Will Paying Property Management Fees Prevent Me From Earning Positive Cash Flow?

Is a Quadplex a Good Real Estate Investment?

If you want to enjoy the financial rewards of owning a rental property but don’t want to manage it yourself, you can consider outsourcing professional property management services. But, is hiring a property manager worth it? Hiring a property manager provides you with the opportunity to delegate most or all of the tasks and headaches associated with property management. While you will have to pay property management fees, a competent property manager can keep your tenants satisfied and safeguard your real estate investment.

Still, if you are thinking of putting your rental property in the hands of a property manager, one of the important things to take into account is whether the fees are actually worth it and how they will affect your cash flow. And it’s not as simple as looking for the cheapest services in town – the lowest property management fees are not always the best. You should also consider the long-term benefits of such an arrangement. Cheap but poor property management could lead to a higher vacancy rate, rental property damage due to delayed maintenance, etc. Therefore, it’s important for every landlord to get a detailed understanding of property management fees and how to find the right property manager.

In this article, we’ll give you a breakdown of property management fees and provide you with the answer to the question, “Will paying property management fees prevent me from earning positive cash flow?”

Related: 4 Investing Mistakes That Kill Profits and Result in Negative Cash Flow

Common Property Management Fees

One of the most common questions asked by new landlords is “how much do property managers charge?” Well, the cost of property management fees depends on a variety of factors such as location, the size, type, and condition of the property, the number of rental properties, and the scope of rental property management services provided.

To a real estate investor, the primary objective of professional property management is to maximize rental income and optimize capital growth on your rental property. Therefore, it’s crucial that you understand what services are included in the total cost of management. Without knowing this, it’s difficult to determine who is providing the best value. The total rental property management fees can be broken down into several different components which include but aren’t limited to the following:

1. Management Fee

The management fee is usually charged monthly and is calculated as a percentage of the total rental income collected from the tenant. This is usually the largest chunk of the total property management fees. The management fee varies between 8% to 12% depending on your location, the number of units being managed, and the rental property management services you are being provided.

2. Leasing Fee

Another important property management fee you need to consider when evaluating a property management company is the leasing fee. This is a fee charged by property managers at the beginning of a tenancy for placing new tenants in your rental property. The leasing fee is usually between 50% and 100% of the first month’s rent. It typically covers the cost of marketing the rental property, screening the potential tenants, executing the lease, and moving the tenants into the rental property.

3. Lease Renewal Fee

At the end of the lease term, the property manager will either renew the lease with the tenant or move them out. In some cases, there may be an increase in the rental price or some change in the rental terms. This is one of the property management fees you should always evaluate when you’re looking for a property manager since it’s one of the largest.

4. Maintenance Fee

This fee is charged when maintenance is done on your rental property.

Other Fees to Consider

There are even more costs to consider.

Apart from the above common property management fees we’ve mentioned, other fees that may be included in the property management agreement include:

- Account setup fee

- Administration fee

- Inspection fee

- Advertising fee

- Accounting fee

- Tribunal preparation fee

- Annual statement fee

- Eviction fee

See Also: Airbnb Property Management Fees Breakdown: Are They Worth It?

A Guide to Rehab Loans for Investment Property

Considering the Costs, Is Hiring a Property Manager Worth It?

Now that you understand what to expect in terms of property management fees, let’s discuss whether they are worth it. Being a landlord comes with many responsibilities and can be time-consuming. You need to take care of repairs, collect rent, find and evict tenants, deal with tenant issues, do inspections, etc. Hiring a property manager will relieve you of all of these and allow you to earn passive income.

While you can still hire a property management company to do the work for you, you should understand how the fees will impact your cash flow. It’s worth it to hire a property manager if the rental property cash flow generated matches your investment goals. You should still be able to earn some good income after offsetting the rental expenses.

How to Ensure Property Management Fees Don’t Hurt Your Cash Flow

Here are 3 tips for you to consider before you pick which property management company to hire:

1. Assess property management experience and reputation

Before you begin evaluating the property management fees, contact multiple property management companies to assess their level of experience. Property managers with a solid reputation, expertise, and experience are likely to give the best service. This would eventually lead to more income and you’ll know that the loss of cash flow may be worth it.

