Cap Rate Calculation: How To Use Cap Rate In Real Estate?

Capitalization Rate or Cap Rate is a term often thrown around in real estate discussions. Yet many people don’t really understand what it means. After all, it can be confused with cash-on-cash returns and the rate of return. When you invest in income-producing property, you are looking for cash flow. You also expect to realize a capital gain, selling the property at some time in the future for a profit. When analyzing investment opportunities, real estate investors evaluate a multitude of different factors.

But a typical investor will be interested in the income that the property can generate now and into the future. That investor is likely to use capitalization of income as one method of estimating value. It is one of the most fundamental concepts in real estate investing and is mostly referred to in calculations as “Cap Rate.” Here’s what you need to know about the cap rate, from its definition to methods of calculation.

What Is The Capitalization Rate?

The capitalization rate is similar to the rate of return on investment. It allows you to compare the relative value of real estate investments independent of their dollar value. The standard cap rate formula is net operating income divided by the market value. Cap rate is one of the most important calculations done by real estate investors.

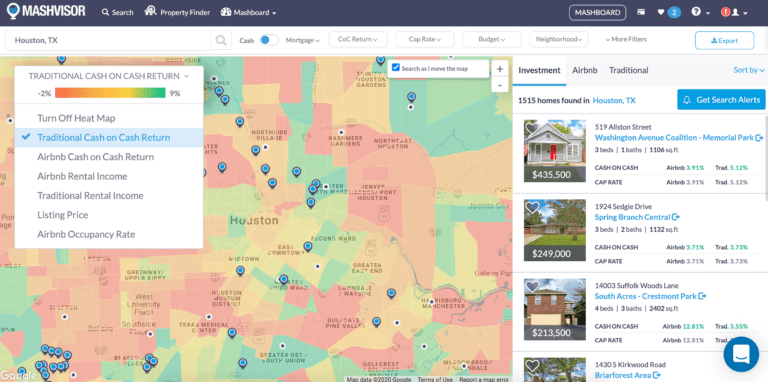

The cap rate is ideal for evaluating comparable properties in the same market area. A cap rate calculator is a useful tool as it allows you to quickly get an estimate for how much money the property is expected to make, and how this compares to similar properties in the area.

The two components of a Capitalization Rate are the Net Operating Income (NOI) and the purchase price of the investment property. NOI equals all revenue from the property, minus all reasonably necessary operating expenses. NOI is a before-tax figure, appearing on a property’s income and cash flow statement, that excludes principal and interest payments on loans, capital expenditures, depreciation, and amortization.

In other words, the cap rate measures a property’s yield on an annual basis, making it easier for investors to compare the risk and return profiles of different assets. It is an estimation of an investor’s potential return on a real estate investment. Several factors can affect the cap rate of a property, such as market demand or interest rates, but one of the most critical factors is its occupancy.

A property’s occupancy directly affects the amount of NOI it can generate. A vacancy rate is the opposite of the occupancy rate. It refers to the percentage of units that are vacant or unoccupied in a given property. Vacancy rates play a big part in business and can help investors determine whether they’re making a good move by putting their money into certain real estate deals. A fully occupied property will generate a higher NOI and a higher cap rate at a given price than one that is only half occupied.

Cap Rate Calculation Example

The Capitalization Rate is the NOI divided by the purchase price and is represented as a percentage.

Cap Rate = NOI / Purchase Price

Now that you know the basic equations used to calculate the cap rate, below is an example to better illustrate how this is used. First, let’s find our values.

- Property Value (or Purchase Price): $250,000

- Total Revenue: Four units x $1,000/month in rent = $48,000/year

Total Expenses:

- Property manager salary – $20,000

- Cleaning and maintenance – $10,000

- Inspection and broker fees – $5,000

Next, let’s calculate NOI. $48,000 (revenue) – $35,000 (expenses) = $13,000. Lastly, we can use this number to calculate the cap rate of the property.

$13,000 (NOI)/$250,000 (property value) = .052, or 5.2% Cap Rate.

The same formula can be used to calculate the purchase price if you have the Cap rate and NOI. To solve for the price, just rearrange the original formula to:

Purchase Price = NOI / Cap Rate.

Purchase Price = $13,000 / 5.2% = $250,000

Now, let us suppose that there is a similar investment property (B) having the same NOI but a higher Cap Rate of 6.5%.

