Boise Real Estate Market Trends & Investment Overview

Los Angeles Real Estate Market & Investment Overview 2021

The Boise housing market is sizzling hot and is being fueled by low mortgage rates and limited supply compared to demand. The result is that buyers have to pay over the asking price. Let’s take a look at the overall housing trends for the previous year. In total, 11,728 homes sold in Ada County in 2020 — 5.2% more than in the previous year. This represents existing and new construction combined, according to the latest report released by Boise Regional Realtors.

The Months Supply of Inventory has dropped 0.4. Typically 5-6 months is considered to be a balanced real estate market. A supply of 0.4 months means that if no additional homes were listed for sale, Ada County would run out of homes to buy in under two weeks. That’s how hot this market is due to insufficient supply compared to demand, especially for existing single-family homes.

It has affected everything from buyer demand to housing supply to mortgage rates, which together have helped drive up home prices across all price points. Despite such a tight supply of houses, the sales are also going up in almost all the price segments. Sellers are expected to list their houses in the coming months and take advantage of the ongoing demand. The Boise Metro Area housing market is expected to see strong home price gains in 2021 (in double-digits).

According to Realtor.com’s forecast, Boise, Idaho would be one of the top metro areas in the country, in terms of year-over-year home price growth. Out of the 100 U.S. metro areas analyzed, Boise ranked at the #3 spot after San Jose and Seattle. According to them, the median list price of homes in Southeast Boise was $455K in December 2020, trending up 13.8% year-over-year. The median listing price per square foot was $249. Zillow also predicts that Boise home values would appreciate by more than 10% in 2021.

Boise Metro Housing Market Report For “January 2021”

The Bosie metropolitan area encompasses Ada, Boise, Canyon, Gem, and Owyhee counties in southwestern Idaho. It also includes Idaho’s three largest cities – Boise, Nampa, and Meridian. Boise Metro housing market is on fire. The Boise-Nampa metropolitan area, also known as the Treasure Valley, includes five counties with a combined population of over 700,000, the most populous metropolitan area in Idaho.

Home prices are soaring and breaking records despite the coronavirus pandemic. Persistently tight inventory in the entire Boise Metro Area housing market, coupled with historically low 30-year fixed mortgage rates are keeping the demand high, which in turn is pushing home prices up in this region.

According to Weknowboise.com, in January 20201, home prices in the Boise Metro area once again set new records due to huge buyer demand coupled with low inventory. The median single-family home price in Ada County hit $449,330 in January, an increase of 23.78% or $86,000 in just 12 months.

Homes at all price points routinely sell for thousands of dollars over the asking price. There’s so much competition that in addition to paying more than market value for property the buyers are offering to pay for the closing costs to seal the deal. Here are the key housing metrics for January.

- Median list price – $427,750 (up 20.53%)

- Median sold price – $433,250 (up 22.08%)

- Price per square foot – $249 (up 23.27%)

- Total home sales – 218 (down 59)

- Median days on market – 4 days (down 22 days)

- Available homes for sale – 0.22 month supply (down 0.51)

- 30-year mortgage rates – 2.74% (down 0.88)

Median Sales Price By Area:

The Canyon County median home price jumped to $339,000, a year-over-year increase of 33.36%. In Boise, the typical house price hit a new record of $433,250, up 22% since last year. The median price of Nampa homes has jumped a staggering 37.19% in the past year. Eagle homes have increased by 35.87%. Meridian home prices have gone up 20.79%.

- Ada County – $432,462

- Eagle – $746,442

- Garden City – $335,000

- Kuna – $$430,000

- Meridian – $434,720

- Star – $460,000

- Canyon County – $339,000

- Caldwell – $307,000

- Middleton – $342,500

- Nampa – $342,961

The supply of available homes in the Treasure Valley is at the lowest levels ever recorded.

- Ada County currently has a 0.31 month supply (or about 9 days) of active inventory.

- Canyon County has a 0.34 month supply (roughly 10 days).

- In Boise, there is only a 0.22 month supply (or about 7 days).

