San Francisco Bay Area Real Estate Market & Investment 2021

Chicago Real Estate Market: Prices | Trends | Forecast 2021

This article has been updated to reflect the most recent trends in the San Francisco Bay Area housing market. Motivated home buyers drove prices and sales up in December in a tight California housing market. The San Francisco Bay Area remained on top with the highest gain of 40.2 percent over last year’s sales. Regionally, all the counties saw massive double-digit gains in sales as compared to last year except for Solano, where an 8% growth was seen.

According to C.A.R., on a month-to-month basis, except for the Bay Area, all major regions experienced a year-over-year decline of 35 percent or more in for-sale properties in December. Bay Area’s housing price growth in December was 16.4% on a year-over-year basis. The median price of single-family homes was $1,058,000, a decline of -3.8% percent from the previous month. Buyers appear to be looking for extra space in homes, which has pushed up median home prices in suburban areas like Santa Clara, San Mateo, and Contra Costa counties.

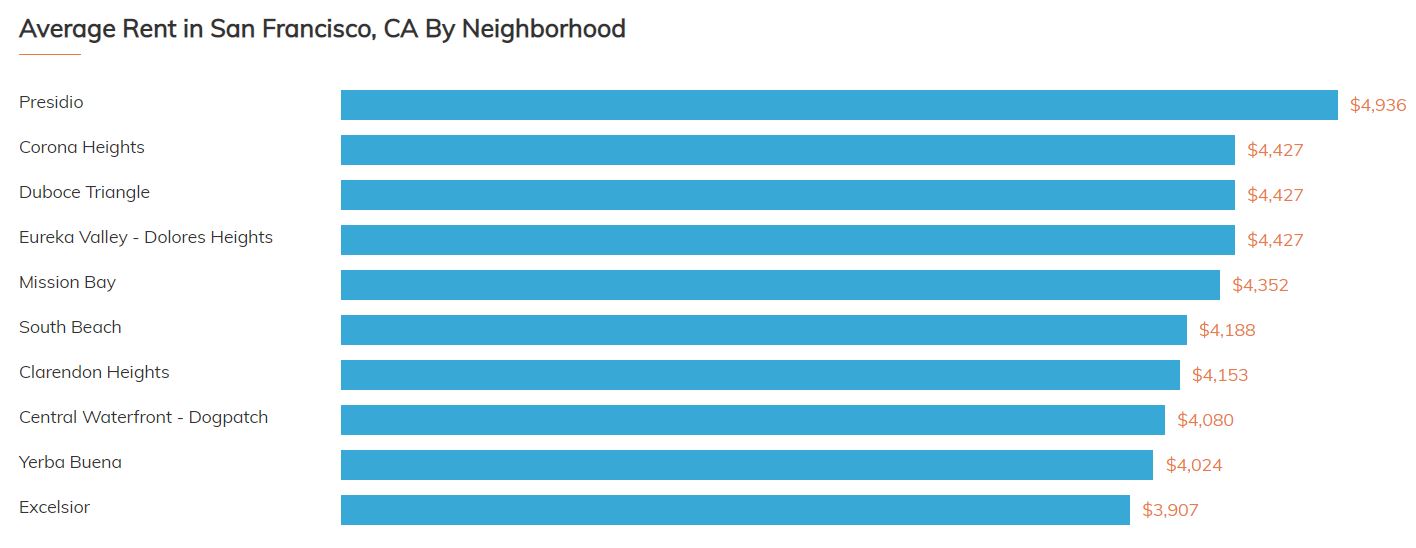

Median sale prices in 8 of 9 Bay Area counties rose by double-digit percentages over last year. Only San Francisco County, up 9.0 percent to $1.58 million lagged behind other hot markets. 3 out of 9 counties saw a drop in prices as compared to the previous month — San Francisco (-6.9%), Contra Costa (-5.8%), and Santa Clara (-0.6%).

Though the pandemic has taken a massive toll on the service and retail sectors, tech continues to thrive, and the San Franciso Bay area is mainly driven by the tech market. San Francisco’s office vacancy rate has roughly doubled this year to 8.3%, driving asking rents down almost 9%, according to real estate firm CBRE. That’s because most of the techies are working from home leading to vacancies.

According to a Mercury News report, high-income-earning tech workers remain steadily employed due to remote-work policies, and limits on leisure travel and commuting mean they have more to spend on real estate. That’s probably the reason why the San Francisco Bay Area had the highest sales growth in California of nearly 40 percent over last year. In fact, all the 9 counties posted double-digit increases in sales with Marin Couty leading the pack with a growth of almost 60% over last year.

Overall, the San Francisco Bay Area sales showed an MTM increase of 1.5% from November. All counties except Marin, San Mateo, Santa Clara, and Solano showed a decline in sales as compared to the previous month. Having said that, the Bay Area housing market is very much skewed toward sellers with a stronger demand as compared to the supply of properties for sale.

Sales Price to List Price Ratio was 101.9% in December signaling a very competitive market. Anything over 100% gives sellers an upper hand in price negotiations. The housing supply remains tight with a drop of -15.5% in the active listings over last year. The unsold inventory index now sits at 1.1 months, which means it would take less than five weeks to squeeze away all the listings from the market at the current sales pace.

