Where To Buy Atlanta Investment Properties In 2021?

San Diego Real Estate Market And Investment Overview 2021

Atlanta investment properties are sought by all types of investors because you’re paying for quality real estate when you decide to buy them in good neighborhoods. Atlanta real estate has continued to appreciate in value faster than most communities in the nation. Starting at just $100,000, the Atlanta investment properties have an annual appreciation rate of over 5%.

Atlanta property appreciation rates in the latest quarter were at 1.32%, which equates to an annual appreciation rate of 5.40%. Property values have risen by 5.6% in the last twelve months, making a good fortune for short-term investors in Atlanta. In this article, we shall discuss some of the best neighborhoods in Atlanta where you can buy investment properties.

Table of Contents

Is it the Right Time to Buy an Investment Property in Atlanta?

The short answer to this question is yes. The longer answer is: yes, definitely, especially if you’re buying in the right Atlanta neighborhoods. If you asked about the Atlanta real estate market 15 years ago, the answer would be someone pointing at the suburbs. The city was expanding in all directions. The problem was that the infrastructure couldn’t grow fast enough.

Its urban core is seeing a wave of redevelopment as people choose to pay more to be close to jobs, amenities, and public transportation. And this has caused Atlanta real estate development to surge. Almost four billion dollars worth of real estate investing has poured into downtown over the past ten years, and that much more is either on the drawing board or under construction.

The downtown population has risen roughly 2% a year per year since 2010. While Atlanta home prices rose roughly 10% between 2016 and 2017, they are expected to go up nearly that much in 2021. Overall, the Atlanta housing market trend is much hotter than the rest of the nation. Atlanta was ranked at #11 in the U.S.

Markets to Watch by PWC.com. Cities like Atlanta & Dallas are benefiting from fundamental demographic and economic shifts. It is one of the emerging markets in South’s Atlantic region. All 11 markets including Atlanta that make up the region are ranked in the good potential for investment and development. Opportunities are expected to be readily available in these markets.

The continuing attractiveness of primary markets like Atlanta makes a lot of sense to buy investment properties. Atlanta has experienced net migration over the last five years. In Atlanta, rents have recovered and grown – The high construction costs contribute to the upward pressure on rents.

Atlanta Investment Property Forecast 2021

What are the Atlanta real estate market predictions for 2021? The Atlanta housing market is expected to see one of the country’s steepest rises in home prices next year, according to the 2021 housing forecast from Realtor.com. The forecast shows a growth of 6.7% in 2021, compared to a 5.7% increase nationally — putting metro Atlanta in the 20 markets expected to experience the huge home price increases.

Population growth has had a positive impact on the housing market in Atlanta. Nearly 285,000 people moved to Georgia in 2019, according to the most recent data from the U.S. Census Bureau. This migration has been made possible the state’s consistent ‘best state for business’ rankings.

Area Development magazine named Georgia No. 1 for business – for seven straight years (2014-20). Nine out of 10 Fortune 500 companies have operations in Georgia – and 18 of these have made Georgia their world headquarters. Much of this migration is driven by the strong business environment in Atlanta and the relative affordability of the city.

Its robust knowledge-based economic ecosystem attracts new talent to the city. The net migration has led to an ever-increasing demand for housing in Atlanta which cannot be met with the current pace of the new construction. The Atlanta housing market has a housing shortage which will continue to contribute to increasing prices. Atlanta home prices on average are less expensive than the national average.

Despite being below the national average, Atlanta home prices have more than doubled since 2012, and are projected to continue increasing. Let us look at the price trends recorded by Zillow over the past few years. Since 2012, the median home prices in Atlanta have appreciated by nearly 117%, from $138,000 to $299,841.

NeighborhoodScout.com’s data also shows that Atlanta real estate appreciated by nearly 71% over the last ten years. Its annual appreciation rate has been averaging at 5.55%. This figure puts it in the top 10% nationally for real estate appreciation. During the latest twelve months, the Atlanta appreciation rate was nearly 5.7%, and in the latest quarter, the appreciation rate was 1.32%, which annualizes to a rate of 5.4%.