Ada County Housing Market Trends

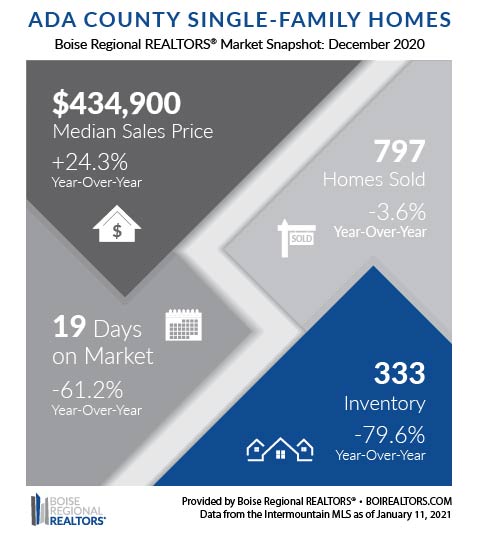

Two of the largest cities of Idaho are Bosie and Meridian. Both of them fall in Ada County. Boise is the capital and most populous city of the U.S. state of Idaho and is the county seat of Ada County. This area is a hot seller’s market with a month’s supply of inventory being 0.4, a decline of -77.8% as compared to Dec 2019. The median sales price in December 2020 was $434,900, up 24.3% YTY.

New home sales made up 34.2% of all sales in 2020, up slightly from 2019. The median sales price for new construction in Ada County in 2020 was $424,995 compared to $375,000 for existing homes. Taking the two segments together, the median sales price for the market overall was $392,230 in 2020.

Here’s the city-wise data for the Ada County housing market, released by Boirealtors.com.

| Ada County | Closed Sales | Median Sales Price | ||||

| Dec 2019 | Dec 2020 | % Chg | Jan 2019 to Dec 2019 | Jan 2020 to Dec 2020 | % Chg | |

| Boise | 357 | 385 | 7.8% | $332,718 | $379,040 | 13.9% |

| Eagle | 88 | 77 | ·12.5% | $509,555 | $605,112 | 18.8% |

| Garden City | 6 | 3 | -50% | $368,650 | $335,228 | -9.1% |

| Kuna | 85 | 73 | -14.1% | $282,502 | $333,401 | 18.0% |

| Meridian | 278 | 292 | 5.0% | $348,486 | $388,766 | 11.6% |

| Star | 43 | 51 | 18.6% | $400,296 | $442,095 | 10.4% |

Credits: Boirealtors.com

Credits: Boirealtors.com

Elmore County Housing Market Trends

The data released by Boise Regional REALTORS shows that 517 homes were sold in Elmore County in 2020, down just slightly from the 524 sold in 2019. Of those, 448 were existing sales, while 69 were new construction — up significantly from 2019 when there were just 17 new homes sold. Elmore County is also a strong seller’s market where we can see double-digit home price appreciation.

Prices also continued to be driven by insufficient supply compared to buyer demand. There were only 26 homes available for purchase at the end of December 2020, a decrease of 69.0% from December 2019. The overall median sales price of homes in Elmore County to $235,000 year-to-date (January 1—December 31, 2020) an increase of 20.5% over the same period in 2019.

Here’s the city-wise data for the Elmore County housing market.

| Elmore County | Closed Sales | Median Sales Price | ||||

| Dec 2019 | Dec 2020 | % Chg | Jan 2019 to Dec 2019 | Jan 2020 to Dec 2020 | % Chg | |

| Glenns Ferry | 2 | 2 | 0% | $144,710 | $196,522 | 35.8% |

| Mountain Home | 32 | 29 | -9.4% | $191,347 | $234,277 | 22.4% |

Gem County Housing Market Trends (September 2020)

Demand for Gem County homes continued to outpace the supply of available properties for sale, which drove up prices. There were 324 homes sold in Gem County in 2020, up 13.7% from 2019. The overall median sales price of homes sold in Gem County reached $319,950 year-to-date (January 1—December 31, 2020) an increase of 30.6% over the same period in 2019. There were only 23 homes available for purchase at the end of December 2020, a decrease of 62.3% compared to December 2019. We saw a year-over-year decline in inventory every month of the year except March.

Boise Real Estate Market Forecast 2021 (Updated)