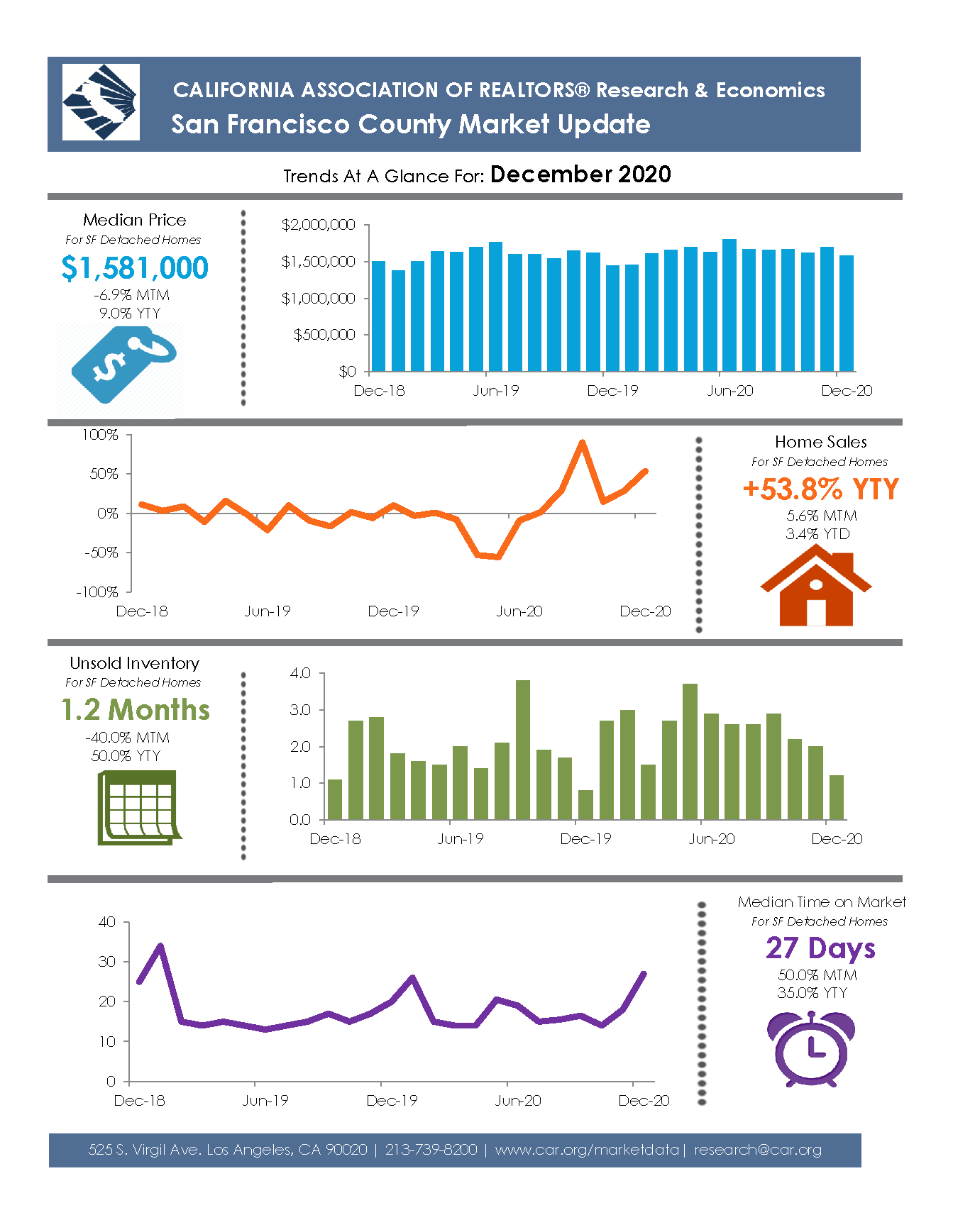

Bay Area Housing Market Trends – December 2020

Below is the latest tabulated housing market report for the entire Bay Area release by the California Association of Realtors. The tabulated report shows the sales and prices of the Bay Area counties for December 2020.

Much of the Bay Area real estate market remains firmly in “seller’s market” territory with months of supply of available properties being just 1.2.

| Dec-20 | Median Sold Price of Existing Single-Family Homes | Sales | |||||

| S.F. Bay Area | Dec-20 | Nov-20 | Dec-19 | Price MTM% Chg | Price YTY% Chg | Sales MTM% Chg | Sales YTY% Chg |

| Alameda | $1,060,000 | $1,049,040 | $881,500 | 1.00% | 20.20% | 5.40% | 44.50% |

| Contra Costa | $763,000 | $810,000 | $665,000 | -5.80% | 14.70% | 7.90% | 52.40% |

| Marin | $1,459,000 | $1,425,000 | $1,300,000 | 2.40% | 12.20% | -5.90% | 59.60% |

| Napa | $842,000 | $824,500 | $765,000 | 2.10% | 10.10% | 26.00% | 45.80% |

| San Francisco | $1,581,000 | $1,697,500 | $1,450,000 | -6.90% | 9.00% | 5.60% | 53.80% |

| San Mateo | $1,700,000 | $1,650,000 | $1,475,000 | 3.00% | 15.30% | -2.90% | 35.90% |

| Santa Clara | $1,375,000 | $1,383,000 | $1,225,000 | -0.60% | 12.20% | -8.80% | 31.00% |

| Solano | $510,000 | $505,250 | $455,500 | 0.90% | 12.00% | -3.80% | 8.60% |

| Sonoma | $720,000 | $715,000 | $647,500 | 0.70% | 11.20% | 5.70% | 39.40% |

San Francisco (County) Housing Market Trends 2021

San Francisco’s infamously hot real estate market seems to have cooled. People are moving out of the city and the demand in suburbs has increased. The suburban single-family homes are shooting up in value while the tech hubs have seen declines in rents and pricing. The median price for a single-family home in San Francisco was $1,581,000 in December, down 6.9% MTM and up 9.0% YTY.

Earlier in August, the number of active listings in San Francisco reached the highest point in at least four years. The median listing price of a San Francisco home in August, at below $1.4 million, was the lowest since February 2019. Many agents feel that the San Francisco housing market has cooled even though the demand is still there in suburban neighborhoods. The pandemic has accelerated migration out of large cities, and it seems like most of the movement is going to be a permanent one.