This figure corroborates with Realtor.com’s forecast, which also predicts that home prices in this region are expected to increase by nearly 6.7% in the next twelve months. In other words, if you buy a property now, then after twelve months, you can expect an ROI of anything between 5-7%. It is going to be a strong seller’s market that will be much more stable than the unpredictable trends experienced this year.

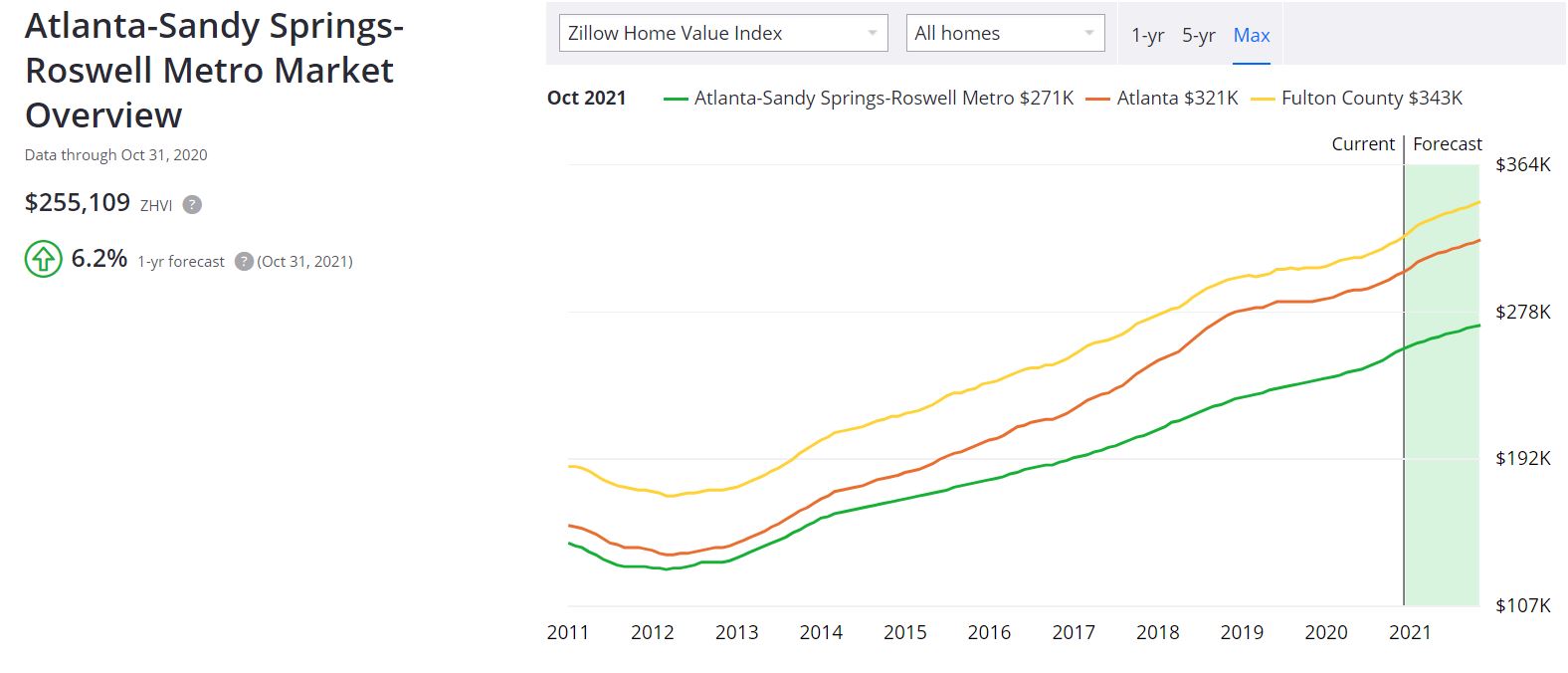

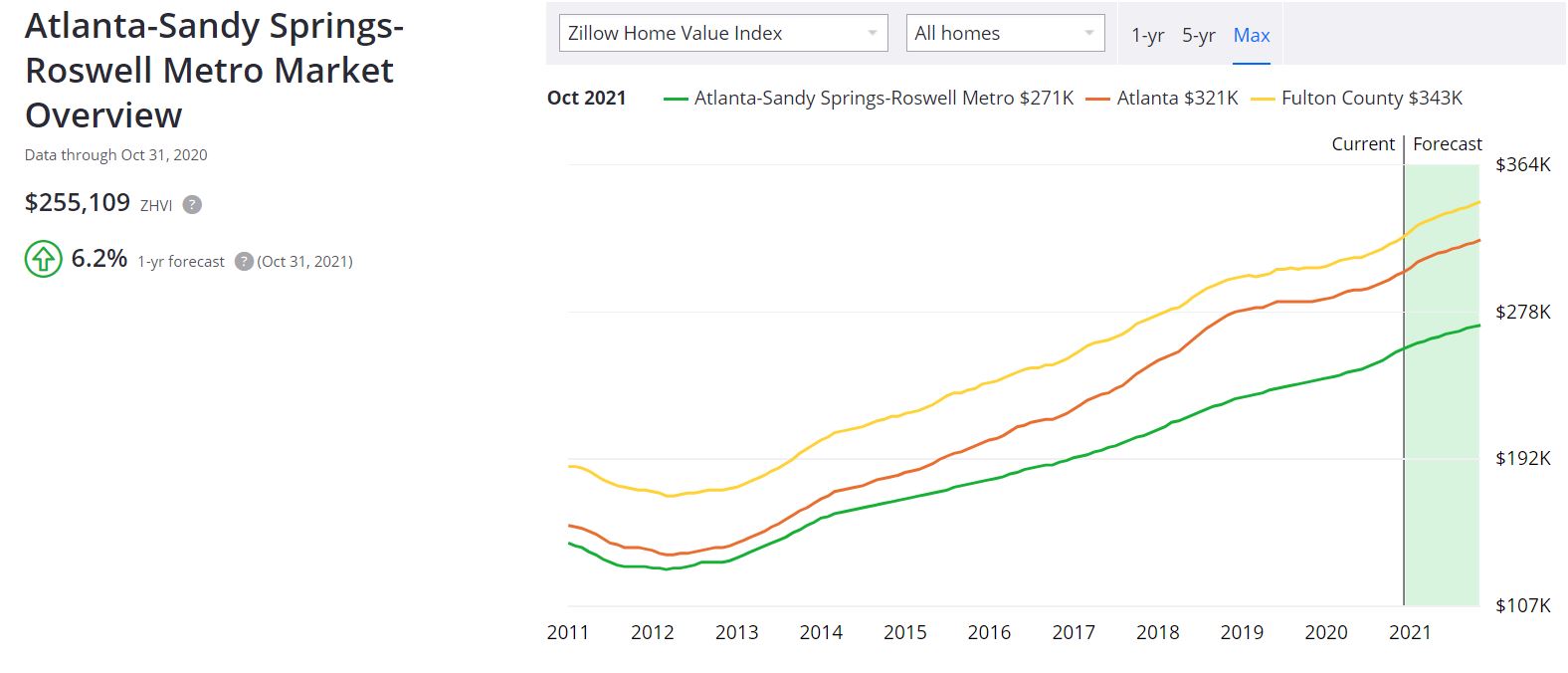

Here is Zillow’s home price forecast for Atlanta, Fulton County, and Atlanta Metropolitan Area. The forecast is until October of 2021 and you can expect to see very strong home price gains in this region.

- Atlanta home values have gone up 5.2% over the past year and the latest forecast is that they will rise 7.1% in the next year.

- Fulton County home values have gone up 5.2% over the past year and the latest forecast is that they will rise 7.1% in the next year.

- Atlanta-Sandy Springs-Roswell Metro home values have gone up 7.1% over the past year and the latest forecast is that they will rise 6.2% in the next year.

Here is the visual representation of how home prices have grown from 2011 and their forecast (in the green area) until October 2021.