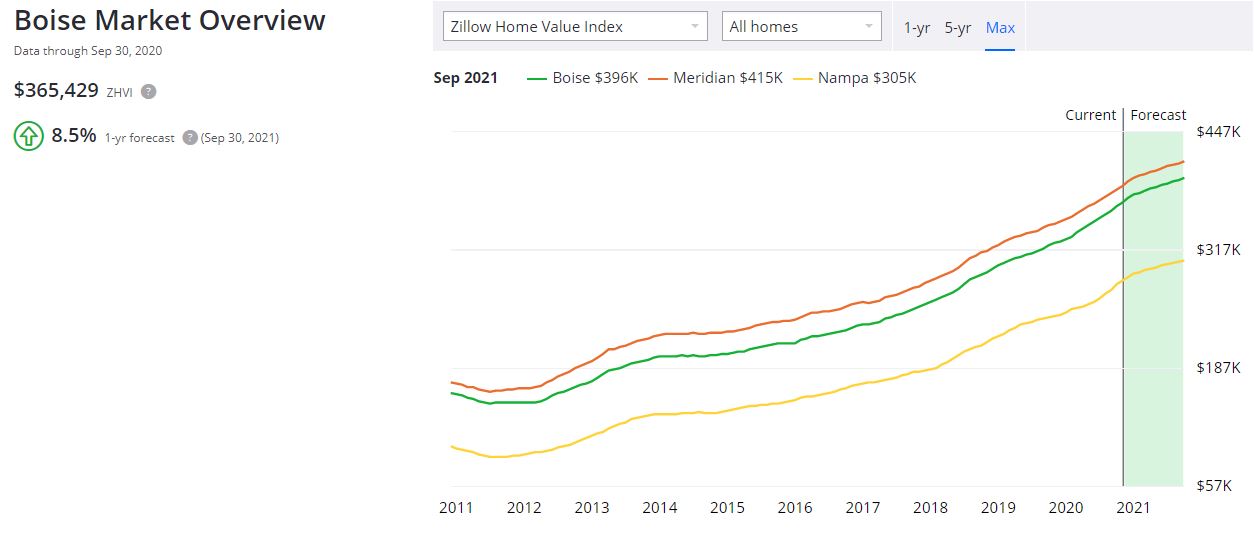

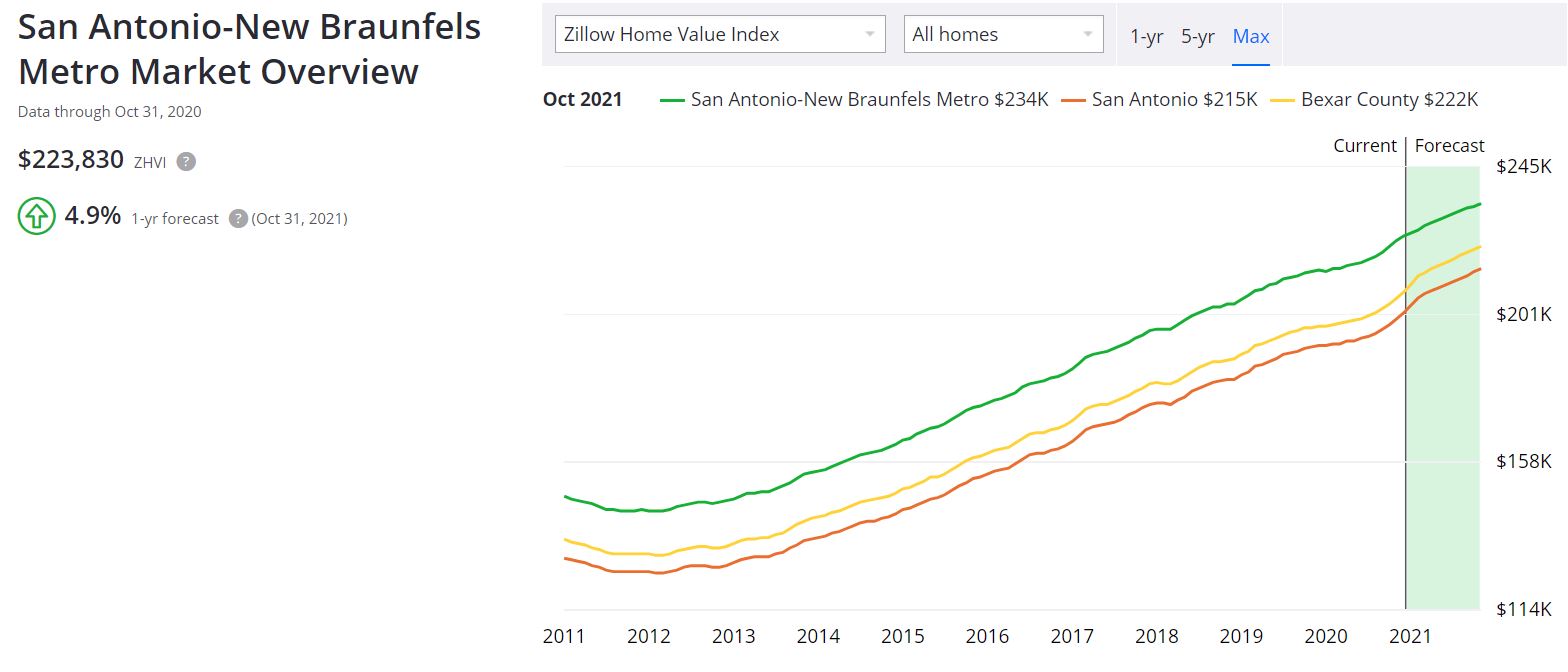

What are the Boise real estate market predictions for 2020? Let us look at the price trends recorded by Zillow over the past few years. Boise home prices have risen by nearly 80% in the past five years. Since 2011, the median home price in Boise has increased from $151,000 to $406,579 — that’s an appreciation of nearly 170%.