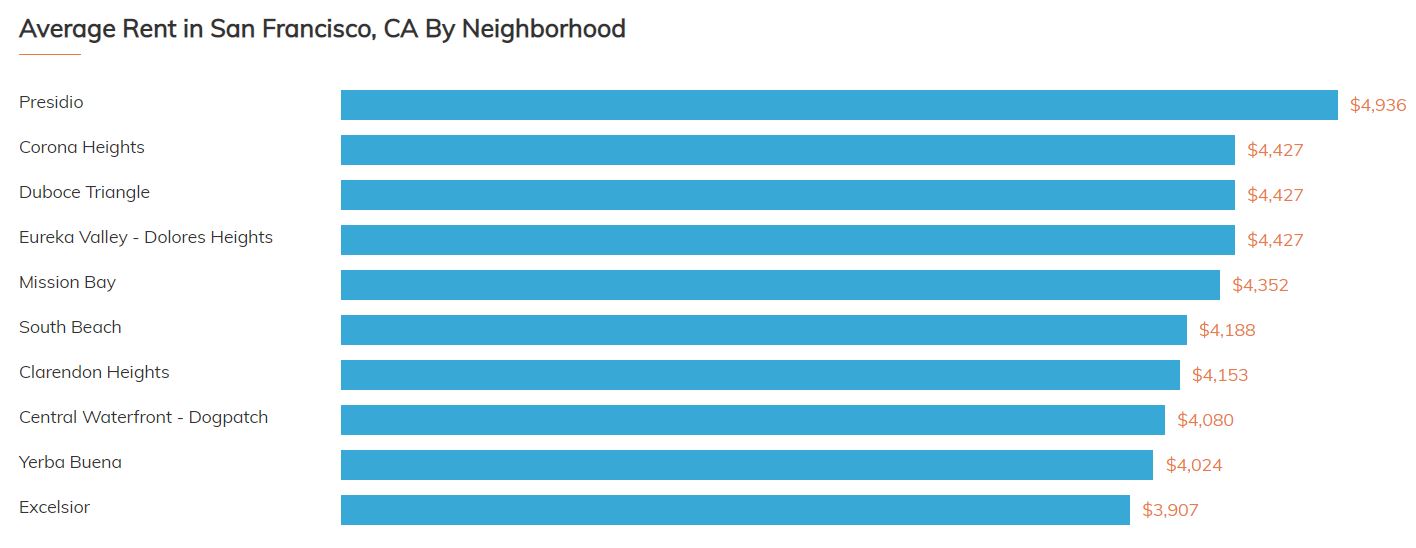

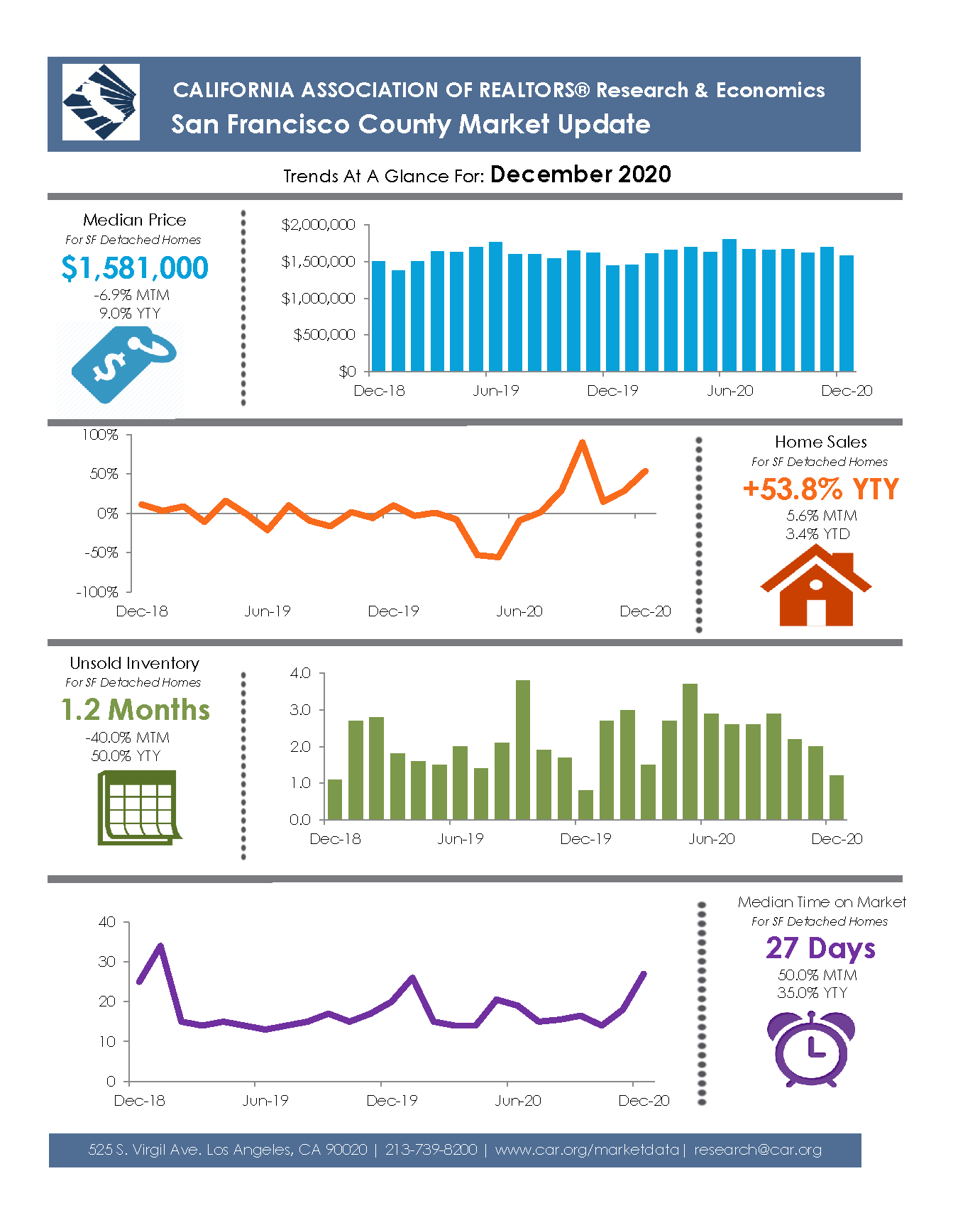

In California, San Francisco and Los Angeles are the top markets for outward migration, for both permanent and temporary moves during the pandemic. San Franciso has also seen significant rent declines (down nearly 23% from last year). Most experts agree that rents and condominium prices will remain lower through 2021, while prices for single-family homes will be less impacted. Less popular neighborhoods with more space such as the Richmond, the Sunset, and West Portal, are becoming more highly sought after.

Rents are falling in many major cities across the country, but the drop is most pronounced in San Francisco, one of the nation’s priciest housing markets. Studio rents have been falling on a year-over-year basis since March when the pandemic led to lockdowns but it took until May for rents to begin falling for one and two-bedroom units.

Renters and landlords have been hit hard by coronavirus lockdowns. It has impacted the ability to make payments amid business shutdowns. Apartment dwellers are seeking rent reductions and almost 9% didn’t pay November’s rent in full, according to data collected by the San Francisco Apartment Association, which works on behalf of landlords. The data shows that rents for downtown apartments near office buildings have been completely decimated.

The residential areas have been comparably stable but rents are still declining in double-digits. Rent declines in the expensive high-tech hubs remain the norm. Counties in the San Francisco Bay Area are seeing the largest declines in rents. The main reason being cited is that San Franciso has a lot of workers who are working remotely now.

If you’re in the market for a condo in San Francisco, that means you could get a great deal. In November, the median rent for a studio apartment was down 35 percent to $2,100 year-over-year, according to Realtor.com’s data as cited by Bloomberg. One-bedroom units are down 27 percent over that period, to $2,716. As rent prices fall, they are going to benefit those workers who cannot afford the city’s housing market.

According to Realtor.com, in December 2020, San Francisco again topped the list of rent declines in all three unit types with studio rents declining by 33.8 percent, one-bedrooms by 25.5 percent, and two-bedrooms by 22.8 percent.

The high inventory levels for condos and townhomes in San Francisco county have made it favor buyers. The current unsold cond inventory index is 2.4 months and the sustained oversupply is finally lowering median prices of condos. People simply no longer wish to live in densely populated areas, especially apartment buildings where they have to share common areas. They want enough space for a home office or two and their own outdoor space as well.

Condo inventory in San Francisco is the highest it’s been in 15 years, which has driven down resale prices by 10% since the pandemic hit. The current median price for a San Francisco condo is $1,139,000, down -7.0% MTM and -8.7% YTY. The good thing for SF condos is that lower prices are driving more sales. Condo sales in the county were up 5.1% MTM and 76.2% YTY. A massive annual growth shows that condo sales are going extremely strong. There is a consistent demand for condos as the month-to-month sales are also increasing.

Higher levels of inventory, following a flood of new listings during the pandemic, are sitting on the market in the city proper, a significantly larger jump than the surrounding suburbs. In San Francisco, though, the softening is clear as sellers flood the market with their listings and buyers have not changed their pace to match.

San Francisco had an unusually low inventory relative to other large cities before the pandemic. You can expect more condo listings and prices could come down, even more in 2021. It could be an opportunity for those that have been wanting to buy a condo for a while and were previously priced out.