Courtesy of Zillow.com

Courtesy of Zillow.com

Here is a short and crisp Atlanta housing market forecast for the 3 years ending with the 3rd Quarter of 2021. The accuracy of this forecast for Atlanta is 85% and it is predicting a positive trend. LittleBigHomes.com estimates that the probability of rising home prices in Atlanta is 85% during this period.

If this price forecast is correct, the Atlanta-Sandy Springs-Roswell, GA home values will be higher in the 3rd Quarter of 2021 than they were in the 3rd Quarter of 2018. The change in home prices for Atlanta-Sandy Springs-Roswell, GA are shown below for three time periods. The Atlanta Home Price Index has increased for the last 25 consecutive quarters (data up to 3rd Quarter, 2018).

The highest annual change in the value of houses in the Atlanta Real Estate Market was 15% in the twelve months ended with the 1st Quarter of 1980. The worst annual change in home values in the Atlanta Market was -11% in the twelve months ended with the 1st Quarter of 2010.

The highest growth in home values in the Atlanta Real Estate Market over a three year period was 29% in the three years ended with the 3rd Quarter of 2018. The worst performance over a three year period in the Atlanta Market was -22% in the three years ended with the 1st Quarter of 2012.

| Time Period | Metro Atlanta Real Estate Appreciation |

| Last 5 Years | 51% |

| Last 10 Years | 28% |

| Last 20 Years | 83% |

Is Atlanta is going to remain a seller’s real estate market amid the ongoing Coronavirus pandemic, which no one knows when it is going to end? These numbers can be positive or negative depending on which side of the fence you are — Buyer or Seller?

The constraint on available inventory and a decline in new listings is keeping the Atlanta real estate market skewed to sellers. Atlanta and the entire metro area market is so hot that it cannot shift to a complete buyer’s real estate market, for the long term. The Atlanta real estate market benefits from a large and robust economy.

According to the data insights provided by the Bureau of Economic Analysis, the Atlanta metro area was the tenth-largest in the U.S. and among the top 20-largest in the world (as of 2020). The housing demand in Atlanta is still high, according to online real estate brokerage SimpleShowing. To counter the effects of this ongoing crisis, FED did an emergency rate cut which put rates at their lowest level in the last 50-year span.

The low-interest rates are already leading to an increase in mortgage applications. Buyers looking for this opportunity to invest or buy a house. Low-interest rates coupled with Atlanta’s solid job market could be a boon for the local real estate market even in the time of the Covid-19 pandemic.

Keeping aside the short-term effects of Covid-19 which would hopefully end, the Atlanta housing market is strong. There are no signs of weakness in the Atlanta real estate prices. In a balanced real estate market, it would take about five to six months for the supply to dwindle to zero.

In terms of months of supply, Atlanta can become a buyer’s real estate market if the supply increases to more than five months of inventory. And that’s not going to happen. This housing market is skewed to sellers due to a persistent imbalance in supply and demand.

Whether you’re looking to buy or sell, timing your local market is an important part of real estate investment. For buyers in Atlanta, the mortgage rates are at their lowest. So they should take advantage of scooping up their favorite deals which otherwise are taken away by seasoned investors in the bidding wars.

Please do not make any real estate or financial decisions based solely on the information found within this article. Real estate market forecasts given in this article are just an educated guess and should not be considered financial advice. Many variables could potentially impact the value of a home in Atlanta in 2020 (or any other market) and some of these variables are impossible to predict in advance. Real estate prices are deeply cyclical and much of it is dependent on factors you can’t control.

20 Best Cities To Invest In Real Estate In 2021

Investment Property For Sale In Atlanta

Atlanta, GA is one of the top markets for single-family rental homes in the US. Many young families and couples thinking about the future are interested in renting such a property. Therefore, the demand for single-family homes for rent in Atlanta is high. Another research regarding Atlanta’s population and demographics reveals that 49% of the population in the city lives in family households with kids.

In comparison, 38% of people are living alone. People who inhabit family households are more likely to rent single-family homes rather than apartments because they offer more space and privacy. As we write this, there are 81 investment properties for sale in Atlanta on Zillow.