Boise home values increased dramatically throughout 2019 by 10.4%. The prices have risen by 21.7% over the last 12 months alone. Last year was the ninth consecutive year of home price gains. Zillow considers Boise a sizzling hot seller’s real estate market which means that there exists a limited supply of homes in Boise, and buyers are forced to compete often resulting in higher prices and/or quicker sales that tend to benefit sellers.

Similar growth has been recorded by NeighborhoodScout.com. Their data also shows that Boise real estate appreciated 115.10% over the last ten years. Its annual appreciation rate has been averaging at 7.96% — more than the national average. This figure puts Boise in the top 10% nationally for real estate appreciation.

During the latest twelve months, the Boise appreciation rate was nearly 10%, and in the latest quarter, the appreciation rate was nearly 3%, which annualizes to a rate of 12%. This figure matches Zillow’s positive forecast, which predicts that home prices in this region are expected to increase by 8.5% in the next twelve months. So, if you invest now, then after twelve months, you can expect a good return on investment.

Here is Zillow’s home price forecast for the three largest cities of the Boise-Nampa metropolitan area — Boise, Nampa, and Meridian. The forecast is until September of 2021 and you can expect to see very strong home price gains.

- Boise home values have gone up 13.3% over the past year and the latest forecast is that they will rise 8.5% in the next year.

- Nampa home values have gone up 14.7% over the past year and Zillow predicts they will rise 9.2% in the next twelve months.

- Meridian home values have gone up 11.5% over the past year and the latest forecast is that they will rise 8.1% in the next year.

Courtesy of Zillow.com

Courtesy of Zillow.com

In Ada County, home prices are expected to increase by 31% over the next three years. Expect 6,000 new single-family homes built over the next three years with 5,000 new rental units.

In Canyon County, home prices are expected to increase by 33% over the next three years. Expect 4,000 new single-family homes built over the next three years with 3,000 new rental units.

In Bonneville County, home prices are expected to increase by 29% over the next three years. Expect 2,000 new single-family homes built over the next three years with 1,500 new rental units.

Here is a short and crisp Boise housing market forecast by LittleBigHomes.com. It is for the 3 years ending with the 3rd Quarter of 2021. The accuracy of this forecast for Boise is 78% and it is predicting a positive trend.

They estimate that the probability of rising home prices in Boise is 78% during this period. If this price forecast is correct, the Boise home values will be higher in the 3rd Quarter of 2021 than they were in the 3rd Quarter of 2018.

OUR TAKE: It is quite evident that the ongoing pandemic has not had any major impact on Boise’s housing market. It shows no sign of cooling off, just like the national housing market. The entire Treasure Valley Market is breaking records over records in sales prices of new and existing single-family homes.

New listings are seeing multiple offers and homes are moving quickly off the market. According to local realtors of that region, they have seen a decline in demand and new listings in the past month when compared to previous years.

The Boise and the entire metro area market is so hot that it cannot shift to a complete buyer’s real estate market, for the long term. In a balanced real estate market, it would take about five to six months for the supply to dwindle to zero. In terms of months of supply, Boise can become a buyer’s real estate market if the supply increases to more than six months of inventory.

And that’s not going to happen. Therefore, in the long term, the Bosie real estate market remains strong and skewed to sellers, due to a persistent imbalance in supply and demand. Due to the lack of inventory of homes for sale at the lower price points, the share of higher-priced (above $300,000) home sales would rise in 2021.

As a result, as more existing homes sell at higher price points, it further drives up the median price for the segment, as well as the market overall. The population is growing, which is fueling demand. The low mortgage rates are enticing buyers to compete with each other, and the supply is at an all-time low.

Very tight inventory & buyers trying to take advantage of low mortgage rates are helping sellers to move their properties quickly. There is no likelihood of mortgage rates rising back but some new lender restrictions could be expected to make it a little tougher for buyers to qualify.

Therefore, the buyers are in a state of urgency and are competing with each other, which is driving the prices higher. The conditions are favoring the sellers even in this pandemic. Home prices in Boise should continue to climb at a steady pace in 2021.

Boise Housing Market 2020 Summary: Prices And Trends

We shall now do a quick recap of the impact of the pandemic on the Boise housing market in 2020. We shall mainly discuss median home prices, inventory, economy, growth, and neighborhoods, which will help you understand the way the local real estate market moves in this region.