Source: CAR.org

Source: CAR.org

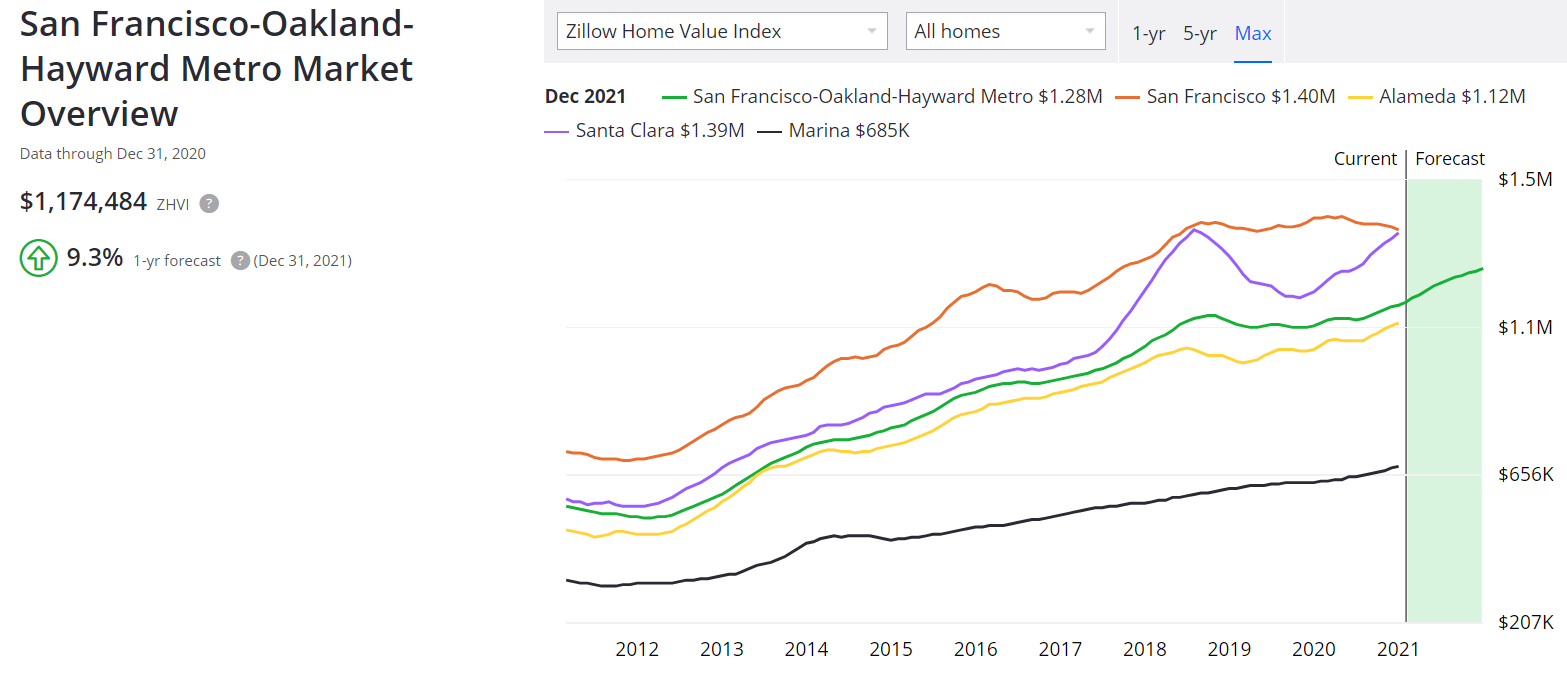

San Francisco Bay Area Housing Market Forecast 2021 (Updated)

San Francisco’s real estate market is shaping up to continue the trend of the last few years as one of the hottest markets in California. What are the San Francisco real estate market predictions for 2021? According to Zillow, a real estate database company, the median home price in San Francisco has been pretty much flat since Aug 2018.

As you can see in the graph given below, the San Francisco & Bay Area home values increased consistently, from 2012 through 2018. After that, it marked the beginning of a flattening out of prices which lasted for over a year.

The median home value of single-family homes and condos in San Francisco is currently holding at $1,385,625. The typical home value of homes in San Francisco-Oakland-Hayward Metro (Bay Area) is $1,158,018. (Seasonally adjusted and only includes the middle price tier of homes).

Here is the latest housing market forecast for all the Bay Area counties. Except for San Franciso, all the counties are expected to show a median price growth in double-digits in 2021 with Santa Clara leading the pack.

- Bay Area (San Francisco-Oakland-Hayward Metro) home values have gone up 5.8% over the past year and Zillow predicts they will rise 9.3% in the next twelve months.

- San Francisco home values declined 1.1% over the past year and the latest forecast is that they will increase by 7.5% in the next twelve months.

- Alameda home values have gone up 7.8% over the past year and Zillow predicts they will rise 10.5% in the next twelve months.

- Contra Costa County home values have gone up 7.6% over the past year and the latest forecast is that they will rise 10.2% in the next twelve months.

- Marin County home values have gone up 9.8% over the past year and the latest forecast is that they will rise 10.4% in the next twelve months.

- Napa home values have gone up 7.0% over the past year and the latest forecast is that they will rise 10.2% in the next twelve months.

- San Mateo home values have gone up 2.1% over the past year and the latest forecast is that they will rise 9.5% in the next twelve months.

- Santa Clara home values have gone up 14.4% over the past year and the latest forecast is that they will rise 11.9% in the next twelve months.

- Solano County home values have gone up 6% over the past year and the latest forecast is that they will rise 10.5% in the next twelve months.

- Sonoma County home values have gone up 7.3% over the past year and the latest forecast is that they will rise 10.8% in the next twelve months.

Here is the graphical representation of historical home prices in this region and their forecast for 2021.

Source: Zillow.com

Source: Zillow.com

Here is another short and crisp San Francisco housing market forecast by LittleBigHomes.com for the 3 years ending with the 3rd Quarter of 2021. They have estimated that the probability of rising home prices in San Francisco is 77% during this period.

If this price forecast is correct, the San Francisco-Redwood City-South San Francisco, CA home values will be higher in the 3rd Quarter of 2021 than they were in the 3rd Quarter of 2018.

The change in home prices for San Francisco-Redwood City-South San Francisco, CA is shown below for the three-time periods by LittleBigHomes.com (up to 3rd Quarter, of 2018). The San Francisco Home Price Index has increased for the last 26 consecutive quarters. The all-time high in the San Francisco Home Price Index was 489.9 in the 3rd Quarter, of 2018. The Home Price Index indicates that the San Francisco Market is up 81% over the last 10 years.

Over the last thirty years, it is up 435%. The highest annual change in the value of houses in the San Francisco Real Estate Market was 28% in the twelve months ended with the 4th Quarter of 1979. The worst annual change in home values in the San Francisco Market was -12% in the twelve months ended with the 3rd Quarter of 2008.

| Time Period | San Francisco Real Estate Appreciation |

| Last 5 Years | 68% |

| Last 10 Years | 81% |

| Last 20 Years | 289% |

There has been a short term impact of the Coronavirus pandemic on the Bay Area Housing Market—buyers withdrawing offers and sellers removing their homes from the market. The general uncertainty is playing a smaller role in recent weeks. Sales were down 28% from early March, statewide. According to the California Association of Realtors, there has been the biggest drop in housing starts in 1984.

The pandemic, however, has not had much impact on prices yet. The buyer demand has significantly rebounded as is reflected in June’s housing data. Despite high rates of unemployment and an economic downturn, housing has held onto its value in the San Francisco Bay Area. As the Bay Area employs a high number of skilled workers with college degrees, its unemployment rate is lower than other areas of the United States, and its housing market is holding strong.

The high-end buyer activity has pushed the median price to an all-time high. More affluent buyers having the greatest financial resources have been jumping back into the market to a greater degree than other segments. Nationally, the showing activity has notably increased from the depressed levels in recent months, reflecting pent-up demand by prospective home buyers. The fall season has become as active as the summer buying season.

Despite the ongoing health and economic crisis precipitated by COVID-19, the SF Bay Area real estate market made a large recovery from the steep declines in March and April. On a 4-month rolling basis, SF median house sales prices are as high as they’ve ever been.

The median condo sales price has also been running higher than the highs of last year. It posted an increase of 7.2% YTY in December. Condo sales are surged by 39.9% YTY. The condo market is being flooded by new listings, especially in San Francisco County.

In a balanced real estate market, it would take about five to six months for the supply to dwindle to zero. In terms of months of supply, San Francisco, or the entire Bay Area housing market can become a buyer’s real estate market if the supply increases to more than five months of inventory. And that’s not going to happen.

This entire Bay Area region is very much skewed to sellers due to a persistent imbalance in supply and demand. In December, the inventory of available properties was holding at 1.6 months and there was a resurgence of the buyer demand to a new level. This will push the home prices up even though at a medium pace in the coming months.

To be noted is that the supply of listings in San Francisco County in August was is at its highest point in 8 years. As the market softens, correct pricing becomes increasingly critical for sellers. When that happens, the sellers will have to compete for buyers.

For buyers in San Francisco and the entire Bay Area, the good thing is that mortgage rates are at their lowest. Therefore, this is a good time for them to enter the market and scoop up their favorite deals. Higher San Francisco home prices and economic recession have dampened housing affordability.

San Mateo and San Francisco counties were the least affordable, tied at 19 percent of households able to purchase the median-priced home. Forty-six percent of Solano County households could afford the $485,000 median-priced home, making it the most affordable Bay Area county, according to C.A.R.