If you are looking for turnkey rental properties, Norada Real Estate Investments can save you time by finding the best investment properties in Atlanta. We can provide you newly rehabbed properties with screened tenants in place. Properties starting at $100,000, providing up to 11% Cap Rate.

Best Places To Buy Atlanta Investment Properties in 2021

If you are dreaming of owning an investment property, what better place to do that than in Atlanta, GA? The city has a thriving real estate market that promises lucrative returns. Atlanta suburbs offer a diversified population in which a newcomer can easily fit. Most of the Atlanta investment properties in the suburban areas are single-family rental homes.

Top Reasons to Invest in Atlanta Investment Properties |

|

|

|

Now the question is, where to buy investment properties in Atlanta? If you looking to invest in Atlanta, here are the 10 best places to buy Atlanta investment properties in 2021.

1. Hanover West, Atlanta

Hanover West is a small, legacy development built in the 1960s. It offers several amenities that attract residents of all ages. Niche ranked this one of the best places to buy a house in Atlanta, but they rarely come on the market. This allows landlords to charge a median rent of $1100 per month. The average home value here is higher than the national average and well above the average for Atlanta, forcing many who want to live here to rent.

2. Midtown Atlanta, Downtown Atlanta

Downtown adjacent areas like Midtown and Buckhead have seen prices rise substantially. If you can buy an investment property in Midtown Atlanta, you can rent it out for a top dollar. These Atlanta investment properties will be valued for their space and privacy in an area quickly converting to multi-family housing. The median rent here is about $1800 per month. Properties close to Georgia Tech profit from the steady stream of renters.

3. Buckhead, Atlanta

Buckhead is a great place to buy Atlanta investment properties. The homes are worth a lot because of their proximity to downtown. Then there’s the fact that it is full of mansions and estate homes, though there are a few small cottages that can be rented out as starter homes. Or you could buy an old bungalow and replace it with the four to six-bedroom executive homes becoming the norm for this area.

The urban neighborhood of Buckhead Heights has a population of roughly 2,130 people. Residents have been ranked as A, based on ethnic and economic diversity, with many of its residents having bachelor’s or master’s degrees.

4. Gwinnett County, Georgia

This area is in such demand that time on market fell 20% in 2018. Median home prices rose 5% here year over year. Part of this is because Gwinnett schools are so good. Buford in Gwinnett County had the best public schools in the state.

5. Grant Park, Atlanta

Grand Park is the oldest city park in Atlanta, and the same name applies to the residential district around it. This area is close to downtown, but it is full of older single-family homes that command high rents for the privilege of living here. You’ll receive significant cash flow from investment properties in Grant Park, Atlanta if you can buy low since the median rent in 2019 was $1300 a month.

6. Decatur, Northeast of Atlanta

Decatur was ranked one of the best suburbs in Georgia by Niche.com. Decatur is a city in Georgia, northeast of Atlanta. Even better, they were ranked 32nd on Niche’s best places to live in America list in 2017. It was also named one of the best suburbs for millennials in 2016. Buying investment properties in the suburbs of northeast of Atlanta can be a great investment step for 2021.

7. Alpharetta, North of Atlanta

Alpharetta is an attractive real estate market to home buyers and renters, and that makes it a good place for real estate investors. It is a suburb north of Atlanta. The real estate market is a mix of condos and detached single-family homes. Alpharetta had numerous schools rank 10 out of 10 at Greatschools.org.

8. Peachtree Heights West, Atlanta

Peachtree Heights West is located in southwest Atlanta. This upscale neighborhood has been ranked as one of the hottest in the city due to increasing sales and rental activity. It is a great place to buy an investment property in Atlanta especially an apartment for rental income. It is a short distance south of the already overpriced Buckhead Forest. This area is a great place for investing in Atlanta investment properties since median rents are well above average at more than $1700 per month.