Purchase Price of B = $13,000 / 6.5% = $200,000

Both the properties have the same NOI of $13,000 but a lower Cap produces a higher purchase price and vice-versa. As Cap rate increases to 6.5%, it decreases the property value by $50,000.

Note a very important consideration involving a Cap rate calculation shown above. The purchase price is based on an all-cash purchase. No loans or mortgages were involved or factored into the calculation. The leveraged money that is used to acquire an investment property must be accounted for in any calculation involving a rate of return. Therefore, a Cap based on an all-cash purchase can never equal a rate of return.

What is a Cap Rate Calculator in Real Estate?

A cap rate calculator is used in real estate to find the comparative value of a piece of property to determine if it would be a good investment. It’s calculated by balancing the costs of owning and maintaining a property, the property’s market value, and the direct earnings received from that property.

For example, say your client wants to buy a property for $250,000. It currently has four units and receives $1000 in rent from each tenant each month. The current owner paid $35,000/year in inspection fees, maintenance and cleaning fees, and a property manager’s salary. The cap rate calculator takes each of these factors into account to come up with a simple percentage that’s easy to compare across properties.

Cap Rate Calculator Equation

The cap rate calculator equation is pretty straightforward, assuming you have all of the necessary information at hand. To calculate the cap rate, you take the Net Operating Income (NOI)/Property Value. You can typically take the asking price as the property value, or there are plenty of online tools available that can provide property value estimates as well.

How to Calculate Net Operating Income (NOI)

Coming up with the NOI for a property is a bit trickier, not because the math is complicated, but because it requires a lot of different numbers upfront. The equation for NOI is Total Revenue – Total Expenses. Total revenue is typically the yearly rent collected from tenants and/or the interest gained over the year. Expenses can include any number of factors such as:

- Broker or inspection fees

- Pest control

- Maintenance

- Property management salary

- Tenant screening

- Property taxes

To find NOI, you add together your revenue sources for the year, then subtract the combined expense amount. You can then use this number to calculate the cap rate. It’s important to note that the cap rate does not take the mortgage payments into account, as this is not a factor that affects the value of the property itself.

Benefits of Using a Cap Rate Rental Property Calculator

There are many ways to use the cap rate when evaluating rental properties. In general, you can think of the cap rate as an estimate that’s used to get the lay of the land for real estate investing. Examples of the different uses for a rental property cap rate calculator include:

- Understand the value of a property in relation to its neighbors – It stands to reason that properties in similar neighborhoods with similar assets should have similar cap rates. You can use the cap rate to identify if a particular property is priced too high or too low, or if there may be underlying issues contributing to an unusual cap rate.

- Get a picture of larger market trends in an area – Cap rate is a useful indicator of wider changes in a certain city or area within a city. For example, cap rates changing in a specific neighborhood but staying flat in another similar area can indicate a shift in buyer/renter interest.

- Provide useful estimates to clients – For agents, the most important use for a cap rate calculator is to be able to provide accurate estimates to clients for the value of the property, an important factor when making a buying decision.

- Identify under-the-radar opportunities – If a property has a conspicuously high cap rate for the area, this could be an indication of mismanagement and an opportunity for a higher return on investment if operations were to be more streamlined and yearly expenses minimized.

Drawbacks of Using a Cap Rate Rental Property Calculator

Though the cap rate is undoubtedly a useful estimate of a property’s value, there are a few limitations to using this metric.

- Requires comparisons to be useful – Because cap rates are most often used in comparison to properties of similar sizes, assets, and areas, they require a robust market to be valuable. This limits their usability in both smaller markets and for unique properties like tourist attractions, where there typically aren’t enough similar properties to compare to.

- Relies on knowing historical costs – Since the cap rate calculation incorporates net operating income, which in turn requires knowing the property’s yearly expenses, it can be difficult to get an accurate estimate without the proper records. For mismanaged properties or even properties that have been owned by a single family for a long time, tracking down this information may not be possible.

- Only accurate with steady income and expense costs – Like any estimate, cap rate can be thrown off by any outlying data points in terms of extra income or unexpected costs. Things like flooding damage can skew maintenance cost data for that year or unexpected seasonal business can drastically increase income, causing an inaccurate cap rate that may not actually be the typical amount year to year.

What is Cash-on-Cash Return?

The cash-on-cash return of an investment property is a measurement of its cash flow divided by the amount of capital you initially invested. This is usually calculated on the before-tax cash flow and is typically expressed as a percentage.

