President Biden Extends Eviction Ban to March 31

Should You Buy a Real Estate Portfolio for Sale?

The Biden administration wasted no time making big moves within the first few weeks in office. One of the real-estate-related acts included extending the federal eviction ban as a part of Biden’s COVID-19 relief response.

This means that many landlords who’ve been dealing with non-paying tenants through the pandemic are still prohibited from carrying out evictions. The federal eviction moratorium is meant to protect renters during this health crisis but is also impacting players in the real estate industry.

Eviction Moratorium Extension: Fast Facts

On January 20th, President Biden released an executive order to have the eviction moratorium extended until at least March 31st. He also extended the foreclosure moratorium on federally backed mortgages. The CDC released a statement to the public, which you can read here.

As far as we can tell, the eviction moratorium extension did not include any new federal guidelines or regulations regarding evictions. It was an order meant to prolong the duration of the original eviction ban, released in 2020 and later extended until January 31st, 2021.

Understanding the Eviction Moratorium

If you aren’t familiar with the eviction moratorium order, the basic information is listed below. Also refer to this article, Eviction Moratorium FAQs for Landlords, for more information. You can view the CDC’s eviction moratorium FAQs here.

- Landlords are not required to inform their tenants of the eviction ban.

- Tenants must qualify in order to receive the protections of the eviction moratorium.

- The eviction ban does not excuse a renter’s obligation to pay.

- Landlords have the right to dispute if they feel their tenant does not qualify for protection.

- A renter is considered covered under the moratorium unless a court proves otherwise.

- The moratorium does not prevent all evictions. It only prevents evictions due to nonpayment of rent due to income loss as a result of the pandemic.

- While they cannot carry through with eviction, landlords may begin the process of eviction at any time, unless their state prohibits it.

- States may have additional requirements or laws regarding eviction during the pandemic, and landlords must stay up to date and compliant with state laws as well as federal laws.

What the Eviction Ban Means for Landlords

The nationwide eviction moratorium is a measure meant to protect renters from financial hardship, minimize the effect of the pandemic on the economy, and ultimately reduce the spread of the virus to end the pandemic as quickly as possible. While it may help to achieve these goals, there are some downsides for real estate investors.

For full-time rental property owners, an eviction ban means several things:

- Loss of cash flow and income

- Potential financial ruin or bankruptcy

When tenants stop paying, it does not take away a landlord’s obligation to pay a mortgage, property taxes, utilities, repairs, insurance, and other expenses associated with owning real estate. Luckily, forbearance on federally backed mortgages has helped in part, but it does not eliminate the other expenses landlords are responsible for. As a result, some landlords are struggling without their rental income.

Fortunately, President Biden’s plan also includes providing rental assistance to struggling tenants through the duration of the pandemic. If his third stimulus package is enough to meet the needs of the country’s financial shortcomings, it could also help to keep landlords afloat.

Will the Eviction Moratorium Be Extended Again?

While there are no definite answers on the matter, most sources are stating that President Biden would likely not hesitate to order another extension if the coronavirus is not under control by March.

With the distribution of the COVID-19 vaccine comes a hope that the virus may begin to subside by the spring, though experts are predicting it will take longer to reach herd immunity. Chief Medical Advisor, Dr. Fauci, recently stated that the COVID-19 vaccine is effective at preventing the new coronavirus strain and that if vaccination rates reach 75%-80%, we might be able to return to normalcy by this fall.

What Is a Good Gross Rent Multiplier?

However, some experts say it is unlikely that we will have enough vaccines in pharmacies by next month to make a significant enough impact on the infection rates this spring. In that case, President Biden will likely not hesitate to prolong the moratorium as long as needed. That being said, there is a good chance the moratorium will be extended beyond March 31st, and rental property owners would be wise to prepare.

Landlords: What to Do About the Eviction Ban

Unfortunately, there is nothing landlords can do to reverse or repeal the eviction moratorium. However, there are actions rental property owners can take to lessen the impact of the pandemic on their rental property business.

#1. Follow the Guidelines

The CDC outlines all of the requirements of the eviction ban, which you can view here. If you have a tenant who cannot pay, make sure both you and the tenant are following the guidelines set forth. This means your tenant must fill out a form and submit it to you if they are attempting to seek the protections of the moratorium.

#2. Communicate with Tenants

If a tenant is not paying, it might be worthwhile to have a conversation with them about their situation, so you can better understand their circumstances. Make sure tenants understand that they must make what payments they can and that the eviction ban does not exempt them from paying rent. Let them know that you are willing to work with them on a solution that is reasonable for both of you.

#3. Be a Resource to Struggling Tenants

If you’re aware that a tenant has become unemployed and needs assistance with filing for government benefits, consider being a resource to them. Educate yourself on the benefits that are available, and when you speak with tenants, let them know you are a resource for information. Offer to share access to a computer, printer, and forms or applications as needed.

If necessary, it may be possible for you to apply for federal relief on behalf of your tenant, and you should check with the local and state government to determine your eligibility. Being a help could go a long way in making sure your tenants get the unemployment benefits they need, which will help you secure rental income.

Rather have your tenant move out? If the best option for your rental property business is to have a tenant leave, try this strategy to have them move out: Can Landlords Use Cash for Keys During COVID-19?

#4. Keep Careful Records

Keep very careful records of your expenses and any payments tenants do make. If you ever need to file for unemployment yourself, you may need to present this information in an application.

#5. Seek Government Assistance

If renting properties is your full-time job or makes up a sizable portion of your income and you are not maintaining a positive cash flow, you should apply for self-employed unemployment assistance.

#6. Keep Things in Perspective

It’s important to understand that evicting tenants unlawfully could result in legal consequences and contribute to the spread of COVID-19. During this stressful time, know that everyone is truly in this situation together. Though the pandemic has taken a toll on everyone differently, everyone wants it to end as quickly as possible. The best way to do this is to keep tenants safe in their apartments, where they can socially distance and reduce the spread of the virus. Be patient and empathetic to tenants as they navigate through some of the hardest times we have yet to face.

Looking for more ideas? Read this: What Landlords Can Do During the Coronavirus Eviction Ban

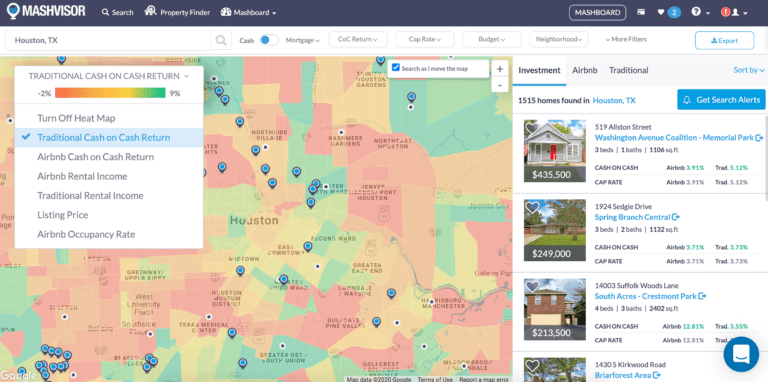

Start Your Investment Property Search!

EvictionLandlordTenants

How to Rent Your House: The 8-Step Guide to Success

Recent Comments