Roofstock Review 2021-Purchase of Real Estate with Rental Services

- December 20, 2020

- Blog, Rental Income

- Comments Off on Roofstock Review 2021-Purchase of Real Estate with Rental Services

- admin

Advertising Disclosure This article contains references to services or products from several of our marketers or companions. We may obtain settlement when you click on links to those service or products

Advertising Disclosure This article contains references to services or products from several of our marketers or companions. We may obtain settlement when you click on links to those service or products

RoofstockIf you wish to become an investor in the potentially rewarding real estate market yet simply can not picture on your own swinging a hammer for a fix-and-flip or taking care of an occupant’s commode in the middle of the evening, Roofstock may be the option for you.

Payments & Charges – 8.5

Client service – 8.5

Alleviate of Use – 8.5

Roofstock provides non-accredited investors the possibility to purchase single-family rental realty. Nevertheless, it calls for a significant deposit to start, as well as the residential or commercial properties are a highly illiquid financial investment.

PAY JUST $99 FOR FIRST INVESTMENT

Exactly How Roofstock Works?

Comparable to various other property business such as Fundrise, Patch of Land, as well as Realty Mogul, Roofstock supplies a simpler path to an extra easy type of real estate investing than the regular path of discovering an agent, touring residence after residence, and also manually investigating all the compensations and also files … as well as the problems of repairing and/or taking care of a residential property.

However, here’s where Roofstock is various. With many real estate crowdfunding industries, the financier is lending cash to a rehabber or realty designer for a specific task within a specified duration. On Roofstock, the financier is purchasing the property outright. This is not crowdfunding; this is merely a less complicated and cheaper method to purchase a rental building.

Through Roofstock, busy experts or financiers who simply do not intend to put in that much job themselves however still would love to have rental property can easily invest. Comparable to completes– where a typical condition to closing is to have actually the property rented with a paying lessee in position– Roofstock’s residential or commercial properties prepare to generate capital for the proprietor on day one.

And now, if you’re a certified financier and also intend to invest in shares of rental residential properties and diversify your portfolio across several places as well as houses, Roofstock has a brand-new offering that might attract you.

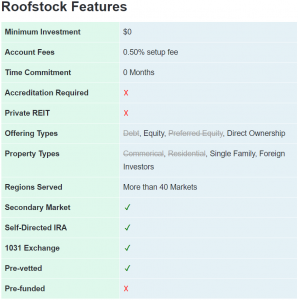

Roofstock Functions

Minimum Investment$ 0.

Account Fees0.50% arrangement charge.

Time Commitment0 Months.

Accreditation Required.

Private REIT.

Supplying TypesDebt, Equity, Preferred Equity, Direct Possession.

Building TypesCommerical, Residential, Single Household, Foreign Investors.

Regions ServedMore than 40 Markets.

Secondary Market.

Self-Directed IRA.

1031 Exchange.

Pre-vetted.

Pre-funded.

Pay Only $99 Charge For Your First Financial Investment Home Purchase with Roofstock.

Free to Join– There are no membership or gain access to fees to view residential properties on Roofstock.

Qualified Properties– To be detailed on the system, each property should pass a vetting and testimonial procedure verified by Roofstock. All papers are published with the residential or commercial property details, so any kind of possible financier has full accessibility. There are projected forecasts on each residential property too.

Rental Cash Flow and Possible Funding Gains From Property Admiration– Similar To any other rental residential or commercial property, investors make returns from the rental cash flow and any kind of recognition in the home value when it’s sold.

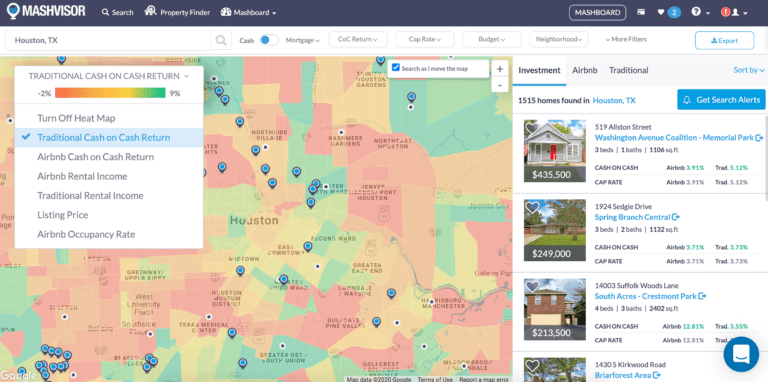

Online Searchable Data source– The platform is easy to use and enables you to swiftly look for residential properties that satisfy your wanted standards.

30-Day Contentment Assurance– Roofstock supplies a 30-day assurance to customers under a Roofstock Real Estate LLC Purchase and also Sale Arrangement. If a customer is not pleased with a residential or commercial property, they can alert Roofstock in writing within thirty days of the closing. Roofstock will certainly re-list the home totally free as well as will buy it themselves if it does not offer within 90 days.

Roofstock One (New)– Own shares of specific rental residences with an absolutely passive security offering. All management is dealt with. See listed below for even more details.

Roofstock Screenshots.

What Is Roofstock?

Roofstock was initially funded and also launched in May 2015 and also formally opened its industry less than a year later, with the initial deal taking place in March 2016.

According to CEO Gary Beasley, previously the co-CEO of Starwood Waypoint Residential Trust, among the leading single-family rental companies in the USA, Roofstock is “focused on markets where there are a healthy supply and demand for single-family rental homes.”.

Roofstock currently serves almost 40 markets, consisting of Atlanta, Dallas, and also Las Vegas.