Cash-on-cash returns are most accurate when calculated on the first year’s expected cash flow. It becomes less accurate and less useful when used in future years because this calculation does not take into account the time value of money (the principle that your money today will be worthless in the future).

Therefore, the cash-on-cash return is not a powerful measurement, but it makes for an easy and popular “quick check” on a property to compare it against other investments. For example, a property might give you a 7% cash return in the first year versus a 2.5% return on a bank CD.

The cash-on-cash return is calculated by dividing the annual cash flow by your cash invested:

Annual Cash Flow / Cash Invested = Cash-on-Cash Return

- Calculate the annual pre-tax cash flow for the property.

- Determine how much you’d put down on the property from the down payment to rehab costs. Total these expenses to find your total cash investment.

- Divide the annual pre-tax cash flow by the total cash invested.

- The result is the cash-on-cash or CoC return.

Let’s make sure we understand the two parts of this equation:

- The first-year cash flow (or annual cash flow) is the amount of money we expect the property to generate during its first year of operation. Again, this is usually cash flow before tax.

- The initial investment (or cash invested) is generally the down payment. However, some investors include their closing costs such as loan points, escrow and title fees, appraisal, and inspection costs. The sum of which is also referred to as the cost of acquisition.

Let’s look at an example. Let’s say that your property’s annual cash flow (before tax) is $3,000. And let’s say that you made a 20% down payment equal to $30,000 to purchase the property. In this example, your cash-on-cash return would be 10%.

$3,000 / $30,000 = 10%

Although the cash-on-cash return is quick and easy to calculate, it’s not the best way to measure the performance and quality of a real estate investment.

Let’s look at one more example taking into account repairs and renovations:

Suppose you want to put 20,000 dollars down on a 100,000 dollar house. This is 20 percent down. You’ll have to pay 2,000 dollars in fees. You’re renting it out for a thousand dollars a month to a tenant. This yields 12,000 dollars a year in rental income per year. And you’ve got an ultra-cheap 3000 dollars a year or 250 a month.

The annual cash flow is $12,000 – $3,000 or $9,000.

The total cash invested is the down payment and fees. In this scenario, it is the 20,000 dollar down payment and 2,000 in repairs for a total of 22,000 dollars.

The cash-on-cash return is 9000 divided by 22,000 or 0.41. This translates into a 41 percent return.

California Real Estate Market: Prices | Trends | Forecast 2021

What if the property had no additional repairs necessary? Then the total cash invested is 20,000. The cash flow is unchanged at 9,000 dollars.

The cash on cash return is then 9000/20000 or 0.45 or 45%.

If the property needed 10,000 dollars in repairs and renovations, the cash invested hits 30,000 dollars. Divide 9,000 by 30,000 and the cash on cash return is 0.3 or 30%.

You can use the cap rate to estimate the NOI. The NOI is going to be the market value of the property multiplied by the capitalization rate. If they’re selling a property for 150,000 dollars and say it has an 8 percent cap rate, then the NOI is 12,000 dollars a year. For comparison, it is reasonable to assume an NOI of roughly one-third of the rental income.

And the fair market value of any property can be estimated using the cap rate. Divide the NOI by the cap rate. In the scenario above, a property with a 12,000 dollar NOI and an 8 percent cap rate is worth 150,000 dollars.

You can use the cash on cash return to gauge the return on renovations that allow you to raise the rent. Add the renovation or upgrade costs to the total cash investment number, and determine how much more you could charge in rent for the nicer property.

The ratio compares the total cash earned on an annual basis (pre-tax) to the amount of cash invested. Cash-on-cash ratios are used instead of return on investment since ROI calculations are skewed when you buy a property with a large amount of debt.

Difference Between Cap Rate and Cash-on-Cash Return

The capitalization or cap rate is often confused with the cash on cash or COC return. That problem is compounded by the fact that the cap rate and cash on cash returns are the two main metrics used to assess individual real estate deals. As discussed above, Cash on cash or CoC return calculates the cash income earned on cash returned on investment.

Cash on cash return excludes debt and only looks at the cash amount invested; this is generally the down payment on the property. If you pay all cash for a property, the Cash-on-Cash rate will be the same as the cap rate. However, most property investors don’t pay 100 percent of the cash for properties. Yet the cash on cash calculation can still be of benefit to them.

