer investments in the following real estate asset classes: Office, Industrial, Hospitality, Senior Residential, Retail, Single Family, Flexible/Office, Multi-Asset, Mixed Use, Multi-Family, Storage, Flexible R&D, Cannabis, Franchise Schools, banknotes, medical offices, data centers, student housing, prefab homes, build-to-rent, parking lots, land, co-living, and vets.

It’s a continuous sentence stating that they have something to offer every potential real estate investor.

In terms of volume, the platform has funded more than 500 projects, with more than $2.4 billion invested in projects with a total investment of more than $21 billion. The transaction volume is roughly 4 times what RealtyMogul has invested in, and more than 10 times what EquityMultiple has done to date (as of fall 2021).

Again, bigger isn’t always better, but it’s clear that a large number of investors already trust Crowdstreet with their investment funds.

Where and how to invest in Crowdstreet

As you might imagine, Crowdstreet doesn’t take every transaction from them. In fact, 95% of them are rejected. If they or any platform gets deals from inexperienced operators on less favorable terms, their business won’t last long.

Their Capital Markets team details a three-step review process here.

First, they evaluate the sponsor, conduct a background check, review the sponsor’s past record, and rate it as Emerging, Experienced, Lifetime, or Enterprise.

Second, they evaluate specific deals to assess whether they think the deal is viable, whether the assumptions are supported by market data, and whether the forecast is realistic and fits a typical Crowdstreet offering.

Finally, if all goes well, they review the deal documents and terms, negotiate with the promoter, and come up with a product that is attractive to both the investor and the promoter.

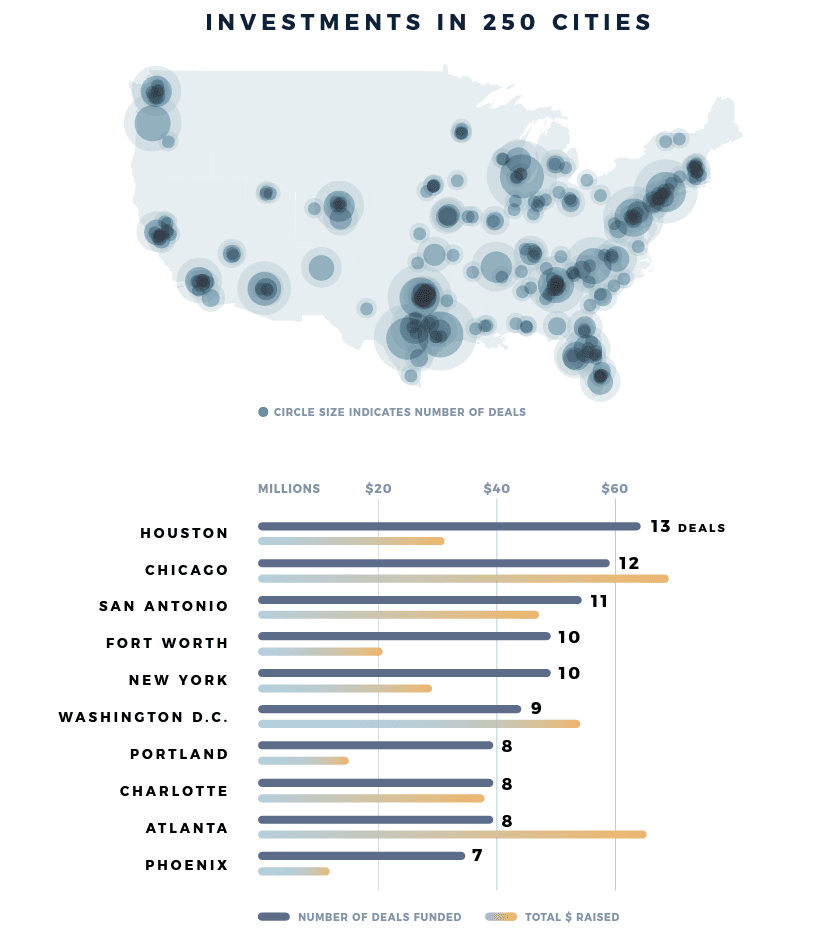

As of fall 2021, funding deals are in place in more than 250 U.S. cities.

Note that 3 of the top 4 cities that received funding are in Texas, a state with no state income tax, and I made two investments here to avoid any potential issues with out-of-state income taxi.

More than 40% of the top 500 transactions on the Crowdstreet platform were for multifamily properties, with office, hospitality, industrial, student housing and senior housing being the second most popular asset type.

Value-added deal types accounted for about one-third of deal types, followed by development, opportunistic deals, core deals and core deals.

Crowdstreet User Experience

It’s been a few years since I signed up with Crowdstreet, but I remember the process was simple. You’ll see a button to create an account on most pages on the site. They now offer weekly new investor guidance via Zoom calls.

