Where to Buy Las Vegas Investment Properties in 2021?

Seattle Real Estate Market Trends & Investment Outlook

Willing to invest in real estate? Then Las Vegas is one of the best places to buy investment properties. This rapidly growing city is one of the hottest real estate markets in the United States. Right now it is the best time to buy and rent a property in Las Vegas, as the market has not reached its peak yet. But the question lies that which are the best neighborhoods for buying a Las Vegas investment property?

Where can you get a strong rental income as well as good equity in the long term? In this article, we’ll discuss the best neighborhoods where you can buy Las Vegas investment properties. Investing in a Las Vegas Property is a great option as Las Vegas has very low investment property taxes and no personal income tax.

The average effective property tax in Las Vegas (Clark County) is 0.70%, slightly higher than the statewide average, but still significantly lower than the national average. The state’s average effective property tax rate is just 0.69%, which is well below the national average of 1.08%. Although the pandemic is still causing disruptions for businesses, there is no downturn happening in the Southern Nevada housing market.

Before the pandemic, the unemployment rate of Las Vegas had reached its lowest at 3.5% due to the addition of new job opportunities. The market has recovered and reached new heights this year. In fact, the Las Vegas housing market is among those cities that are showing the most signs of a positive recovery from the pandemic. Nevada’s unemployment rate was at its peak in April (30.0%). It has now dropped to 9.2% as of December 2020, down from 10.1 percent in November, according to Local Area Unemployment Statistics (LAUS).

As the local economy rebounds and the unemployment rate reduces further, it will have an indirect impact on this region’s housing market. The population growth is increasing at 2.98%, making the demand for Las Vegas investment properties even higher. The metro area has a population of more than two million people. The area is one of the top tourist destinations in the world, seeing more than forty million visitors annually.

The primary drivers of the Las Vegas economy are tourism, gaming, and conventions, which in turn feed the retail and restaurant industries. No state tax for individuals or corporations, as well as a lack of other forms of business-related taxes, have aided economic growth. All these economic & job indicators positively impact its real estate market and this is the right time for investors to make a move and start buying investment properties in Las Vegas.

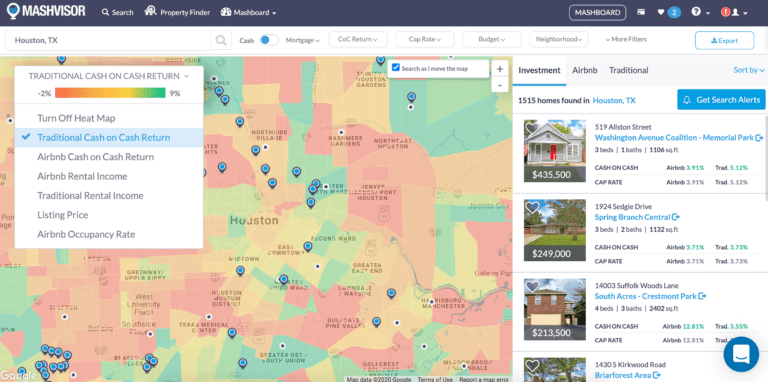

Residential short-term rentals are illegal in much of the area. They are illegal in unincorporated Clark County and North Las Vegas, while Henderson and Las Vegas allow them with strict restrictions. Las Vegas has passed laws that make buying and renting out Las Vegas homes via short-term rental sites like Airbnb quite difficult.

For example, the only allowable situation is when it is your primary residence, but less than 2 percent of Las Vegas rental properties met that definition when the law was passed in 2018. Also, homeowners are required to pay an annual $500 licensing fee and a monthly hotel tax, and they are no longer be permitted to rent out for less than 31 days in the city.

On the other hand, the traditional rental property investment in Las Vegas is getting bolstered by Nevada’s low property taxes & huge population of renters. The Las Vegas job market is dominated by hospitality and entertainment industry jobs that are high turnover and often low paying, increasing the size of the renter population. For example, roughly half the population can’t afford to own a home in the Las Vegas area. This ratio is ten points higher than it was before the Great Recession of 2007-2012.

Las Vegas was hit hard by the housing bubble burst, leading many who could afford to buy a home to rent instead. That makes investing in Las Vegas rentals a great choice for real estate investors. Note that the median home price is around 300,000 dollars. Home prices had increased six percent year over year before the medical-related shut down in March 2020.