You need the cash-on-cash calculation to properly compare projects that will require significant investment in the form of loan fees, rehab costs, and closing costs in addition to a down payment or cash purchase. Anything you need to pay to get the property ready for tenants falls into this category.

The cap rate can be used to gauge how good of an investment the property is, while cash on cash calculations allow you to determine which deals have the highest returns.

How to Use Cap Rate as a Rental Property Investor?

The cap rate can be used to compare your relative success as a real estate investor or the value of a given property. For example, you can calculate the cap rate for your entire portfolio and identify under-performers. Or you can learn the average cap rate for a given neighborhood and then gauge the value of a property based on its cap rate. If it has a lower cap rate, then it is worth less than a comparable home with a higher cap rate.

Know that you don’t have to go into high cap areas to find profitable investments. A low cap area may have room for significant improvement. Look for areas where there are rapidly increasing rental rates because these are the places where the cap rate will be better next year than this year. And that higher cap rate will lead to property values increasing in a year or two.

The ideal properties will have rising rents combined with unchanged expenses. However, if the operating expenses are skyrocketing, NOI will go up and kill that great cap rate for the current calendar year. This is a risk with older buildings that need major work. If you can find properties in good condition and even rehabbed older ones, you could create long-term value by buying something through NOI increases.

Estimating Property Value With The Capitalization Rate

The Cap Rate merely represents the projected return for one year as if the property was bought with all cash. But since we don’t normally buy property using all cash we would use other measures, such as the cash-on-cash return, to evaluate a property’s financial performance.

The Cap Rate is calculated by taking the property’s net operating income (NOI) and dividing it by the property’s fair market value (FMV). The higher the Cap Rate, the better the property’s income and market value. The Cap Rate is calculated as follows:

Capitalization Rate = Net Operating Income / Value

Let’s look at an example. Let’s say your property’s net operating income (NOI) is $50,000. And let’s say that the market value of your property is $625,000. Your Cap Rate would be 8%.

Capitalization Rate = Net Operating Income / Value

Capitalization Rate = $50,000 / $625,000

Capitalization Rate = 8.0%

As another example, let’s suppose you are looking at purchasing a property that has a net operating income of $20,000. From doing a little research you know the average Cap Rate for the area is 7.0%. By transposing the formula we can calculate the estimated market value as follows:

Value = Net Operating Income / Capitalization Rate

Value = $20,000 / 7.0%

Value = $285,715

An advantage of the Cap Rate is that it provides you with a separate measure of value compared to appraisals where value is derived from recently sold comparables (which are primarily based on physical characteristics). This is especially true when comparing commercial income properties.

Note that a small difference in the Cap Rate may not seem like much but it can make a large difference in your valuation. For example, the difference between a 7.0% and 7.5% Cape Rate, a mere 0.5% difference, on a property with a $50,000 net operating income is a $47,619 difference in value! So be sure to double-check the accuracy of your numbers.

As always, you want to look at multiple financial measures when evaluating income property including the cash-on-cash return, debt coverage ratio, and internal rate of return.

Commonly Asked Questions About Cap Rate

Below are a few additional clarifying answers to some of the frequently asked questions about cap rate calculators.

What is a Good Cap Rate?

The capitalization rate for real estate can range from a negative number to a double-digit return. A standard cap rate is typically between 4% and 8%, according to CBRE’s 2019 North American Cap Rate Survey. However, there is no such thing as a “good” cap rate. It all depends on the level of risk the property owner is comfortable with and how the cap rate compares to similar properties in the area.

Some investors say they won’t buy anything with less than an 8 percent cap rate. It is difficult but possible to find properties with a 20 percent cap rate.

A high cap rate is generally caused by a low purchase price (including distressed sellers) or a high NOI. The key is knowing why the cap rate is higher than normal, not rejecting a property because the CAP rate is much higher than average.

A low cap rate is less risky, while a high cap rate is riskier but there is an opportunity to make more income. As we mentioned earlier, an unusually high or low cap rate (compared to other properties in the area) can indicate that something is “off” with the property.

What Does a 7.5% Cap Rate Mean?

A 7.5% cap rate doesn’t mean much by itself. Rather, it indicates the ratio between a property’s net operating income and its market value, in this case, 7.5%. Cap rate is a way of displaying how much the property is expected to make in a year using the relationship between revenue, operating costs, and market value for the property.