Roofstock provides research, analytics, and understandings to evaluate and also purchase separately certified homes at set costs. Roofstock doesn’t possess the residential or commercial properties published in the market; nonetheless, it does pre-certify all residential properties before detailing them.

To be certified, each property needs to have:.

A residential property walkthrough assessment carried out by a seasoned investment residential property inspection firm;.

A price quote of the cost of major and minor repair work necessary in the brief and near terms;.

A title record with no uninsurable encumbrances or liens and also preliminary title commitments where suitable;.

An assessment evaluation of the property as well as market problems in the neighborhood rental market;.

A 3D online scenic tour of the property;.

A residential property floor plan;.

Pictures of the property;.

A review as well as summary of the lease terms; and also.

A testimonial and also recap of the tenant option procedure.

Roofstock currently provides more than 470 buildings available on the site, connecting thousands off investors and sellers.

You may be questioning why an individual would want to sell a cash-flow favorable rental home. According to Roofstock, sellers typically note for one of 3 primary reasons:.

The vendor was not able to gather enough homes in a certain geography to acquire the economies of scale wanted;.

They are reshaping their more comprehensive portfolio to concentrate on a much more details strategy or kind of home; or.

They want to have actually funding returned or to redeploy funds into other geographical areas or “fix-up” buildings.

Roofstock may offer selling price recommendations, yet the home vendor determines the sticker price. However, as part of the certification procedure, Roofstock will not note a building if the firm executives think the property is not valued appropriately.

Chief Executive Officer Beasley says the firm’s objective is to use innovation to effectively match buyers and also sellers and also lower the purchase expenses for both events. The business version is to charge half of the 6% generally charged by real estate professionals. Sellers pay a 2.5% marketing charge and also buyers pay half a.

point in commissions.

Roofstock One.

Roofstock’s most recent offering permits recognized financiers to acquire shares of certain residential or commercial properties. Each share represents 1/10th of the house’s equity. Financiers receive financial right in the underlying property, including any type of possible web rental earnings after expenses. Yet you will not need to get your hands dirty– Roofstock deals with all maintenance as well as management.

Roofstock itself will maintain a minimal 10% ownership rate of interest in each residential property for the very first year, which must offer capitalists some satisfaction.

After a six-month holding duration, Roofstock One financiers will be able to redeem shares and even convert to a traditional possession design (if they own 90% or even more of the shares).

The minimal investment to take part in Roofstock One is presently $5,000. If that seems high, remember you’re buying at least 1/10th of a residential or commercial property!

By possessing shares in several Roofstock One buildings, you can potentially expand your profile throughout numerous different markets. This can make your real estate holdings more powerful as well as probably even more profitable.

Roofstock Pros & Cons.

Pros.

Very Own Real Estate– Buying a rental building in a location where you can make use of high rental fees as well as reduced property prices can end up being a fantastic investment. Rental residential or commercial properties use the opportunity to become a homeowner while including an additional revenue stream to a financial investment profile.

Non-accredited Capitalists– Unlike real estate crowdfunding systems, you do not require to qualify as an approved capitalist to buy Roofstock residential properties.

Cash-Flow Positive Investments– Unlike house turning that might call for substantial fixings to make a house habitable, a Roofstock financial investment is already rented and also is cash-flow favorable the day it’s acquired.

Connected Home Supervisor Not Mandated– Roofstock provides accessibility to accredited residential or commercial property supervisors for investors that pick not to self-manage their residential properties. Nevertheless, unlike standard complete operators, Roofstock doesn’t require making use of an associated property manager for any one of the homes provided on their website.

Lower Payments– With technology, Roofstock has the ability to charge less than the usual 6% charged by property representatives. Vendors pay a payment of 2.5% and also buyers are charged 1/2 of one factor (a factor is a percent of the agreed-upon cost– 1/2 point of a $100,000 property is $500).

Cons.

Long-Term Investment– Rental building is extremely illiquid, and also it can be much easier to purchase than to market. And also unlike investing in a REIT or lending cash on a real estate crowdfunding system for a specified term, you’re purchasing a house on Roofstock. The procedure is likely to be research-heavy, and it might call for a lot of time to carefully assess all the papers as well as properly perform due persistance. The only way to minimize threats is to do considerable due diligence and make certain to invest in top quality.

Emergency situation Money– You will certainly need to have actually funds reserved for emergency situation repair work and also expenditures. Rent-paying lessees expect a broken dishwashing machine to be fixed immediately. Any kind of rental home investor need to have a reserve barrier to take care of the regular loss of money that becomes part of having any kind of rental property: jobs, upkeep as well as tenant turn overs.

Large Deposit– Like any other residential property, you can obtain a home loan. Nevertheless, be prepared to gather a much more big down payment as home mortgage lending institutions for houses that are not your key residence usually call for 20%– 30% down.

Pay Only $99 Charge For Your First Financial Investment Home Purchase with Roofstock.

Recap.

Roofstock makes use of innovation to supply a platform that streamlines a historically difficult property acquiring process and gives financiers accessibility to localized offers they could otherwise never see. The outcome is that investors seeking rental buildings can study, testimonial and buy residential properties from anywhere with openness and efficiency. Roofstock’s goal is to make investing in UNITED STATE property from throughout the world as basic as well as efficient as buying stocks.

- Real Estate Investment Advice

- Real Estate Investors

- Rental Property Investment in 2021

- Rental Property Investment Information

- Roofstock

- the Basic Situation of US Real Estate in 2020

Recent Comments