Real estate market forecasts given in this article are just an educated guess and should not be considered financial advice. Real estate prices are deeply cyclical and much of it is dependent on factors you can’t control. Many variables could potentially impact the value of a home in San Francisco in 2020 (or any other market) such as big changes in the distressed, new-construction, or luxury home segments. There are also a wide variety of economic and political factors that can and do impact real estate markets. Most of these variables are difficult to predict in advance.

Bay Area Housing Market 2020 Summary: Impact of Pandemic

San Francisco Bay Area consistently ranks among the most expensive real estate markets in the world, and it is one of the most densely populated cities in the U.S. The Bay Area housing market consists of all nine counties (Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma) and 101 municipalities. The region is home to three major cities: San Francisco, Oakland, and, the largest, San Jose.

Despite the ongoing health and economic crisis caused by the COVID-19 pandemic, the San Francisco housing market made a large recovery in sales from the steep declines in March and April. The median sold price hit a new monthly high in June ($1,800,000).

As affluent buyers are least affected by the economic downturn, they are seen to have been jumping back into the market to a greater degree than other segments. High-end luxury real estate has seen a very strong demand in virtually every housing market in the entire Bay Area.

The Bay Area housing markets with the largest year-over-year increases in the number of listings accepting offers in June 2020 were the 4 outer Bay Area counties of Monterey (up 61%), Santa Cruz (58%), Sonoma (47%), and Napa (37%). They also have among the lowest population densities in the Bay Area.

The more urban counties saw more modest year-over-year increases: San Francisco (6%) and Alameda (7%). Other factors may play a role in this: length/strictness of shelter-in-place rules, home price differences, second-home buying patterns, and so on.

Home sales declined by 7.8% from the prior year but there was a gain of 69.2% as compared to the previous month (May). The median sold price of existing single-family homes in the San Francisco Bay Area housing market was $1,000,000, a year-over-year rise of 4.2%, according to C.A.R.

San Francisco Bay Area housing market had the strongest sales growth in August with a more than 10 percent surge in sales from last year, which is an amazing recovery from the lows in May. This trend continued in September as well with 34.2 percent sales growth as compared to last year. SF Bay Area home prices have also been climbing due to strong demand and low supply.

After reaching near-record levels in July, the median price of single-family homes posted an increase of 20.5% year-over-year in September — the second-highest median price increase in the state of California.

The price decreased by -0.7% as compared to the previous month (August). In the San Francisco county housing market, the median sold price increased by 0.1% to $1,665,000, $2000 more than August’s median price. Sales of single-family houses rose by a whopping 90.2% YTY. Sales also increased by 8.4% MTM.

Among Bay Area markets, San Franciso County saw extremely high demand in September. The sales surged by 90.2% YTY — the highest among all the counties of the Bay Area. Single-family house prices rise by 8.1% to $1,665,000, $2000 more than August’s median price.

In San Francisco, supply and demand conditions have diverged between house and condo markets, with the latter being far weaker and rapidly climbing into “buyer’s market” territory.

However, the condo market showed a suddenly increased buyer turnout in September. Sales of condos jumped by 63.1% YTY and 29.9 MTM. Condo prices in San Francisco declined by 7.8% to $1,221,000. As compared to the previous month, the median condo price declined by -4.2%.

In October, the active listings declined by -23.8%. The home prices increased compared to last year in all the nine counties of the SF Bay Area except San Franciso. All nine counties posted an increase in year over year sales. Sales of houses throughout the Bay Area increased by 1.5% month to month and 18.9% year to year.

San Mateo, Santa Clara, Marin, Sonoma, and Contra Costa enjoyed the largest sales growth year to year. The highest sales came from Santa Clara County, up 32.4% from last year and 9.5% from the previous month.

Bay Area home prices increased by $40,000 from September to $1,100,000, up by 3.8% MTM. Prices are up 17% more than last October which represents a big growth of $160,000. The highest price growth came again from the Central Coast with an increase of 25.9% from the previous year. September’s annual price growth for Central Coast (42.0%) was also the highest in the Bay Area.

The latest report for December 2020 (give at the top) shows that prices are rising and inventory is declining. There aren’t enough homes on the market to meet the demand increased by the pandemic.

San Francisco Real Estate Investment 2021: Should You Invest?

Should you consider San Francisco real estate investment? Many real estate investors have asked themselves if buying a property in San Francisco is a good investment as the median price for a two-bedroom sits at $1.35 million. The high cost of real estate in San Francisco is impossible for most families to manage. Exodus is yet another problem and a new report confirms that the numbers are staggering. Online real estate company Zillow released new statistics shining a stark light on the issue this week.

Their “2020 Urban-Suburban Market Report” reveals that inventory has risen a whopping 96% year-on-year, as empty homes in the city flood the market like nowhere else in the country. Although this article alone is not a comprehensive source to make a final investment decision for San Francisco, we have collected some evidence-based positive things for those who are keen to invest in the San Francisco real estate market. If you can afford it, then it’s an investment that will continue to increase in value over time.

Amid low-interest rates, there has been an influx of high-end luxury buyers, with certain instances where homes have been sold for $1 million over asking.

Let’s talk a bit about San Francisco and the surrounding bay area before we discuss what lies ahead for investors and homebuyers. San Francisco is home to nearly 900,000 people. It is the hub of the San Jose-San Francisco-Oakland area; this larger metro area is home to nearly nine million people. The city alternately makes the news for people paying incredibly high rents to live in boxes, the homeless problem, and the tech industry.

This makes many wonder why or how anyone could live there. Others would think why you’d want to buy a property now in such an overvalued real estate market. Yet we can give you ten positive signs about the San Francisco housing market 2020. Keep on reading to find out more. Why is housing so expensive in San Francisco?

First of all, the entire state of California has a consistent housing shortage due to limited land. Most of the cities including San Francisco are failing to meet the regional housing needs. New construction permits in all cities often lag due to community resistance which blocks new housing. Jobs are increasing and the economy is strongest in 50 years. But due to the tight supply of homes, San Francisco home prices have grown much faster than incomes.

The minimum annual income required for owning a house in the San Francisco bay area in 2019 was $197,970. That’s an increase of 119.1% since 2012 when affordability was at its peak. Homeownership is not rebounding anytime soon in San Francisco. By 2025 more than 60% of the population is estimated to rent. Housing affordability has been a consistent issue for first-time buyers over the last few years.

Boise Real Estate Market Trends & Investment Overview

They have limited options in the San Francisco housing market. Although mortgage rates have decreased, big down payments & all-time high home prices aren’t spurring more sales. Many simply can’t afford to buy a house due to these factors. Despite Covid-19, in the latest quarter, the San Francisco real estate appreciation rate has been around 0.21%, which amounts to an annual rate of 0.84%.

Some experts feel that home prices may drop by 1 to 2% in the next twelve months. This is a good sign for new homebuyers and investors as far as affordability is concerned as many of them can’t afford to buy a median-priced home in San Francisco.

We shall discuss some more important reasons why you may want to consider buying San Francisco investment properties for the long term buy and hold.

San Francisco’s Strong Economy Propels Real Estate

Why doesn’t everyone just move out of the San Francisco housing market? Some do move, but they have a one and a half to two-hour commute each way to work because they still want to work there. They just can’t afford to live there. Moreover, it is the high tech job market that draws so many people to San Francisco and leaves many others struggling to pay the bills. San Francisco is turning into a major international city. It is a white-collar city, with fully 90.74% of the workforce employed in white-collar jobs, well above the national average.

In a report published by Google in June 2019, it announced one billion dollars of investment in housing across the Bay Area. A 10-year plan to add thousands of homes to the Bay Area. The company would be making this major investment in what it believes is the most important social issue in the bay area real estate market.

This proposition by Google will add thousands of new homes to the Bay Area real estate market over the next ten years. About $750 million would be used for repurposing Google’s own commercial real estate for residential purposes. This will allow for 15,000 new homes at all income levels in the Bay area.