Boise has a mixture of owner-occupied and renter-occupied housing units for sale. There are more homeowners than renters. As per Neigborhoodscout.com, a real estate data provider, three and four-bedroom single-family detached home houses are the most common housing units in Boise. Other types of housing that are prevalent in Boise include duplexes, rowhouses, and homes converted to apartments.

Single-family homes account for about 65% of Boise’s housing units. The year 2020 began with a new record in price gains for Boise. The Boise housing market looked hotter than before with a supply hitting a two-year low. The extreme shortage of existing homes and increasing share of new home sales drove prices up.

In Jan 2020, the share of new home sales in Ada County increased by 8.2% compared to last year. About 40% of all home sales were new constructions. Inventory of existing single-family homes for sale dropped by 28.1% compared to last year. The median sales price of single-family homes in the Boise housing market was $354,900, up 20.31 percent from last year. House prices in Ada County rose 15.33 percent to a record of $363,000.

Impact of Covid19 on The Boise Housing Market

The median sales price of a single-family home made a record-setting of $365,645 in March 2020, a year-over-year increase of 8%. Even in the times of the Covid-19 pandemic, the homes are still being listed & sold and the entire Boise Metropolitan Area housing market remains steady strong. Despite statewide social distancing rules and economic uncertainty, the housing market reported new record-high home prices and sales in April as well.

According to a report published by Weknowboise.com, the median sale price for single-family houses in Boise, ID from April 1st to the 30th 2020 was $350,000, based on 326 home sales. The median sales price increased by 7.72% from last year.

- The average price per square foot for Boise is $208, an increase of 8.9 percent compared to the same time last year.

- The median list price increased to $351,000, up 8% from last year

- Median days on market declined to 5 days, down by 1 day compared to the same time last year.

- Months of Supply was 1.22, +0.21 vs. last year.

Ada county falls in the Boise MSA, which encompasses several other counties as well. Here’s Boise Regional REALTORS’s report for the month of April.

- There were 761 home sales in April 2020, down by 19.5% compared to the same month last year.

- The overall median sales price in Ada County reached a new record of $374,900, up 13.6% year-over-year, and up 2.2% from March 2020.

- In April, 35.0% of closed sales were for new homes and the segment had a median sales price of $416,287, compared to $345,000 for existing/resale.

- The months’ supply of inventory equated to 1.7 months.

Here’s how 2020 ended for the real estate market:

According to Boise Regional REALTORS®, in total, 11,728 homes were sold in Ada County in 2020 — 5.2% more than in the previous year. The only other time we saw more sales in one year was in 2005 which had 11,974 sales. This represents existing and new construction combined. On the last day of December 2020, there were just 333 homes available for sale, for both existing and new construction combined — 79.6% lower than December 2019 and a record low based on data going back to 2004.

More inventory is needed to bring balance back into the market at all price points and product types. The median sales price for the market overall (new construction and existing homes) was $392,230 in 2020.

In Elmore County, 517 homes were sold in 2020, down just slightly from the 524 sold in 2019. Of those, 448 were existing sales, while 69 were new construction — up significantly from 2019 when there were just 17 new homes sold. Prices also continued to be driven by insufficient supply compared to buyer demand.

There were only 26 homes available for purchase at the end of December 2020, a decrease of 69.0% from December 2019. The overall median sales price of homes in Elmore County to $235,000 year-to-date (January 1—December 31, 2020) an increase of 20.5% over the same period in 2019.

In Gem County, 324 homes were sold in 2020, up 13.7% from 2019. The overall median sales price of homes sold in Gem County reached $319,950 year-to-date (January 1—December 31, 2020) an increase of 30.6% over the same period in 2019. There were only 23 homes available for purchase at the end of December 2020, a decrease of 62.3% compared to December 2019. We saw a year-over-year decline in inventory every month of the year except March.

Boise Real Estate Foreclosure Trends

Here are some foreclosure statistics of the Boise real estate market. At the height of the collapse, when the U.S. national foreclosure rate topped out at 4.5 percent, Boise never exceeded 4%. In recent years, it has stayed at least 2 percentage points below national averages for each of the past ten years.

US Housing Market Forecast 2021: Will It Crash or Boom?

In April 2020, there were 42 properties in Boise, ID that were in some stage of foreclosure (default, auction, or bank-owned) while the number of homes listed for sale on RealtyTrac is 376. The number of properties that received a foreclosure filing in Boise, ID was 95% lower than the previous month and 88% lower than the same time last year.

| Potential Foreclosures in Boise | 42 (RealtyTrac as of April 2020) |

| Homes for Sale in Boise | 376 |

| Recently Sold | 2645 |

| Median List Price | $334,700 (1% drop vs Mar 2019) |

Boise Real Estate Investment: Should You Invest or Not?

