Why You Need Predictive Analytics Tools for Real Estate Investing

How to Find Cash Flowing Rental Income Property for Sale

Like in all other sectors, there has been massive technological advancement and innovation in the real estate industry in the last few decades and it’s not about to stop. There are now several predictive analytics tools that real estate investors are using to generate quick, actionable insights and gain a competitive advantage in the real estate market. The impact of real estate predictive analytics on property investing is evidently massive.

In this blog, we’ll look at what predictive analytics entails and why you need predictive analytics tools for real estate investing in 2021.

Related: The Power of Predictive Analytics in Real Estate Investing

What Is Predictive Analytics?

In real estate, predictive analytics is a type of real estate analytics that involves analyzing historical data to make predictions about future trends using techniques like machine learning. With the help of predictive analytics tools, anyone can use past and current data to generate future insights with a high degree of accuracy. Such analytics are very useful for decision making in all sectors, including real estate.

It’s evident that the power of real estate predictive analytics is being realized as more and more investors are abandoning methods that rely solely on traditional analytics and turning to predictive analytics. But why is predictive analytics crucial to real estate investors?

Why Do Real Estate Investors Need Predictive Analytics?

Real estate predictive analytics can increase an investor’s competitive advantage by streamlining the decision-making process and producing useful insights that lead to better actions. In the past, investors used traditional analytics to get a retrospective understanding of what went wrong in a market or with a particular investment. Conversely, predictive analytics now provide investors with a snapshot of the big picture. Therefore, investors can use predictive analytics tools to make more informed decisions when buying investment properties. Specifically, predictive analytics can be useful to investors in the following ways:

1. Helps Investors Quickly and Easily Find the Right Investment Property

The goal of every real estate investor is to find an investment property that will make them money. This can be achieved using predictive analytics. Investors who want to get the most from their investment need to use reliable predictive analytics tools to identify real estate deals that, not only match their criteria, but that will provide a high return on investment and cash flow.

2. Helps Investors Make Faster Decisions

If you use traditional methods to find an investment property, it can take you several months to find one. However, predictive analytics tools enable you to find investment properties for sale from the comfort of your home in a matter of minutes.

3. Reduces Risk

Every business has some level of risk including real estate investing. Predictive analytics reduces this risk by providing accurate metrics that are based on reliable real estate data. With that, you can avoid negative cash flow properties in bad markets where they’ll only lose value with time.

4. Makes Investment Property Search Easier for Everyone

With predictive analytics, anyone can become a real estate investor. It makes real estate investing simpler for everyone regardless of their financial knowledge or background in real estate. Every average Joe and Jane can find profitable investment properties and compete with experienced real estate investors. You don’t even need to work with a real estate agent to find lucrative deals. This can actually save you lots of money.

The Best Predictive Analytics Tools for Real Estate Investors

Mashvisor has a number of predictive analytics tools that help investors to analyze real estate data and ultimately, find the perfect investment property for sale.

Sign Up for Mashvisor

Is It a Good Time to Buy My First Rental Property?

They include:

1. The Real Estate Heatmap

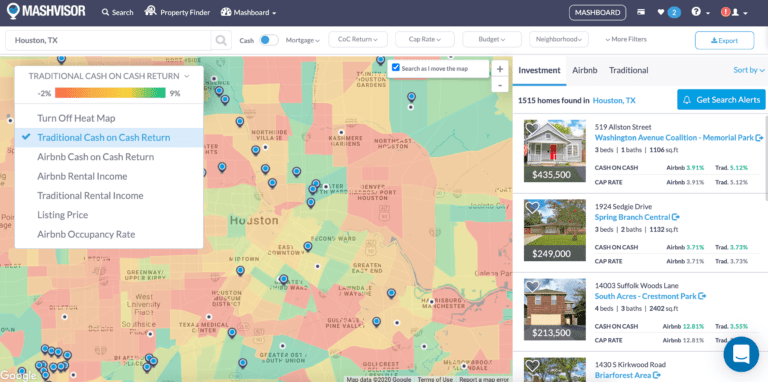

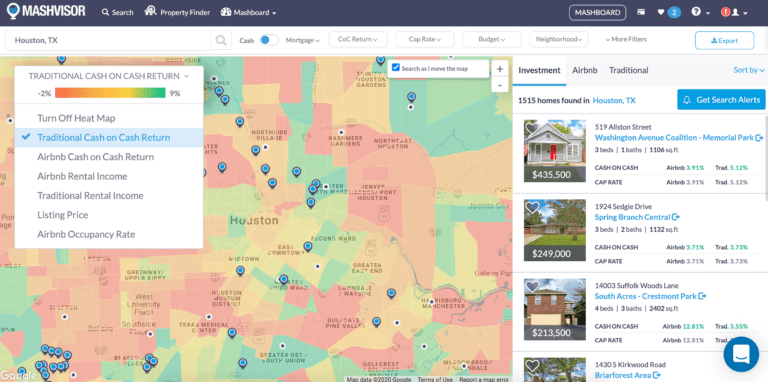

Mashvisor’s Real Estate Heatmap

Location is the most significant factor when searching for a profitable investment property. However, researching and understanding real estate markets tends to be complicated, especially when you’re trying to make predictions about future trends. Investors need to use predictive analytics to objectively assess the real estate market and identify the best places to invest in.