Another $250 million investment fund would be utilized to provide incentives to enable developers to build at least 5,000 affordable housing units across the Bay area housing market.

As a move to support affordable housing initiatives these investments will help Google plans to give $50 million in grants through Google.org to nonprofits focused on the issues of homelessness and displacement of citizens. The company also plans to fund community spaces that provide free access to co-working areas for nonprofits, improving transit options for the community, and supporting programs for career development, education, and local businesses.

As it is the epicenter of the technology industry, there are a lot of people with an immense amount of wealth. Wealth isn’t just limited to the uber-wealthy founders of major tech companies or successful VCs but also the general workforce, whose salaries and incomes are among the highest in the world. Overall, San Francisco is a city of professionals, managers, and sales and office workers. Also of interest is that San Francisco has more people living here who work in computers and math than 95% of the places in the US.

The predicted 2020 job market slowdown won’t result in layoffs, just a drop in job growth to 1.5 to 2 percent a year. Note that the area already has an unemployment rate of 1.2 percent below the national average. The unemployment rate in the San Francisco-Redwood City-South San Francisco MD was 1.8 percent in December 2019, down from a revised 1.9 percent in November 2019, and below the year-ago estimate of 2.1 percent.

This compares with an unadjusted unemployment rate of 3.7 percent for California and 3.4 percent for the nation during the same period. An upcoming recession is likely to have a limited effect on the SF Bay Area’s housing market. It will only temper housing price appreciation but not reduce it. These solid economic fundamentals are integral to maintaining high rental property demand and ensuring a good return on investment.

San Francisco Rental Market

You may read about the growth of Portland and other Pacific Northwest cities as talent and businesses flee the expensive San Francisco real estate market. That’s hardly impacted the San Francisco housing market, though. However, San Francisco has several advantages over its Oregon rivals, and that’s the fact that you aren’t in Oregon. Oregon passed a state-wide rent control law in 2019. This is in addition to many city regulations regarding affordable housing. In Oregon, your ability to raise rents is limited by the state.

Making matters worse, there are many more renters than property owners, so they’ll tighten the allowable rental increases and continue to hamper owners until they’re losing money. And then there is California. You can find a variety of rent control laws in the San Francisco housing market because every city takes its approach to the problem. This means that you can find suburban San Francisco rental properties where you could raise rental rates to match the market. Furthermore, rent control laws typically don’t apply to newer single-family homes.

California, on the whole, is unfriendly to landlords. It is challenging to evict people. It can take a long time to evict someone who occasionally pays the rent. Taxes are high. What does this do to the San Francisco housing market? It leaves open the possibility that you could snap up San Francisco rental properties at a relative bargain price by people who just want to quit, whether they want to sell the properties or leave the state. For example, the laws governing the San Francisco real estate market allow you to buy San Francisco rental properties and evict the tenants to turn the units into condos for sale.

SF Rental Statistics: San Francisco holds the position of the priciest rental market. It is still #1 among the top 5 rental markets in the nation. The average rental income for traditional San Francisco investment properties is well above the national average. Like most of the Bay Area, the percentage of people renting in San Francisco is more than owners. San Francisco has around 56 percent of its residents living in rental homes.

If condo prices are going to drop in 2021, people will see a good investment opportunity. They’ll be able to get in at a good price and there will be an increase in demand. If you’re in the market for a condo in San Francisco, that means you could get a great deal.

According to Zumper.com, for the first time since April 2020, they saw rental prices increase at a monthly rate in San Francisco after months of decline in the city and throughout the entire Bay Area. However, on a year-to-year basis, 1 Bedroom rent in San Francisco was down -23.9% ($2,680) and 2 Bedroom rent was down -23.1% ($3,500).

Another report shows us that as of January 2021, the average rent for an apartment in San Francisco, CA is $3026 which is a 25.81% decrease from last year when the average rent was $3807, and a 0.76% decrease from last month when the average rent was $3049.

- One-bedroom apartments in San Francisco rent for $2884 a month on average (a 20.25% decrease from last year).

- Two-bedroom apartment rents average $3832 (a 20.3% decrease from last year).

- The average apartment rent over the prior 6 months in San Francisco has decreased by $331 (-9.9%).

- One-bedroom units have decreased by $190 (-6.2%).

- Two-bedroom apartments have decreased by $205 (-5.1%).

Some of the most affordable neighborhoods where the rent is below San Francisco’s average rent price:

- Treasure Island, where the average rent goes for $2,616/month.

- Tenderloin, where renters pay $2,944/mo on average.

- Van Ness – Civic Center, where the average rent goes for $2,944/mo.

- Downtown District 8 – North East where the average rent goes for $2,956.

- Marina where the average rent goes for $2,974.

- Outer Sunset where the average rent goes for $3,117.

- Outer Richmond where the average rent goes for $3,117.

Screenshot Courtesy of RENTCafé.com

Screenshot Courtesy of RENTCafé.com

San Francisco’s Geography & Zoning Restrictions Limits inventory

San Francisco real estate market is perpetually constrained in terms of inventory. Several factors contribute to this, but principally the strict zoning laws prevent new development and high rise construction throughout the city. The strict zoning laws, coupled with the fact that the SF is only seven by seven miles, makes it a very constrained market and keeps supply perpetually low. San Francisco sits on a peninsula, surrounded on three sides by water.

They cannot build-out to meet housing demand. The surrounding cities are densely built up, as well. The only way the San Francisco real estate market could meet demand is by ripping out large swaths of two and three-story buildings to build condo towers, but that’s almost impossible given local regulations. The ability to build up is limited in the surrounding suburbs because of the mountains.

The San Francisco real estate market is, for better or for worse, beholden to several competing interest groups. For those with money that own their homes and have the most influence, “not in my backyard” or NIMBY means that voters fight any proposal to replace a 2 or 3 story warehouse with a 20 story apartment or condo building. They want to protect the look and feel of the community, through high rise construction could start to relieve the overcrowding in the San Francisco real estate market.

The horrific stories of developers going through four years of red tape to build multi-family San Francisco rental properties deter others from even trying. Ironically, this creates significant returns for those who buy up San Francisco rental properties and can convert them to multi-family housing.

San Francisco’s Environmental Movement

The environmentalist movement and California are intertwined in the public’s mind and for good reason. This is the best demonstration of its impact in Marin County. An estimated 85 percent of the county is off-limits to development. This doesn’t mean there are no homes here. It means that there are large estates that cannot be turned into tract homes. Neighbors fight any such project. This is why George Lucas had to threaten to build hundreds of homes on Skywalker Ranch when they wouldn’t let him expand his studios there. This also explains why the San Francisco real estate market cannot solve its affordable housing crisis by building in the relatively open lands in Marin County.

Warehouses and factories have been converted to lofts in large, established cities around the world. They offer open spaces, high ceilings, and proximity to public transit and downtown amenities. San Francisco is no exception to this trend. The difference is the growth in high-density San Francisco rental properties as can only be found in co-living spaces. These can be considered high-end dorms.

People may rent a bunk bed and storage space for their possessions, gaining access to laundry, kitchen, and workout facilities. Several people may share a bedroom that rivals a cramped college dorm room. These facilities are booming because they cater to the new college graduates already used to living this way and willing to continue to do so to work for Big Tech firms in San Francisco.

San Francisco’s Luxury Real Estate Market is Booming Despite Pandemic

Dealing in the luxury real estate market has its benefits. More affluent buyers are the demographic least affected by any economic crisis such as brought up by the Covid-19 pandemic as they have the greatest financial resources. Although home prices soaring there is an influx of wealthy buyers. A relatively high percentage of the buyers in the city are all cash (Around 40 to 60 percent of them). Those that aren’t paying all cash are putting at least 20 percent down with the ability to close fast, even with a loan.