After registration, you must verify your Accredited Investor status before you can invest. That is, you must demonstrate that you have earned $200,000 per year as an individual or $300,000 per year as a couple over the past two years, or that your net worth (excluding your primary residence) is $1 million. They provide a verification letter template that can be completed by your CPA, investment advisor or attorney or an independent third party who has reviewed your W-2, 1040 or brokerage statement. VerifyInvestor is a third-party online option that I’ve used before.

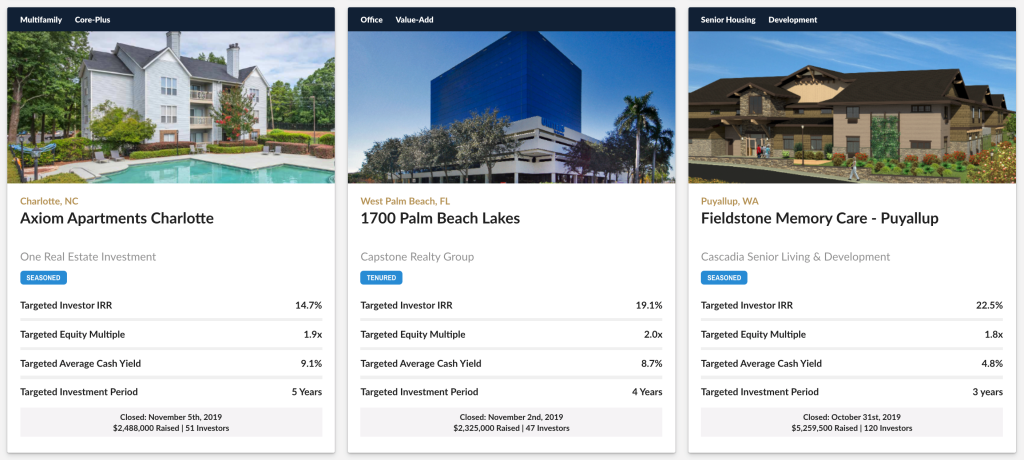

As a Verified Accredited Investor, you can view detailed information on each investment on the platform, which is often provided before trading opens an investment. Having this kind of access can be important because deals can quickly deliver on promises. It’s also common to have an interactive video call with a sponsor to learn more about a specific deal and answer your questions before anyone has a chance to invest.

I obviously can’t share investment details on the market, but anyone can see a preview of the current products on the market and some of the most relevant details for each product.

my experience

Every quarter, I get an email inviting me to see the latest updates on the projects I’ve invested in. These are .pdf files containing construction updates, pictures, and any changes made or challenges encountered.

Since I choose to invest in the underlying development projects, most of the returns will be realized upon completion, and these two projects are still a year or two away from this, so I can’t comment on the distribution, but you should be able to deposit them directly into your Bank account.

The student housing project I invested in was delayed by a year, mainly due to COVID-related construction delays. Other than that, no big surprises.

Crowdstreet Investment Returns

I can’t tell you my results yet, but Crowdstreet publishes data for every transaction on the platform. As of this publication, this is over 60 transactions.

These deals provided investors with an average internal rate of return (IRR, annualized rate of return) of 17.3% per year. The average holding period is 2.4 years, during which investors have earned an average 41% total return.

It’s important to note that these numbers are the average results of more than 5 dozen investments. The range is quite large, with the best result being an IRR of 88.4% and the worst being -100%.

Yes, you may lose your entire investment in a particular trade, a fact I dare not hide. There’s a reason you have to be an accredited investor; you really shouldn’t be making an investment like this with money you can’t afford to lose. Of course, on average, the rewards are excellent, but that reward comes with risk. At 1.6% odds so far, they have only lost one total out of 63 trades, but the risk of losing your investment is non-zero.

How can you protect against this risk? The two best ways are to diversify (in funds or multiple trades) or invest in safer trade types such as Core or Core-Plus.

Result of transaction type

Core Offer

Considered the least risky investment category on the platform, there are 11 opportunities to invest in the core deal with Crowdstreet, but none of them fully materialize as of 2021.

core plus

With 6 fully realized transactions, the results for Core + Investments on the Crowdstreet platform ranged from 7.5% to 19.7%, with an average internal rate of return of 12.6%. No one has ever lost money.

More than 90 Core-Plus transactions have been funded since 2014, with more data points to be added in the coming years.

value added

40 of the 42 value-added deals delivered positive returns to investors, with an average internal rate of return of 20.2% on average returns (including total losses and another negative outcome). The top-performing accretive trade returned investors 42.8%.

Funded over 200 additional value-added transactions through Crowdstreet.

opportunistic

Opportunistic investments aim for higher returns but take more risk. Less than 10% of opportunistic deals have fully materialized (13 out of 165 to date), 11 of which provided positive returns. The range is -66.2% to +88.4%, with an average internal rate of return of 11.8%.