Property prices vary based on both size and demand for the property, but the sale price of a home is roughly 175 dollars per square foot. Demand for condos is actually higher in Las Vegas. This is partly because they’re very popular in Las Vegas. People like to pay a premium to live near work and entertainment hubs like The Strip.

The average rental income from an apartment in Las Vegas is $1,107, a 5% increase compared to the previous year, as per Rentcafe.com The average condo or townhome costs nearly 200,000 dollars, and their prices increased 11 percent before the ongoing crisis pushed pause on the Las Vegas real estate market.

Table of Contents

Best Places To Buy Las Vegas Investment Properties

Las Vegas has a large no. of renters. Therefore, buying investment properties in Las Vegas, and renting them out is an excellent choice for real estate investors. Here are the top neighborhoods in and around Las Vegas where you can buy investment properties.

1. Green Valley, Henderson, Nevada

Green Valley is a popular neighborhood in Henderson, NV. Henderson is just a fifteen-minute drive from the Las Vegas Strip. This is one of the best areas to buy Las Vegas investment properties for rent to tourists because Henderson legalized AirBnB rentals. The demand by locals is also high. Rental rates are very high for both locals and tourists because it is a fifteen-minute drive to the most popular tourist attractions in the area.

Henderson does apply several rules to landlords. For example, you must register with the city and pay nearly a thousand dollars a year in fees. Planned communities can prohibit short-term rentals, while apartment complexes and condo buildings don’t allow more than one-quarter of units to be rented out short-term. Green Valley can be broken up into Green Valley North and Green Valley South.

Green Valley North’s schools received a B from AreaVibes. Its livability score is 80. This neighborhood is seeing rapid appreciation because homes here cost 15 percent less than the average Henderson, Nevada home. Yet rental rates are 7 percent higher than the average for Las Vegas investment properties. That’s partly because they allow short term rentals; this drives up the rental rates for everyone in the area.

Green Valley South schools received a grade of B from AreaVibes. Its livability score is 83; that’s considered exceptional. Rents and property prices are about ten percent below the area average. We expect homes in this area to appreciate significantly over the next few years. People are coming here due to the low crime rate, decent schools, a solid if not hot job market, and excellent amenities.

- Median Property Price: $389,465

- Median Property Price Per Square Foot: $189

- Average Rent: $1,326

- Average Rental Property Income: $1,259/month

- Livability Score: 80/100

As of January 2021, the average rent for an apartment in Henderson, NV is $1326 which is a 0.98% increase from last year when the average rent was $1313, and a 0.68% increase from last month when the average rent was $1317.

The average rent in Green Valley North is 6% lower than the Henderson average.

The average rent in Green Valley South is 1% lower than the Henderson average.

The average rent in Green Valley Ranch is 10% higher than the Henderson average.

NYC Real Estate Investment: Where To Invest In New York City?

2. Pioneer Park, Las Vegas

Pioneer Park is one of the more livable neighborhoods in Las Vegas. For example, area schools get a D+ from Areavibes, but Las Vegas schools, on the whole, received an F. Crime ratings for Las Vegas as the whole are high because of the high rate of property theft. This area gets an A- due to its more affordable housing market and A+ for amenities. Its overall livability score is 72. All of this resulted in property prices almost a quarter less than the Las Vegas average.

The average home costs around 230,000 dollars. Yet the rental rates are only a few percent below the average for Las Vegas investment properties. Rental rates in Pioneer Park are around 1300 dollars a month. The Las Vegas investment properties in this neighborhood command a relative premium because the neighborhood is bounded by Highway 95 and Highway 613, connecting it to the rest of the Las Vegas metro area. On Realtor.com, the median list price of homes in Pioneer Park was $225K in December 2020, trending up 11.2% year-over-year.

- Median Property Price: $225,000

- Median Property Price Per Square Foot: $173

- Median Rent: $1,300

- Average Rental Property Income: $1,100/month

- Livability Score: 77/100

3. Tule Springs, Las Vegas

This is a great area for investors looking for Las Vegas investment properties aimed at families. The schools were rated a B+ by Areavibes, and that’s incredibly good by Las Vegas standards. It was given a grade of A for its low crime rate, and that’s excellent given Las Vegas area stats. The area received a D- on housing costs, but that means most residents have to live in Las Vegas investment properties.