9. Ormewood Park/Glenwood Park, Atlanta

Ormewood Park/Glenwood Park is located between Grant Park and East Atlanta Village. This area is dotted with 1920s Craftsman-style homes. Redevelopment in the area is replacing affordable single-family homes with multi-family housing and upscale homes. Many move here to be close to its top-notch charter schools. That’s part of the reason why median rents were a little below $2000 in Ormewood Park.

10. Old Fourth Ward, Atlanta

Old Fourth Ward is a historic industrial district that was, at one point, nearly abandoned. It is being revitalized into a hip neighborhood commanding rents of around $1700. There are significant opportunities for real estate investors to buy investment properties in Old Fourth Ward, Atlanta, since there are still properties in the area that need to be renovated to be attractive to renters.

Should You Buy Atlanta Investment Properties: The Conclusion

It is obvious by now that Atlanta real estate market is very strong. This leaves some worrying if it is a bubble that’s going to pop. The answer to that is no. The metro Atlanta area has seen stellar growth second only to Houston real estate market. Demand has caused home values to rise around ten percent a year for the last few years. Housing prices in Atlanta dipped in 2017, allowing prices to adjust.

Average home prices today are similar to where they were at the 2006 peak, but they’re actually more affordable when you take inflation into account. You should consider buying an investment property in Atlanta if you want to diversify your holdings beyond stocks and bonds. Remember, choosing the right property, maintaining it, dealing with tenants—all that takes work.

A rental property should be turnkey and rent ready. A good investment property is one that is fully refurbished or a new construction residential property. The property must be in growth markets and must produce a positive cash-flow. There are 13 tips to follow when buying a rental property for single-family dwellings.

Purchasing the best investment properties in Atlanta appears to be on the pricier end in 2021. However, this is because you’re also purchasing other positive aspects of the estate such as security, and community diversity. You’re paying for quality real estate in Atlanta when you decide to buy investment properties in the neighborhoods listed above. One disadvantage may come from families looking for premier schools for their children.

Most of the schools surrounding the neighborhoods listed in this article are given ratings of B on Niche.com. Considerably, it may be a not so good decision for parents who want their children to attend the best schools in the country. That being said, Atlanta appears to be a wise choice of city for the youth. In many of the above-mentioned neighborhoods, their residents seem to be young adults, based on their educational attainment. Likewise, Atlanta has come to be a bustling economic center.

When looking for the best real estate investments in Atlanta, you should focus on neighborhoods with relatively high population density and employment growth. We’ve already listed above some of the best neighborhoods to buy Atlanta investment properties.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

Remember, caveat emptor still applies when buying a property anywhere. Some of the information contained in this article was pulled from third party sites mentioned under references. Although the information is believed to be reliable, Norada Real Estate Investments makes no representations, warranties, or guarantees, either express or implied, as to whether the information presented is accurate, reliable, or current. All information presented should be independently verified through the references given below. As a general policy, the Norada Real Estate Investments makes no claims or assertions about the future housing market conditions across the US.

References

Downtown investment of four billion to date, four billion in the future

https://www.bizjournals.com/atlanta/news/2018/03/08/atlantas-downtown-becomes-a-hot-real-estate-market.html

Grant Park, Hanover West

https://www.mashvisor.com/blog/atlanta-real-estate-market-investments-2018/

Decatur rankings, Gwinnett County’s schools

https://www.ajc.com/news/local/you-live-one-georgia-best-suburbs/Ef0lUjpjyMhOQbRZ9uR7XJ

Alpharetta

https://www.movoto.com/guide/atlanta-ga/best-atlanta-suburbs

Buckhead

http://metroatlantasuburbs.com/communities/buckhead-real-estate

Peachtree Heights West

https://atlanta.curbed.com/2017/12/7/16746602/peachtree-heights-atlanta-hottest-neighborhood=2018

Ormewood Park

https://www.greatamericancountry.com/places/local-life/5-great-neighborhoods-in-atlanta

Old Fourth Ward

https://atlanta.curbed.com/2017/12/7/16746602/peachtree-heights-atlanta-hottest-neighborhood-2018

The Rich vs Poor Mindset: Which Mindset Do You Have In 2021?

Recent Comments