Details on these and projected and actual returns for each realized transaction can be found on the constantly updated Crowdstreet Market Performance page.

case study

Crowdstreet conducts case studies of realized deals, comparing projected IRRs, timelines, equity multiples, and holding periods. The level of transparency is respectable.

A transaction that executes as expected

Hoyt20, a multifamily residential development in Portland, Oregon, is more or less on schedule.

The project has an expected internal rate of return of 21.3%, a holding period of 2 years, an equity multiple of 1.47x, and a total return of 47%.

The 2.2-year real rate of return is 55% and the internal rate of return is 21.7%. You can read the case study here.

Seriously underperforming trades

Four of the 63 trades on the platform, or 6.3%, gave investors negative returns. Let’s look at the one that caused the overall loss. I despise the overuse of the term “perfect storm,” but if applied to real estate investing, it would be a great choice.

This is a Radisson Hotel deal near Houston, Texas that includes a rebrand and renovation. It had an ill-fated start when the oil and gas market slumped sharply at the time of the scheduled acquisition, resulting in fewer business travelers to the region.

This was followed by severe flooding from Tropical Storm Imelda, which caused damage to the entire first floor. In the end, any hope of rebounding from these setbacks was dashed by the COVID shutdown and uncertainty about the future. Declared bankruptcy in April 2021. You can read the full case study here.

Transaction that exceeds expectations

This accretive transaction, which introduced investors to an office/industrial park in Seattle, Washington in the fall of 2016, has an IRR of 20.4% over a 5-year period and an equity multiple of 2.34x, implying a 134% return.

The scheduled improvements came in a more timely fashion than expected, and the project sold in less than half the initial forecast.

Investors achieved nearly the same total return of 128% compared to the expected 134%, but with a holding period of only 2.3 years. This gives them an annualized IRR of 42.8%. Navigate to the full case study for full details.

For an additional 60+ case studies where you can see what’s doing well and what’s not, visit Crowdstreet’s Market Performance page. You don’t need to register to view these content.

Educate

Most real estate investment platforms offer a fair amount of investor education. From a business perspective, this makes sense. They need well-educated investors, few surprises, and the more information they can provide on the site, the fewer questions employees need to answer in person.

A great place to start learning about commercial real estate is Crowdstreet’s Quick Start Guide for Investors. The searchable Help Center is a great place to find the specific information you’re looking for.

You’ll also find quick, helpful articles in the Commercial Real Estate 101 section that answer questions such as “What are equity multiples and IRR?” or “What are promotions?” There’s also a commercial real estate investing glossary.

You’ll also find more timely articles that go beyond the basics of real estate investing. For example, the ranking of the 25 best cities for real estate investment in 2021.

Other options for real estate investing

There are many ways to invest in real estate.

You can buy separate rental properties. This is usually an active form of investment where you can act as the landlord yourself or hire a property management team (and manage the manager). I’ve done it before, but have since moved to passive real estate investing.

You can invest in privately traded or publicly traded REITs. I have invested in Vanguard’s REIT index funds for many years. Note that during the Great Recession, the fund’s value plummeted 78%. If diversification is what you’re after, these investments aren’t as correlated to the stock market as you’d like them to be.

If you can afford a six-figure minimum investment, Origin’s IncomePlus Fund will invest $100,000, giving you immediate diversification among numerous stock and preferred stock trades. The DLP’s housing fund is similar in several ways, with its minimum $100,000 (for PoF readers) increasing to $200,000 in November 2021. They also announced a development fund called the Building Community Fund.

You can also find funding from Cadre, Alpha Investing and others. Crowdstreet’s fund offerings include the Opportunistic Fund and the Subelt Multifamily General Partner Fund, where investors receive 30% of sponsor promotions.

You can also invest in syndicated transactions independently of any platform. These do not go through the screening process, so due diligence is crucial in this process. Passive Income MD specializes in teaching others how to best review individual transactions. At the very least, whether investing through a crowdfunding platform or not, it’s wise to look at the sponsor’s track record and carefully study the “pro-form” numbers that represent projected returns to see if they make sense for the type of investment, and location.

Regardless, this is not an exhaustive list of real estate investment options. You can also invest in notes (mortgage loans), tax liens, short-term leases, or even the real estate investment platform itself, among other options.

Get started with Crowdstreet

While Crowdstreet as a platform could not have existed prior to the passage of the 2012 JOBS Act, which allowed crowdfunding to bring institutional investing to accredited individuals, they are making investments to sponsors with longer track records, some of whom already operate decades.

To learn more about their current and future investment products, create a free account and start learning more today.

Physicians on FIRE may be compensated if you choose to create an account, but this site will not receive additional compensation regardless of whether you invest your funds in Crowdstreet or any of the other companies mentioned in this article. Also, the fact that I invest with them doesn’t mean it’s a good investment for you. I’m most likely in a different financial situation than you.

Nonetheless, with a solid track record, admirable transparency and robust transaction process, Crowdstreet is a great place to start if you plan to consider these types of real estate investments.