In June, house values in California city reached a record monthly high of $1.8 million. Deep-pocketed home buyers across San Francisco bolstered the market’s rebound and pushing up transactions and house prices, according to a report Monday from Compass. The number of luxury single-family homes—defined by the report as those priced at $3 million and above—that accepted an offer in June surpassed 30, the highest level the metric has reached in two years, data from the brokerage showed.

The increase helped push San Francisco house values to a record monthly high of $1.8 million in June, 3% higher than the previous peak of $1.75 million in June 2019. You will find first-time homebuyers who are buying over $2.5 million or baby boomers looking for second homes in the $2 million range. New units are being built in the San Francisco housing market. However, the reality is that the pool of people who can afford to buy is smaller and smaller and the supply of housing is not growing with demand. They mostly consist of luxury condos and mega-mansions built for the elite of the Big Tech workforce.

Another unintended side effect of regulations on San Francisco rental properties is that it incentivizes the construction of high-end units. Investors could invest in these projects or buy properties in the hopes that they are torn down and redeveloped. This is why burned-out husks can sell for hundreds of thousands of dollars and ones with demolition permits can sell for a million or more.

San Francisco’s Real Estate Appreciation Rate is High

Thanks to all the factors discussed above, the entire bay area has one of the highest appreciation rates. A major reason San Francisco’s housing prices have climbed so high over the past decade is the city’s vibrant tech industry, which started booming in 2012 (thanks, in part, to a tax incentive aimed at attracting tech companies to the city over Silicon Valley). It now attracts a skilled workforce to the city while also driving up the demand for housing and the cost of living.

The data from NeighborhoodScout reveals that San Francisco real estate appreciated 91.99% over the last ten years, which is an average annual home appreciation rate of 6.74%. This figure puts San Francisco in the top 10% nationally for real estate appreciation. And within San Francisco, some individual neighborhoods’ home values have jumped by more than 100%, according to Trulia. Here are the five San Francisco neighborhoods that have had the biggest jump.

- Bayview: Bayview had a $424,900 median home value in April 2009, which went to $918,300 in April 2019.

- The Forest Knolls: In April 2009, the neighborhood’s median home value was $811,800, and it topped $1.7 million in April 2019.

- Bernal Heights: This neighborhood went from a median home value of $715,000 in April 2009 to $1,507,800 in April 2019.

- Mission: This East of The Castro neighborhood is in central San Francisco. The median home value was $699,900 in April 2009 and $1,460,800 in April 2019.

- Potrero Hill: This neighborhood lies in the East of the Mission District. It has a median home value of $734,200 in April 2009 and in April 2019 it was just over $1.5 million.

The good news is that if you are a home buyer or real estate investor, San Francisco has a track record of being one of the best long term real estate investments in the nation through the last ten years. So if you bought a home in San Francisco 10 years ago, it’s very likely you’d have profited on the deal by now — in fact, in several neighborhoods, you would have a good chance at doubling your money. All the variables that contribute to real estate appreciation continue to trend upwards which makes investing in SF real estate a sound decision.

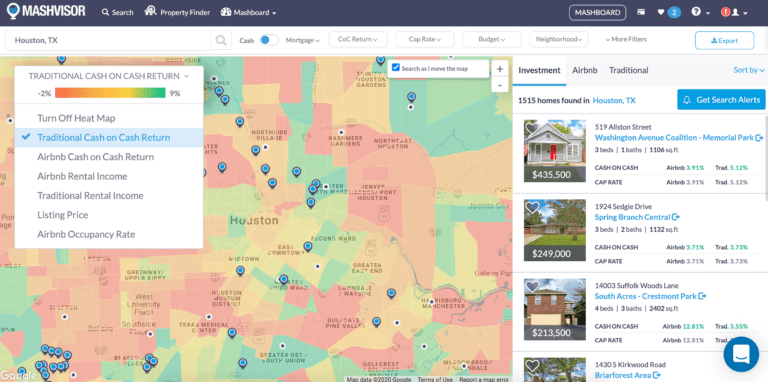

Where To Invest In San Francisco Real Estate Market?

Are you looking to buy an investment property in the San Francisco real estate market? California has the 6th largest economy in the entire world. This is largely driven by its innovative production, the heavy tech sectors in the state, and more. The San Francisco market is expensive, but that doesn’t mean it is overpriced. There are opportunities, though they come with risks. If the city had better leadership and more people willing to allow redevelopment on a large scale, the city could blossom.

Good cash flow from San Francisco investment property means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding the best investment property in San Francisco in a growing neighborhood would be key to your success.

If you invest wisely in San Francisco real estate, you could secure your future. If you are a beginner in the business of cash flow real estate investing, it very important to read good books on real estate. The less expensive the San Francisco investment property is, the lower your ongoing expenses will be.

When looking for the best real estate investments in San Francisco, you should focus on neighborhoods with relatively high population density and employment growth. Both of them translate into high demand for housing. San Francisco home prices are not only among the most expensive in the state of California but they are also some of the most expensive in all of the United States. According to Realtor.com, Dolores Heights has a median listing price of $2.5M, making it the most expensive neighborhood.

Some of the popular neighborhoods in and around San Francisco are South Beach, Pacific Heights, Mission District, Presidio Heights, Excelsior, St. Francis Wood, North Beach, West Portal, Outer Sunset, Hayes Valley, Portola, Dogpatch, Bernal Heights, Noe Valley, and Russian Hill.

According to Financialsamurai.com, the best neighborhood to buy property in San Francisco is Golden Gate Heights. This neighborhood has many homes with ocean view properties (under $1,000/Sq Ft), and some of the best schools in SF. Golden Gate Heights consists of mainly single-family homes instead of condos. As a result, the neighborhood is family-friendly and much less dense than other areas of San Francisco. The neighborhood is relatively inexpensive. At an average price per square foot of $850 – $980, Golden Gate Heights is an absolute steal compared to other neighborhoods in San Francisco.

Other best neighborhoods to buy investment properties in San Francisco are:

- Inner Parkside, Parkside

- Inner Sunset, Outer Sunset

- Inner Richmond, Outer Richmond

- Diamond Heights

All of these neighborhoods are safe, relatively inexpensive, and offer single-family homes for working-class people in the SF Bay Area. Single-family homes are defensive during downturns and tend to outperform during upturns.

Bernal Heights is considered an ideally located yet still moderately affordable place to raise a family. It’s on the south side of San Francisco, so it’s very easy to commute. The median home value in Bernal Heights is $1,587,365. Bernal Heights home values have gone up 1.5% over the past year and this neighborhood will continue to rise in value.

Tenderloin is an affordable neighborhood for those who can afford to buy a home in the median price range of $570K. As of June 2020, the Tenderloin was a balanced real estate market, which means there was a healthy balance of buyers and sellers in the market. When housing supply meets housing demand, real estate investors should not miss the opportunity since entry prices of homes remain affordable.

Bayview is one of the most affordable neighborhoods, with a median listing price of $944K (on Realtor.com). Bayview saw an astounding 136% appreciation from 2000 to 2006, followed by a huge 50% drop from 2006 to 2010/2011. From 2012 onward the recovery has been consistent. From Jan 2012 ($428,000) to June 2020 ($1.01M), the median home price has appreciated by a whopping 133% (As on Zillow’s home price index). Bayview home values have gone up 4.7% over the past year alone.