What this means in terms of good or bad investment or dollar amounts depends on the situation. For example, let’s say you want to buy a home that costs $1 million, with an expected net operating income (AKA yearly revenue) of $75,000. Using the cap rate equation of NOI (75,000)/property value (1,000,000,) you would get a cap rate of 7.5%. You can then easily compare to other cap rates in the area to evaluate your investment.

What is an Acceptable Cap Rate?

An acceptable cap rate varies depending on the situation. An average cap rate is typically between 4% and 8%, but what is acceptable varies on how much risk the investor is comfortable with.

Is Higher Cap Rate Better?

A higher cap rate is not necessarily better. Again, it depends on the level of risk the property owner is willing to deal with. A wealthy investor looking to make some quick income by flipping a property may be happy with a higher cap rate because of its greater earning potential, while the associated risk isn’t a concern. On the other hand, a young couple who wants to settle in a home and raise kids there for the foreseeable future will likely want a low cap rate, which has a correspondingly lower risk and will likely increase slowly over time.

Why is a Higher Cap Rate Riskier?

Not always. Capitalization rates in real estate are not necessarily an indicator of risk. This is in sharp contrast to stocks and bonds, where the rate of return is proportional to the risk. However, the cap rate can only be used with income-producing property. The formula just doesn’t work if you’re going to buy property now to sell it later, such as when you’re looking for a fix and flip.

Note that the cash on cash return doesn’t take taxes into account. High taxes can wipe out any potential investment return. This means that the actual returns you see after-tax are lower than the cap rate. The cap rate will vary based on several things, not all of which directly affect the property’s value.

The age of the property, the desirability of the area, and the demand for rental properties in the neighborhood are a few such factors. If there is a greater demand for rentals than the market supplies, rental rates, and NOI may be relatively high despite the moderate home values.

And if there is an oversupply of luxury rentals in the area, you’re going to see a low NOI and de facto ROI via the cap rate, because your property may sit empty for a long time or not rent for enough to cover your operating expenses.

There are other issues with the cap rate that explain why you need to know additional values like the cash on cash return. For example, the CAP rate is an annual figure. It will crash if the property was vacant for several months through no fault of the current owner. Yet the metric will rise automatically with inflation if the rents have kept up with market rates.

The cap rate does not tell you how the property has performed over time; vacancy rates and income statements will do that. A higher cap rate is riskier for the same reason that any high percentage investment is riskier. It all has to do with probability and potential uncertainty, something called the Risk-Return Tradeoff, a well-known investment principle.

The math behind the Risk-Return Tradeoff is a bit complicated, but this guide from Model Investing breaks things down into easily understandable sections if you want to get into the nitty-gritty.

Is Cap Rate the Same as ROI?

No, the cap rate is not the same as ROI. Though both metrics use NOI in their calculations, they’re measuring different things. Cap rate is used to evaluate how profitable a piece of property should be in comparison to the market, regardless of buyer, while ROI (return on investment) is a more concrete calculation showing how much a specific owner will make each year. ROI incorporates mortgage payments while the cap rate does not.

The equation for ROI is the annual return/total investment. For example, a person living in a $200,000 home with an NOI of $12,000, an annual mortgage payment of $5,000, and a down payment of $40,000 would calculate ROI as follows: $7,000 annual return ($12,000 NOI – $5,000 mortgage)/$40,000 total investment (down payment) = 0.175 or 17.5% ROI. The cap rate for the same home would be 6% ($12,000 NOI/$200,000 property value).

How to Calculate Property Value using Cap Rate & NOI?

Using the cap rate and net operating income to determine the value of the real estate is known as the income approach to valuation. The Net Operating Income equals all income from the property minus all reasonable operating expenses. This is a before-tax figure. It doesn’t include amortization, depreciation, capital expenditures, and mortgage payments. The NOI is equivalent to the earnings before interest and taxes if you’re comparing the capitalization rate of a business that’s for sale.

- Find the annual net operating income or NOI.

- Divide the net operating income by the cap rate.

For example, a rental property in Dallas with a net operating income of $30,000 and a cap rate of 7 percent is valued at $428,571. The same property with a 10 percent cap rate would have a value of $300,000. In other words, the higher the cap rate, the lower the property’s value.

We hope that the following explanations were helpful for any agent looking to provide a more holistic view of property options to their clients.

Now that you understand how cap rates work, here is an easy calculator that you can use.

Passive Income Ideas 2020 & 2021: Best Sources To Earn Money

Recent Comments