Should you consider Boise real estate investment? Many real estate investors have asked themselves if buying a property in Boise is a good investment? You need to drill deeper into local trends if you want to know what the market holds for real estate investors and buyers in 2020.

If you want to find investment opportunities, you need to find sleeper opportunities. These are places where demand is growing but it isn’t so hot that you risk being burned by buying at the top of the market. And we found such a “sleeper” investment opportunity in Boise, Idaho.

Idaho has much more than potatoes. Boise is a full city, home to more than 200,000 people. Nor is that the entirety of the Boise housing market, since Boise has suburbs. The Boise City–Nampa, Idaho Metropolitan Statistical Area is home to over 700,000 people. Nearly 40 percent of Idaho’s total population lives in the area, and it includes Idaho’s three largest cities – Boise, Nampa, and Meridian.

Is Boise a good place to invest in real estate? To begin with, the supply and demand dynamics continue to drive home prices up in Boise. The Boise housing market was ranked as the #1 in the U.S., by Realtor.com’s metro level housing forecast for the year 2020. Their main criteria were based on the combined yearly percentage growth in both home sales (0.3%) and prices (8.1%) expected in 2020 among the top 100 largest markets in the country.

What Makes Boise a Hotspot For Real Estate Investment? |

|

|

|

Let’s take a look at the number of positive things going on in the Boise real estate market which can help investors who are keen to buy an investment property in this city. We’ll address the biggest factor pulling people to the Boise housing market next.

1. Boise’s Big Student Market That Rents

The Boise metro area is the largest population center in Idaho and home to the state capital, so it is the largest student market in the state. Boise State University is located here. So are satellite campuses of the University of Idaho ad Idaho State University. Boise Bible College is also located in Boise. This provides significant opportunities for those who want to invest in the Boise real estate market and cater to college students.

2. The Lure of Jobs in Boise

One factor propelling the Boise real estate market is the availability of jobs. In Boise, population and job growth triple the national average. Boise is home to far more than lumber and food processors, though it is home to the headquarters of Idaho Pacific Lumber Company.

The area’s largest private employer is Micron Technology, though Hewlett Packard and Simplot employ thousands here. There are several manufacturing facilities here providing more stable and better-paying work than you could find in the seasonal tourism and irregular agribusiness sector.

The university and state government are major employers. Boise has low unemployment overall, currently hovering around 3%. That is two points below the national average.

3. The Strong Boise Rental Market

The average wage in Boise is a dollar an hour higher than the state average, so moving there gives you a pay hike. However, Boise has generally low wages compared to other metro areas. The average pay rate is about $40,000 per person. While housing is cheaper than in states like California and Oregon, the pay is lower, too. This means many people must rent. A healthy vacancy rate is around 5%.

In Boise, it is around 2%, and in the cheapest units, 1%. This has led to a flood of new apartment construction in the Boise housing market, but higher than average construction costs in Idaho slow down relative to demand. It certainly didn’t help local renters when there was no apartment construction at all in 2008 while new construction lagged in the last years of the Great Recession that only ended in 2016. That is why rental rates went up 7% between 2017 and 2018.

4. Boise’s Highly Rated Schools

Boise has the top-ranked school district in the state. And you get these high-quality schools along with cheap housing, high quality of life, and short commutes. If you’re one of the many people fleeing the high crime, unemployment, and regulatory burden of California, that’s an ideal combination.

5. An Excellent Quality of Life in Boise

Any town can say they have a great atmosphere or quality of life, but Boise makes national publication’s lists of best places to live – repeatedly. In 2008, they were listed second in Forbes on the best places for business and careers. In 2014, Time Magazine listed Boise as the best city “getting it right”.

In 2018, Boise ranked 46th in Money magazine’s best places to live list. Boise’s ranking was unusual in that it was a large city and state capital, while most cities that made this list were the suburbs of big cities or college towns. US News and World Report listed Boise as the 23rd best place to live and 66th to retire in the 125 biggest metro areas in the United States.

6. The Outdoor Recreational Opportunities in Boise

This is such a hallmark of Boise that it can’t be considered just one more aspect of the quality of life. The COVID-19 pandemic presents not only a global health crisis but has also disrupted the daily lives of people around the world. From a leisure perspective, urban outdoor enthusiasts are one group particularly impacted by the pandemic and the subsequent institutional response.