Real estate prices are almost 40 percent higher than the area average, but so are the rental rates. The average home in Tule Springs costs around 350,000 dollars. The area is in such high demand that it was a warm seller’s market even during the Wuhan coronavirus crisis. Rent is around 1600 dollars a month, but that number includes both small apartments and single-family homes.

This area is unusual for the number of brand new properties you could pick up. Yet the presence of Red Rock Canyon National Forest, the Las Vegas Indian Colony, and other areas off-limits to new construction will ensure that further new development doesn’t hurt the value of your property holdings. The average rent in Tule Springs rent is 23% higher than the Las Vegas average.

According to Realtor.com’s Market Hotness Index, Tule Springs, Las Vegas, NV is VERY HOT. It ranks in the top 9% of neighborhoods in the area and the top 26% in the U.S. “Hot” markets attract more buyers and sellers, resulting in a higher competition and faster sales. The average rent for a 1-bedroom apartment in Tule Springs, Las Vegas, NV is currently $1,399. Compared to last year, the average rent price has remained flat. Over the past month, the average rent for a 2-bedroom apartment in Tule Springs increased by 8% to $1,395.

- Median Property Price: $384.9K

- Median Property Price Per Square Foot: $169

- Median Rent: $2,290

- Average Rental Property Income: $1,400/month

- Livability Score: 72/100

4. Summerlin, Las Vegas

Summerlin received a livability score of 83 from Areavibes. That’s a very good score by any standards, and it is one of the best in the Las Vegas area. Demand for these Las Vegas investment properties is high because locals want to get their kids in schools that were rated an A- by Areavibes. Others move here for the almost non-existent crime. The high housing costs prevent many residents from potentially buying homes.

Note that those researching Las Vegas investment properties need to distinguish between Summerlin North and Summerlin South. Summerlin North has a better than the average job market, while schools received an A. While properties cost an average of 80 percent higher, rents are only 40 percent higher.

Summerlin South is more desirable, but it is home to many Las Vegas investment properties because of its unaffordable housing market. Homes in this neighborhood cost 85 percent more than the average Las Vegas home. Rents are roughly sixty percent higher because the livability score is a relatively high 79.

If you can find a bargain to turn into a rental, you could see significant returns. Summerlin South received a 78. Both are in the top ten cities in Nevada for livability. That’s why we expect to see an appreciation of any Las Vegas rental property in this area. Summerlin’s west side borders Red Rock Canyon, National Park.

Some of the homes that border the national park or have unobstructed views of Turtlehead Mountain can command several thousand dollars a month. Note that these homes easily cost more than half a million dollars. Properties that have easy access to the Bruce Woodbury Beltway, Highway 613, and Highway 159 are also worth a little more.

According to Realtor.com, the median list price of homes in Summerlin was $375K in December 2020, trending up 7.3% year-over-year. The median listing price per square foot was $221. The average rental property income in Summerlin is 12% higher than the Las Vegas average.

- Median Property Price: $375K

- Median Property Price Per Square Foot: $221

- Median Rent: $1,870

- Average Rental Property Income: $1,780/month

- Livability Score: 83/100

5. Michael Way, Las Vegas

Michael Way made our list of hot spots for potential Las Vegas investment property because of its relative affordability for investors. Homes here cost roughly 250,000 dollars. The price per square foot is 160 dollars, ten less than the area average. The median rent is around 1200 dollars a month. The rents are a little low because its livability index isn’t as good as places like Summerlin. The livability score is 64. The schools aren’t very good.

The area gets high marks for its amenities and cost of living. Crime is higher here, but the proximity to downtown Las Vegas means many choose to live here regardless. Note that the crime rate here is partially inflated by offenses like car break-ins and stolen purses, not shootings.

For example, property here costs roughly 40 percent less than the average Los Vegas home. Yet rental rates are only a few percent below the Vegas average. That means you get a higher return on the investment if you buy a property here. This area caters to childless individuals and couples, especially those who work in the hospitality industry. People chose to be here due to its easy access to Business 95 and Highway 95. Route 574 connects these two and serves as the northern boundary of the community.

The average rental property income in Michael Way is 12% higher than the Las Vegas average.