With predictive analytics tools like Mashvisor’s real estate heatmap, investors can easily identify the best neighborhoods for rental properties within a particular market. This tool enables you to conduct a neighborhood analysis in a city even if you aren’t familiar with it. The analysis is based on a number of metrics such as listing price, rental income, cash on cash return, and occupancy rate.

Related: Finding Income Properties Using a Heatmap

2. The Rental Property Finder

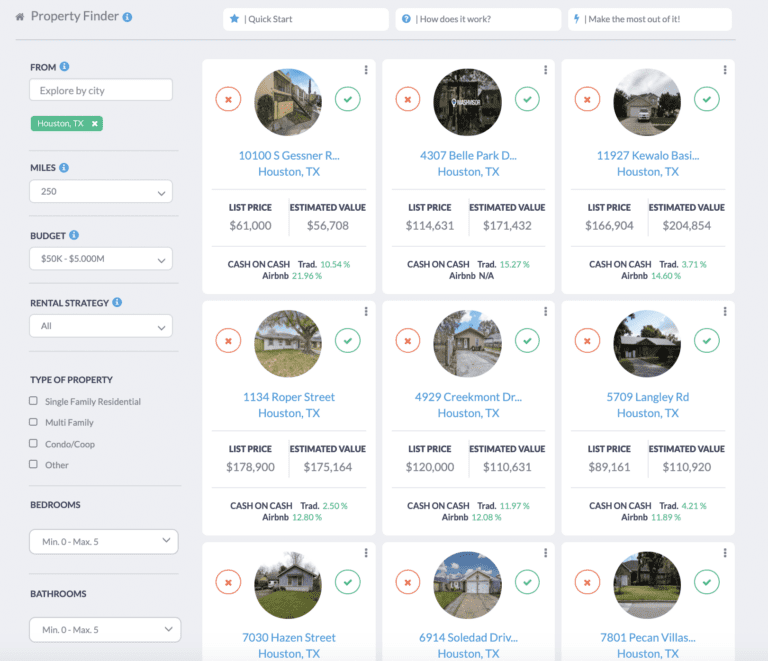

Mashvisor’s Rental Property Finder

After finding an ideal location to buy an investment property, you have to identify investment properties for sale that match your criteria. However, traditional property search methods like driving for dollars can be time-consuming. The rental property finder tool, on the other hand, allows you to customize your property search using a number of filters and instantly find top-performing properties. This is one of the best investment property search tools you need to have.

Related: How to Find Investment Properties Using a Property Finder Tool

3. The Rental Property Calculator

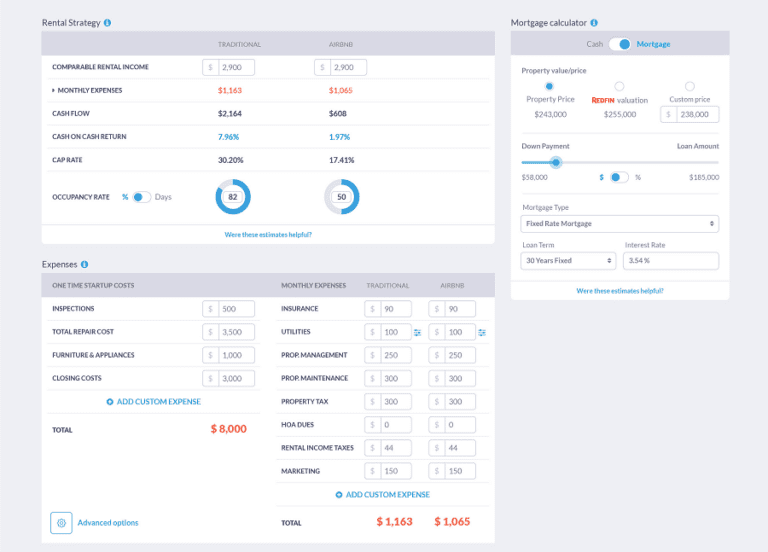

Mashvisor’s Rental Property Calculator

While it’s important to find a good investment location, it’s also important to analyze the individual property. You may have identified a few investment properties that match your criteria but you still need to assess which one has the highest potential for profits. Fortunately, you don’t have to be an experienced real estate investor to determine the profitability of an investment property. One of Mashvisor’s predictive analytics tools can help you perform a full investment property analysis in a matter of minutes – the rental property calculator.

Also known as the investment property calculator, this tool relies on predictive analytics to provide reliable estimates of return on investment (cap rate and cash on cash return). By comparing multiple investment properties and their forecasted ROI, you’ll be able to identify the best. Moreover, the rental property calculator uses both Airbnb predictive analytics and traditional predictive analytics to identify the optimal rental strategy for an investment property.

Related: Mashvisor’s Investment Property Calculator: Real Estate Investing Made Easier

The Bottom Line

Predictive analytics has revolutionized real estate investing and every real estate investor needs to learn how to use it for better decision-making. With the right predictive analytics tools, investors can enhance their investment property search experience and ensure better returns. Mashvisor is the real estate investment software with the best predictive analytics tools you need to find a lucrative real estate deal.

To get access to our real estate investment tools, click here to sign up for Mashvisor today and enjoy 15% off.

Start Your Investment Property Search!

Investor ToolsPredictive AnalyticsReal Estate Data

How to Estimate Rehab Costs in 4 Steps

Recent Comments