Median housing prices in Bayview are also still among the lowest of any neighborhood in the city, which attracts buyers looking to get a foothold in the rapidly appreciating Bay Area housing market. The markets in the Bayview and nearby neighborhoods are quite strong because they contain the most affordable houses in the city. It has one of the highest appreciation rates in the SF Bay Area region. During the downturn, its housing market became dominated by distressed sales and it fell so far that now, with the disappearance of the subprime effect, its recovery has been equally dramatic.

Stoneridge Park is a neighborhood in Pleasanton, California. It lies in Alameda County—one of the nine counties of the Bay Area region. According to Niche.com, it is a family-friendly neighborhood and one of the best places to live in California. Living in Stoneridge Park offers residents an urban-suburban mix feel and most residents own their homes. In Stoneridge Park, there are a lot of restaurants, coffee shops, and parks. The public schools in Stoneridge Park are highly rated (A+). The median home value is $911,000 and the median rent is $2,572.

Parkside receives an overall grade of A from Niche.com. It is a neighborhood in San Francisco County and is also considered one of the best places to live in California. Living here offers residents an urban-suburban mix feel and most residents own their homes. The public schools in Parkside are highly rated. It is an expensive neighborhood with a median home value of $1,010,820. The median rent is $2,322. Parkside home values have gone up 4.9% over the past year and Zillow predicts they will fall -2.1% within the next year.

Here are top neighborhoods in San Francisco having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- Garces Dr / Vidal Dr

- San Francisco State U / 19th Ave

- American Conservatory Theater / Bush St

- Golden Gate Ave / Leavenworth St

- Geary St / Taylor St

- Kearny St / California St

- Turk St / Taylor St

- Ofarrell St / Taylor St

- Montgomery St / Jackson St

- Golden Gate Ave / Market St

California Real Estate Investment Markets

Apart from San Francisco, you can also invest in many other real estate markets in California. California’s real estate market is the focus of many U.S. and foreign real estate investors.

Another market to buy rental properties in California is San Jose. San Jose is part of Silicon Valley, a place where $100,000 a year or higher salaries from competing for tech firms has driven up the cost of real estate. But what about the San Jose housing market itself? San Jose is the third-largest city in California, home to roughly a million people. It has the highest cost of living in any area in the U.S., and it is one of the most expensive housing markets in the country.

If you want to invest in the San Jose rental properties, you may not need to buy and renovate. Instead, if you know of industrial or commercial properties near major employers they may need to convert to employee housing, which you could buy now and hold until it sells. If that doesn’t happen, you could still turn it into a co-working space.

The San Diego real estate market offers an ideal mix of limited supply, high demand, and excellent income potential. If you’re going to invest in California, it needs to be in San Diego. The San Diego real estate market has been ranked among the ten most expensive real estate markets in the country, though it ranks below several other West Coast cities. This creates massive demand for San Diego rental properties by those who simply cannot afford to buy homes. The rental market will continue to grow as the city grows an estimated 500,000 by 2050, adding tens of thousands each year.

Another expensive market like San Francisco is LA. The numbers may not make sense for many investors but if you ask savvy investors based in LA they would like to bet anytime on this expensive real estate market. The Los Angeles real estate market has many points in its favor beyond its sheer size. The strong market fundamentals make the Los Angeles housing market a good place to invest if you’re looking at buying real estate in California.

Los Angeles has an unemployment rate of around 4%. What makes Los Angeles unique is the employment market. Want to work in Hollywood? Move to L.A. Want to work for a production company or in fashion? Come to L.A. If rent is too high, share an apartment or single-family home with friends. The Los Angeles housing market has seen a bump in residential construction. This has helped to satisfy some demand from renters. However, due to increasing demand, the new supply hasn’t brought prices down.

The Oakland real estate market is a cheaper version of the San Francisco real estate market with similar rental rates and a slightly friendly legal climate. It presents a good opportunity for real estate investors. The Oakland real estate market is second only to San Francisco in terms of rental rates. It is rivaling New York City, Boston, and San Francisco in terms of rental prices. One-bedroom apartments are averaging $2400 a month. Yet Oakland housing units remain two hundred to five hundred thousand dollars cheaper than San Francisco properties. This means you’ll see far better ROI on Oakland rental properties than San Francisco properties.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in San Francisco.

Consult with one of the investment counselors who can help build you a custom portfolio of San Francisco turnkey investment properties in some of the best neighborhoods. All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete San Francisco turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

Please do not make any real estate or financial decisions based solely on the information found within this article. Some of the information contained in this article was pulled from third party sites mentioned under references. Although the information is believed to be reliable, Norada Real Estate Investments makes no representations, warranties, or guarantees, either express or implied, as to whether the information presented is accurate, reliable, or current. All information presented should be independently verified through the references given below. As a general policy, Norada Real Estate Investments makes no claims or assertions about the future housing market conditions across the US.

References:

Market Data, Reports & Forecasts

https://www.car.org/en/marketdata/data

https://www.zillow.com/sanfrancisco-ca/home-values

https://www.zillow.com/research/2020-urb-suburb-market-report-27712/

https://www.littlebighomes.com/real-estate-san-francisco.html

https://www.realtor.com/realestateandhomes-search/SanFrancisco_CA/overview

https://www.bayareamarketreports.com/trend/san-francisco-home-prices-market-trends-news

San Franciso (City) Cooling off

https://www.cnbc.com/2020/09/27/san-francisco-housing-suburbs-red-hot-but-city-still-in-demand.html

City details

http://worldpopulationreview.com/us-cities/san-francisco-population

Best Neighborhoods

https://www.neighborhoodscout.com/ca/san-francisco/real-estate

https://www.helena7x7.com/san-francisco-neighborhood-appreciation-rates/

https://www.financialsamurai.com/best-san-francisco-neighborhoods-to-buy-property-for-price-appreciation

https://www.niche.com/places-to-live/search/best-neighborhoods-to-buy-a-house/m/san-francisco-metro-area/

Rental Market Statistics

https://www.rentcafe.com/average-rent-market-trends/us/ca/san-francisco/

https://www.rentjungle.com/average-rent-in-san-francisco-rent-trends/

https://www.zumper.com/blog/rental-price-data/

https://www.nolo.com/legal-encyclopedia/california-rent-control-law.html

https://homeguides.sfgate.com/tenants-rights-landlord-sells-house-53734.html

https://www.npr.org/2019/02/27/698509957/oregon-set-to-pass-the-first-statewide-rent-control-bill

Should You Invest in SF

https://realestate.usnews.com/places/california/san-francisco/jobs

https://sf.curbed.com/2020/3/11/21155283/buying-a-house-san-francisco-2020

https://reason.com/2018/02/21/san-francisco-man-has-spent-4-years-1-mi

https://www.nytimes.com/2017/01/21/us/san-francisco-children.html

https://www.latimes.com/politics/la-pol-ca-marin-county-affordable-housing-20170107-story.html

https://www.citylab.com/equity/2016/04/blame-geography-for-high-housing-prices/478680

https://www.theguardian.com/business/2016/aug/05/high-house-prices-san-francisco-tech-boom-inequality

https://www.mercurynews.com/2019/03/14/bay-area-job-market-slowdown-experts-predict-google-apple-amazon-facebook

https://www.washingtonpost.com/news/morning-mix/wp/2015/04/17/george-lucas-wants-to-build-affordable-housing-on-his-land-because-weve-got-enough-millionaires

Luxury market

https://www.mercurynews.com/2014/03/05/in-the-bay-area-million-dollar-homes-are-torn-down-to-start-fresh

https://www.sfgate.com/realestate/article/863-carolina-street-potrero-hill-tear-down-listing-13844146.php

https://www.housingwire.com/articles/36691-la-demolishing-affordable-housing-building-luxury-housing-instead

Los Angeles Real Estate Market & Investment Overview 2021

Recent Comments