2. Enquire about the property management services provided

Before hiring a property manager, ask for full transparency on their property management fees. Before you sign a management contract, make sure you are aware of all the services offered and the charges so you can make the best decision. Don’t assume that a property management firm provides all the services you need. Be sure to ask if they are not listed on their website

Be wary of property management companies that don’t publish their prices online or tell you what they charge ahead of time. Some property management companies seem to have low fees but later add several extra fees. There should be no hidden fees that could eat up your cash flow.

Related: Professional Property Management Company: What Traits Should You Look For?

3. Conduct a cash flow analysis

Owning a positive cash flow property is the dream of every real estate investor. However, if you are not careful, property management fees can eat into your monthly revenue and even lead to negative cash flow. To ensure positive cash flow, you need to calculate the total cost of property management and include it in your cash flow analysis before signing a contract with a property manager.

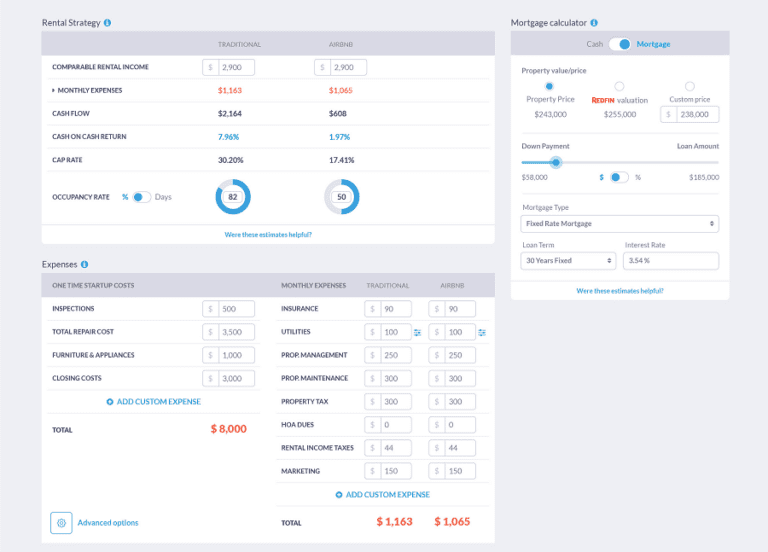

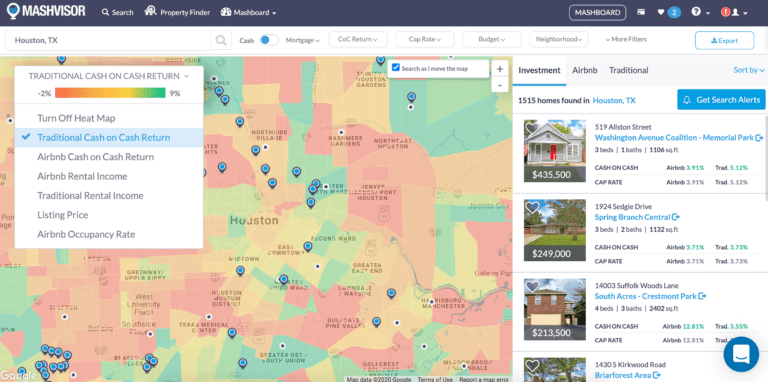

The easiest and fastest way to do so is to use Mashvisor’s cash flow calculator. The cash flow calculator is designed to help investors analyze the investment potential of a rental property based on cash flow and other key real estate metrics such as cap rate, cash on cash return, and occupancy rate. The calculator provides estimates of monthly rental income and rental property expenses, including property management fee estimates. These estimates are based on reliable rental comps and are accounted for in the cash flow calculations.

Use Mashvisor’s investment property calculator to get cost estimates and a cash flow analysis.

Sign Up for Mashvisor

One interesting thing about this tool is that it allows you to adjust the property management fees and other numbers to see how they affect cash flow and return on investment. Therefore, you can easily compare fees from multiple companies and see if they are worth it.

The Bottom Line

Having an effective property manager can free you of management responsibilities and even maximize your overall return. However, hiring a manager can also hurt your cash flow. To know if hiring a property manager is worth it, you should assess the property management fees versus the value of the property management services provided as well as the potential cash flow.

Start Your Investment Property Search!

Cash FlowCostsInvestment CalculatorInvestment Property Analysis

What to Know When Buying a Manufactured Home

Recent Comments