A Guide to Rehab Loans for Investment Property

What to Know When Buying a Manufactured Home

One great way to make money in real estate is by buying distressed properties for sale, renovating them quickly and selling them at a profit, or renting them out. This allows you to make profits in a lump sum or earn more rental income respectively. However, traditional mortgages may not be suitable for rehabbing a house due to limiting property qualifications and long closing periods. This leads real estate investors to ask “Can you get a rehab loan for an investment property?” Yes, you can!

If you don’t have enough cash and want to renovate a property, you should consider rehab loans for investment property. Read on to find out what rehab loans are and learn about the main options available to real estate investors.

Related: Real Estate Investing Tips: How to Finance a Rental Property

What Are Rehab Loans?

Rehab loans are types of investment property loans that help real estate investors to purchase and renovate a property before selling or renting it. These investment loans usually combine the purchase costs and the costs of renovating the property into a single short-term loan. While rehab loans for investment property are typically used for short-term investments, it’s also possible for long-term real estate investors to secure a rehab loan to renovate a rental property before refinancing.

Since they are typically short-term loans, rehab loans for investment property usually carry higher interest rates than other conventional investment property loans. The good thing with rehab loans is that you can get financing within a few days or weeks, unlike conventional loans that can take months. The size of the loan usually varies depending on a number of factors such as the type of loan, the condition of the investment property, and the needed repairs.

3 Types of Rehab Loans for Investment Property

Here are 3 rehab loan options for real estate investors:

1. Hard Money Rehab Loans

Hard money rehab loans are loans that are given by private lenders and are usually secured by the investment property. The main advantage of using hard money loans to finance a real estate rehab is that it is usually easier to qualify for this type of financing compared to other rehab loans for investment property.

Hard money lenders usually focus more on the investment property’s profitability and less on the borrower’s credit-worthiness. Conventional lenders have to check your credit score and income before approving you for a loan. In fact, it’s possible to negotiate everything from the loan amount, payoff period, points, and interest rate with a hard money lender.

Hard money lenders will use the property’s after-repair value (ARV) to determine the maximum loan amount. They may loan you up to 75% of the ARV. Depending on the lender, you can get up to 100% of rehab funding (initial cost of property and renovation) in a matter of days or weeks. For real estate investors looking for fix and flip loans, hard money rehab loans can be a great option.

The biggest drawback of using this type of rehab loan is they usually have relatively high investment property mortgage rates. This is because they have shorter repayment terms than other investment property loans and because renovation projects carry more risk. However, the rates will vary from lender to lender.

Investing in Apartment Buildings vs Small Multifamily Homes

2. Investment Property Line of Credit (LOC)

If you are currently a homeowner, one of the rehab loans for investment property you should consider is an investment property line of credit (LOC).

This loan allows you to tap into your existing property’s equity to finance the renovation of your investment property. Just like a home equity line of credit (HELOC), you will have a revolving line of credit that you can use to buy and rehab new investment properties.

These rehab loans are usually ideal for investors with regular renovation projects. It is a highly flexible financing option that will ensure you don’t miss out on lucrative investment opportunities. However, not all lenders offer this type of rehab loan for investment property.

Related: Weighing Your Investment Options: Rely on Equity or Take Out a New Mortgage?

3. Permanent Rehab Mortgages

For long-term real estate investors, permanent rehab mortgages are the best option for buying a rental property that needs repair work. One common permanent rehab mortgage option is a Federal Housing Administration (FHA) 203k loan. FHA 203k loans are only available to investors who are rehabbing owner-occupied properties. Meaning, if you’re a house hacker, this could be the loan option for you.

New real estate investors are attracted to these loans because they offer an easy entry into real estate investing. They usually have low down payments compared to other rehab loans for investment property (as little as 3.5%). The maximum amount you can borrow will depend on the FHA mortgage limit for the area. You must have a good credit score and the cost of renovating the property must be at least $5,000 for you to be eligible for this loan.

Related: Can You Use FHA Loan for Investment Property Financing?

A Home-Style Renovation (HSR) loan is another permanent rehab mortgage to consider. These are low-interest rehab loans for investors that are backed by Fannie Mae. However, they usually have restrictions and need additional documentation.

The Bottom Line

Finding the funds to take advantage of investment property rehab opportunities doesn’t have to be a barrier if you know where to look. There are a number of rehab loans for investment property that you can consider. However, rehab loans have different requirements. Apart from hard money rehab loans, you will typically be expected to meet a number of requirements for you to qualify. This may include having a stable income, a good credit score, and experience in rehabbing properties successfully.

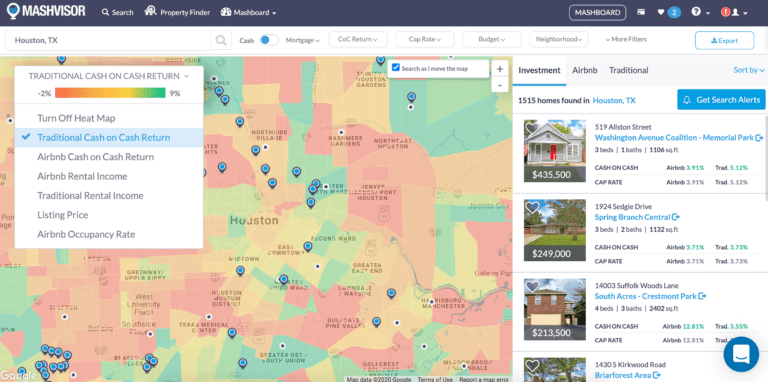

You need to weigh your rehab loan options and lenders and decide which one best fits your situation and investment goals. And remember, when looking for distressed investment properties for sale, always conduct analysis to see how interest rates and mortgage payments will affect your return on investment and cash flow. You can do this easily with Mashvisor’s real estate investment tools. Try out our calculator now.

Start Your Investment Property Search!

EquityFHA LoanHard Money LendersRenovations

7 Best Ways to Find Motivated Sellers in 2021

Recent Comments