How a COVID-19 Vaccine Could Impact the US Housing Market 2021

What Are the Signs of a Housing Bubble?

The long-awaited COVID-19 vaccine is finally here! German company BioNTech and New York-based Pfizer got an emergency green light from the Food and Drug Administration (FDA) after their vaccine was found to be 95% effective in preventing infections. Another US company, Moderna, has also recently received approval for its vaccine.

This week, president-elect Joe Biden received his first dose of the Pfizer COVID-19 vaccine on live TV to show Americans that it is safe. Other political leaders have also received the jab including House Speaker Nancy Pelosi and Vice President Mike Pence. The Biden administration has set a goal of vaccinating 100 million Americans within their first 100 days in office. According to the CDC, 500,000 Americans have already been vaccinated.

However, health experts say that the arrival of the COVID-19 vaccine doesn’t mean that things will immediately go back to normal. Mask wearing, social distancing, and hand washing will still be the norm until most of the population has been vaccinated. Dr. Fauci reckons that at least 70% of the US population must get vaccinated before health precautions are eased in 2021.

How the COVID-19 Vaccine Will Impact the US Housing Market 2021

After a rough year with a rising unemployment rate, impending foreclosures, and an eviction moratorium, the arrival of the vaccine is obviously good news for the US housing market.

Here are some of the ways the COVID-19 vaccine will affect the US housing market:

Increased demand for metro markets

At the peak of the coronavirus pandemic, a significant number of people started moving away from densely-populated cities to the suburban real estate market. People were looking for homes for sale that are not only affordable but also spacious. And crowded cities where COVID-19 was spreading rapidly were no longer appealing to the general population.

However, when economies open up and the COVID-19 vaccine becomes readily available, many that left cities temporarily are expected to return. Lower rents in certain cities will also help attract returning and new city residents. For example, Zillow reports that rents fell 12% in the New York City real estate market and 5.1% in the City of San Francisco.

Related: Suburban Real Estate Market Boom Due to COVID-19

An exponential increase in home sales

Despite the coronavirus pandemic, the US housing market has been incredibly resilient. Home sales have grown by about 6% from 2019. Zillow predicts a 21.9% growth in 2021, which will be the highest annual sales growth since 1983. This exponential growth will be driven by the COVID-19 vaccine rollout and the subsequent economic recovery. Home sellers that have been holding back due to uncertainty will list their homes, thus adding more supply to satisfy the heavy demand in the housing market.

Skyrocketing home prices

In the last year, mortgage payments have become increasingly affordable for property owners, thanks to the historically low mortgage rates. More and more homeowners are taking advantage and refinancing their existing home loans. With the arrival of the COVID-19 vaccine, the economy is expected to rebound in 2021. This is likely to result in slightly higher mortgage rates, which will make homes more expensive. Home prices will be driven further by intense competition for the few properties available for sale. Realtor.com predicts that home values will increase by 5.7% in the US housing market 2021.

Related: How to Find Deals When Housing Inventory Is Low

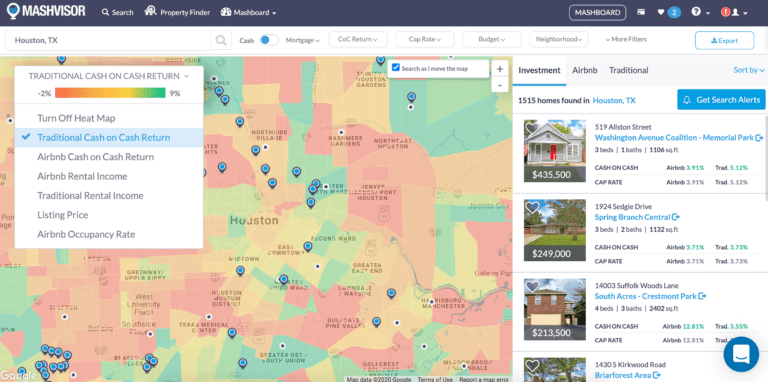

How to Find a Rental Property for Sale with Mashvisor

So if you were wondering whether next year will be a seller’s or buyer’s market, it’s clear a strong seller’s market is in the post-COVID-19 forecast. At the same time, the high demand will prevent a housing market crash.

Rising rent prices

Landlords may raise rents after a COVID-19 vaccine in order to recover 2020 losses.

Due to high pandemic-related job losses in 2020, many Americans were unable to keep up with their rent payments. As a result, the CDC issued a moratorium to protect tenants from eviction and prevent further spread of the coronavirus.

While the eviction moratorium was good news for renters, many property owners are still feeling the pain of missed rents. Forbearance was also issued under the CARES act to protect some property owners from foreclosure, but many still struggled due to the loss of rental income.

Once the eviction moratorium expires on the 31st of January 2021, it is expected that many landlords will hike their rents in an attempt to make up for lost earnings.

Related: 7 Real Estate Trends to Expect Post COVID-19

An increased shift to virtual transactions

New technology is already being adopted in 2020 to make home buying, selling, financing, and renting safer. Even with the COVID-19 vaccine, real estate agents will continue using virtual tools to give potential home buyers a unique home shopping experience. Redfin.com reports that views of 3D walkthroughs, where a potential buyer can click through a 3D scan of a property, have increased 560% since February. Video tours have now become an accepted way of viewing a home, with many buyers making an offer on a property sight unseen.

Tenants will also continue to use different tools to search, locate, apply for, and lease rental property from the comfort of their homes.

Increased demand for Airbnb rentals

Since COVID-19 hit, the travel industry and its star, Airbnb, were negatively affected. Travel bans led to mass cancellations of Airbnb bookings. Many major sports events, concerts, and festivals were canceled during 2020, leaving some Airbnbs empty.

With the rollout of the COVID-19 vaccine, more people will feel safer to travel and restrictions will eventually disappear. As a result, the Airbnb market is likely to be hot, with high Airbnb occupancy rates. Those who put off traveling or are sick of being cooped up at home will look towards short term rental properties to fill the desire. Buying an Airbnb investment property in the right location could therefore be a wise decision for any real estate investor in 2021.

Conclusion

COVID-19 vaccine distribution is currently ongoing in the US. With the pandemic anxiety being eased, housing market predictions point to a hot spring season in 2021. There is likely to be a buyer frenzy as people try to avoid higher mortgage rates later in the year. Since buyers can use technology to shop from home, it is expected that demand will remain high even in the dead of winter.

Whatever comes about in the post-COVID-19 world, you can easily find great real estate deals on Mashvisor. Start your search in one of the best places to invest in real estate in 2021 now.

Start Your Investment Property Search!

AirbnbProperty PricesRental RateSalesSellers MarketTechnology

Why You Need Predictive Analytics Tools for Real Estate Investing

Recent Comments