- Median Property Price: $240,391

- Median Property Price Per Square Foot: $160

- Median Rent: $1,180

- Average Rental Property Income: $1,000/month

- Livability Score: 64/100

Disclaimer: When referencing the average and median rental rates of the local neighborhoods, please keep in mind that the data provided was taken from different credible sources. While deemed reliable, it may not accurately depict the current reality of the local real estate market. The pandemic may have impacted rent rates in a way that is not yet reflected in this blog.

Should You Invest In Las Vegas Investment Properties?

Las Vegas is a hot real estate market for locals and tourists alike. It is one of the cities on the west coast that still offers affordable housing to residents, more people are transitioning to the city for new manufacturing jobs in the area. Although the cost of living in Nevada is 4% higher than the US average one, it is still much more affordable than in California. A median home price in Los Angeles is roughly three times the median home price in Las Vegas, the most expensive city to live in in Nevada.

Homeowners in Nevada are protected from steep increases in property tax bills by Nevada’s property tax abatement law, which limits annual increases in property tax bills to a maximum of 3% for homeowners. If you’re a resident, you have no state income tax if you earn your money in Nevada or if you have passive income even if it comes from other states. That makes investing in real estate properties in Las Vegas a very lucrative option for everyone.

There are neighborhoods in this rapidly growing metro area that offer significant rental income, appreciation, or both. We’ve shared recommendations at both ends of the market so that you can find an area to invest in that fits your budget and preferred renter profile. Rental property investors can get a longer-term guarantee from tenants, proving security during any potential economic hit such as the recent viral outbreak.

Here are some more indicators which make it even more interesting to invest in Las Vegas investment properties.

- Las Vegas is the most populated city in the state of Nevada and the 28th-most populated city in the United States.

- The metro area population of Las Vegas is 2,699,000, a 2.98% increase from 2019 – Macrotrends.net.

- The Las Vegas Valley as a whole serves as the leading financial, commercial, and cultural center for Nevada.

- Las Vegas is home to more than half of the 20 largest hotels in the world.

- There are more than 150 casinos and roughly 150,000 hotel rooms in the Las Vegas valley area.

- Las Vegas annually ranks as one of the world’s most visited tourist destinations – famous for its mega casino-hotels and associated activities.

- A diversified economy is driven by health-related, high-tech, and other commercial interests.

- The primary drivers of the Las Vegas economy are tourism, gaming, and conventions, which in turn feed the retail and restaurant industries.

- Mining constitutes the mainstay of the region’s industrial sector.

- Most of the manufacturing plants are concentrated in the communities of Henderson and North Las Vegas.

- No state tax for individuals or corporations, as well as a lack of other forms of business-related taxes, have aided economic growth.

- Construction is also a significant component of the economy.

- The government is the metropolitan area’s single largest employer.

- The unemployment rate is decreasing from its peak in April — 11.4% as of Nov 2020 – U.S. Bureau of Labor Statistics.

- The average weekly wages for all industries in Las Vegas Metro Area is $950 (the U.S. = $1,093)

Las Vegas Turnkey Rental Properties

Are you looking for a turnkey rental property in Las Vegas? NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in Las Vegas and many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your rental property in Las Vegas.

Consult with one of the investment counselors who can help build you a custom portfolio of Las Vegas turnkey rental properties in some of the best neighborhoods. All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete Las Vegas turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

References:

- Overview of market

https://en.wikipedia.org/wiki/Las_Vegas

https://worldpopulationreview.com/us-cities/las-vegas-population

https://news3lv.com/news/local/local-housing-market-strong-entering-coronavirus-shutdown

https://www.mashvisor.com/blog/2019-las-vegas-airbnb-laws

https://www.ktnv.com/news/zillow-nearly-50-percent-of-all-las-vegas-residents-chose-to-rent-cant-afford-to-buy-home - Best Neighborhoods

https://www.areavibes.com/las+vegas-nv/best-places-to-live/

https://www.fox5vegas.com/news/local/short-term-vacation-rental-market-booming-in-las-vegas-valley-pushing-out-buyers/article_afff7ee4-b8d5-11e9-a333-6f54592625b0.html

https://lasvegassun.com/news/2020/feb/07/short-term-challenges-making-sense-of-the-southern/ - Neighborhood Home Values & Rental Market Trends

https://www.zillow.com

https://www.rentcafe.com

San Francisco Bay Area Real Estate Market & Investment 2021

Recent Comments