Boise’s location puts you in easy reach of the surrounding wilderness, while the local climate means people bike and raft in the summer and ski in the winter. Rock climbing, kayaking, hunting, golfing, horseback riding, and myriad other activities attract people as tourists (providing significant local employment) and keep residents from considering every leaving.

7. Boise’s Demographic Momentum

The Boise housing market is driven more by internal migration than international migration. The high price of real estate in Utah has driven a steady stream of Mormons into the Boise real estate market. Their average family consists of three children, 50% larger than the U.S. average.

The state is attracting refugee families from the West Coast’s high taxes and housing costs, as well, as they seek a better place to start and raise families. That’s why many in Boise openly mock Californians, though it won’t keep them from buying in the Boise housing market. This means that the Boise market will see continual growth from demographic momentum for years to come.

8. Low Taxes in Boise

Boise has very low taxes, especially compared to the West Coast. The progressive income tax tops out at 7.4%, while the sales tax is about 6%. You pay less for utilities and car insurance, too. For investors, the average 1% property tax rate is a bargain, especially when you factor in the low cost of housing. The average property tax bill is around $2300. The national average is 1.2% of the home’s assessed value and an annual property tax bill of $3000, though, in places like New Jersey and New York, it could surpass $10,000.

9. Affordable Real Estate for Buyers Amidst Rising Pricing

One of the attractions of the Boise real estate market is the sheer number of affordable large single-family homes. You could find a four-bedroom home for around $200,000, roughly $100,000 below the national average, several years ago. With increasing demand, homes are still a deal at around $250,000. Positive market trends have supported Boise’s real estate investing too. Not just has Boise real estate market recovered its balance, it has started to flourish.

With strong market basics set up, this development does not seem, by all accounts, to be backing off at any point soon. A strong local economy and sustained employment are giving buyers confidence – just what the Boise real estate market needs. Boise has been one of the fastest-growing cities in the nation and housing inventory has never been tighter, driving home prices up. The trend has been toward fewer available listings each year as the population grows and homes sell fast.

10. Decent Return on Investment

The median rent in Ada County where Boise is located is around $800; you get a two-bedroom apartment for that. You could of course charge much more for a large single-family home while affordable properties and low taxes give you a decent ROI on the investment. Slow and steady demand also ensures that your investment will grow in value; the Boise housing market has seen an appreciation of around 10% year over year. We already mentioned how the high demand for rentals relative to supply is keeping rental rates elevated, and the slow rate of construction means that rental rates and property rates aren’t going to fall in the foreseeable future.

Boise, Idaho Real Estate Investment Markets

The Boise real estate market is a sleeper market, seeing slow but steady demand that the local housing market can’t quite meet. The best opportunity is in rentals catering to those who can’t pay a lot in rent but want to be close to major employers. Good cash flow from Boise investment properties means the investment is, needless to say, profitable.

A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding a good Boise real estate investment opportunity would be key to your success. The best investment is now looking for a rental property that will generate good cash flow.

The three most important factors when buying real estate anywhere are location, location, and location. The location creates desirability. Desirability brings demand. There should be a natural and upcoming high demand for rental properties.

Demand would raise the price of your Boise investment property and you should be able to get a good return on your investment over the long term. The neighborhoods in Boise must be safe to live in and should have a low crime rate. The neighborhoods should be close to basic amenities, public services, schools, and shopping malls.

A cheaper neighborhood in Boise might not be the best place to live in. A cheaper neighborhood should be determined by these factors – Overall Cost Of Living, Rent To Income Ratio, and Median Home Value To Income Ratio.

Some of the popular neighborhoods for buying a house or an investment property in Boise are Harris Ranch, Highlands, North End, Boise Heights, Depot Bench, Downtown Boise City, Southwest Boise City, Sunset, Warm Springs Heights, Warm Springs Mesa, Big Sky, Foothills, East Side, Southwest Ada County Alliance, Southeast Boise, and West Valley.

Boise real estate prices are well above average cost compared to national prices. It depends on how much you are looking to spend and if you are wanting smaller investment properties or larger deals such as duplex and triplex in Class A neighborhoods. The inventory is low, but opportunities are there.

Even as Boise home prices have reached new heights, the market remains attractive to residential real estate investors. As they continue to compete for potential investment properties at the lower end of the market, the challenges for first-time homebuyers will remain.

The homebuyers won’t be able to outbid real estate investors and would end up renting. Highlands has a median listing price of $775K, making it the most expensive neighborhood in Boise. Central Bench is the most affordable neighborhood in Boise, with a median listing price of $254,000.

Idaho Falls is another sizzling hot market for real estate investment in 2020. Idaho Falls, Idaho is enjoying strong but steady growth, because it has the ideal mix of affordable real estate, excellent quality of life, and great economics. People move here because they can find good-paying jobs and affordable homes, while they look forward to a bright future.

The influx of people from rural Idaho, fleeing Boise or the West Coast is all driving up rental rates in Idaho Falls, Idaho. Rents for small one-bedroom apartments grew nearly 20% year over year, while two-bedroom rents increased roughly 6%. Needless to say, the rents for larger Idaho Falls rental houses are rising faster than the rate of inflation, too.

On the west of Idaho lies the neighboring state of Oregon. Portland, Oregon is a also great place to invest in real estate. The Portland real estate market is booming because the economy is doing well on its own and the area is head and shoulders above California’s deteriorating situation. The Portland housing market has experienced double-digit annual price growth in recent years. Home values rose 11.4% in 2016 alone, according to a report from the real estate data company Clear Capital.

Bend is another small city in Oregon and a good place for real estate investment. Bend is arguably everything that Portland isn’t. It has lower taxes, more open space, more affordable real estate and attracts visitors from all over the country. It has seen steady population growth. However, Bend hasn’t been adding new inventory fast enough to meet the rising demand in the Bend housing market. Instead, most of the new construction has been single-family homes snapped up by buyers. It is a good place to consider investing if you’re willing to take up the challenge.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Boise, Idaho.

Consult with one of the investment counselors who can help build you a custom portfolio of Boise turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Boise.

Not just limited to Boise or Idaho but you can also invest in some of the best real estate markets in the United States. All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete Boise turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

Is It The Right Time To Invest In Real Estate? – The national homeownership rate is on the decline for the first time since 2017. As demographics change and baby boomers retire, you’re seeing Millennials who may not be ready to buy houses. In 2018, Millennials made up about 22 percent of the population in the United States. They’re choosing to rent over buying a single-family home or an apartment. Rising home prices and shortage of starter homes have not left Millennials many choices but to delay homeownership. Moreover, it’s even harder to take out a mortgage for those who have student loan debt.

Let us know which real estate markets in the United States you consider best for real estate investing!

Remember, caveat emptor still applies when buying a property anywhere. Some of the information contained in this article was pulled from third party sites mentioned under references. Although the information is believed to be reliable, Norada Real Estate Investments makes no representations, warranties, or guarantees, either express or implied, as to whether the information presented is accurate, reliable, or current. All information presented should be independently verified through the references given below. As a general policy, Norada Real Estate Investments makes no claims or assertions about the future housing market conditions across the US.

REFERENCES:

Latest Market Data, Trends, and Statistics

https://www.boirealtors.com

https://www.weknowboise.com

https://www.zillow.com/boise-id/home-values

https://www.movoto.com/boise-id/market-trends

https://www.realtor.com/realestateandhomes-search/Boise_ID/overview

https://www.neighborhoodscout.com/id/boise/real-estate

https://www.boirealtors.com/april-2020-market-report

https://www.fortunebuilders.com/boise-real-estate-and-market-trends

https://www.littlebighomes.com/real-estate-boise-city.html

Foreclosures

https://www.realtytrac.com/statsandtrends/id/ada-county/boise

Affordable large homes

https://www.deseretnews.com/top/7/3/Boise-Idaho-The-10-best-places-to-raise-an-LDS-family-outside-of-Utah.html

Boise Schools

https://www.niche.com/k12/d/boise-independent-school-district-id/

Low taxes

https://realestate.usnews.com/places/idaho/boise

https://smartasset.com/taxes/idaho-property-tax-calculator

Strong rental market

https://www.idahostatesman.com/news/article214593445.html

https://www.ktvb.com/article/news/local/recent-report-shows-rent-prices-unaffordable-across-idaho/277-564266735

https://www.boiseweekly.com/boise/for-rent-boises-historic-low-vacancy-rate-triggers-a-flood-of-new-apartments/Content?oid=5862461

Quality of Life & Investment

https://www.bestplaces.net/city/idaho/boise

https://www.movoto.com/blog/opinions/moving-to-boise

http://time.com/money/collection/2018-best-places-to-live/5361498/boise-idaho

https://www.estately.com/blog/2013/10/32-things-to-consider-before-moving-to-boise

http://www.boisestatepublicradio.org/post/things-draw-people-boise-and-what-pushes-them-away#stream/0

https://www.forbes.com/sites/ingowinzer/2016/09/20/is-it-time-to-invest-in-the-mountain-states/#200f3b856730

We Made the List! (America’s Fastest-Growing Private Companies)

Recent Comments