Portland Real Estate Market Trends & Investment Overview

Houston Real Estate Market: Prices | Trends | Forecast 2021

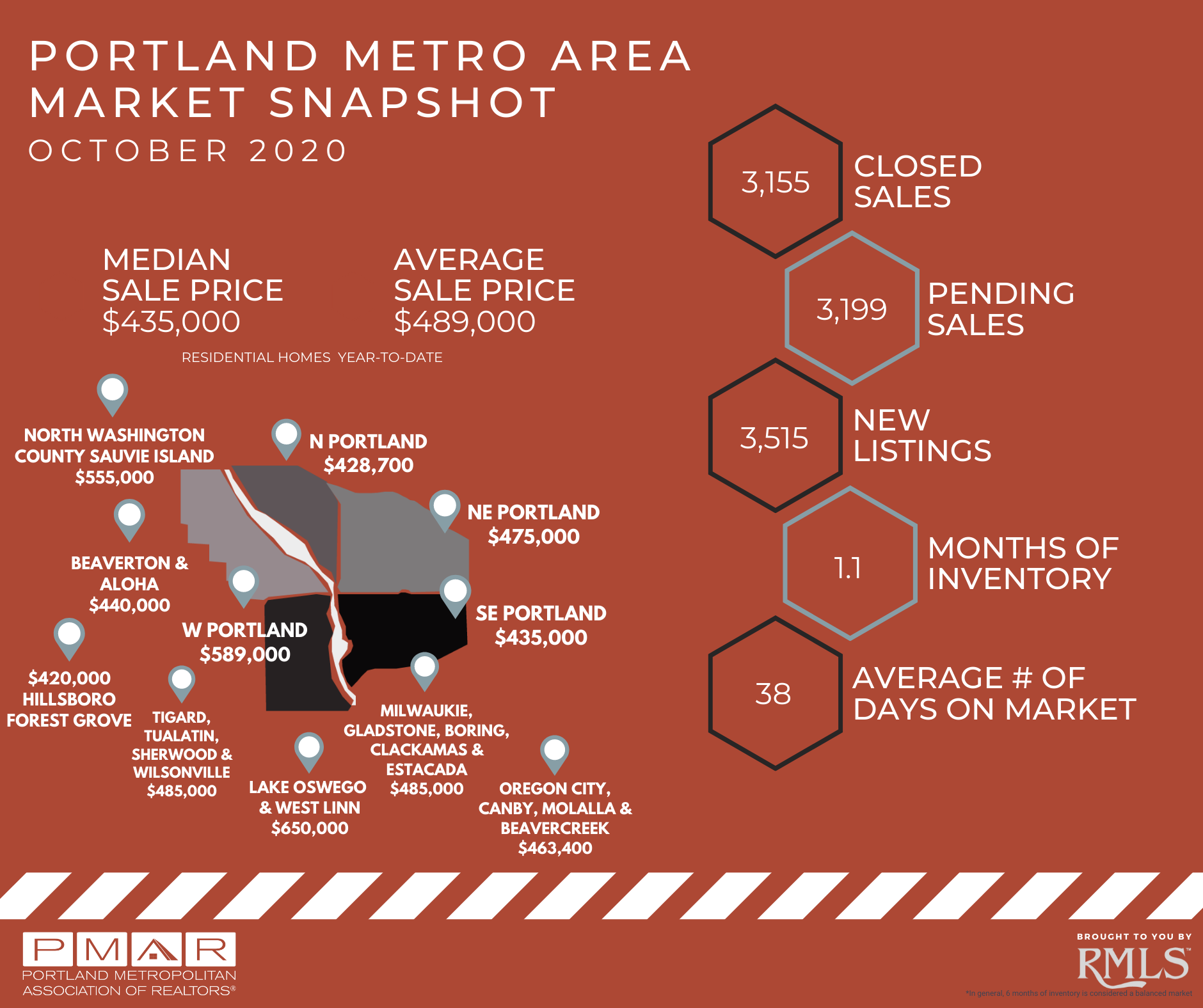

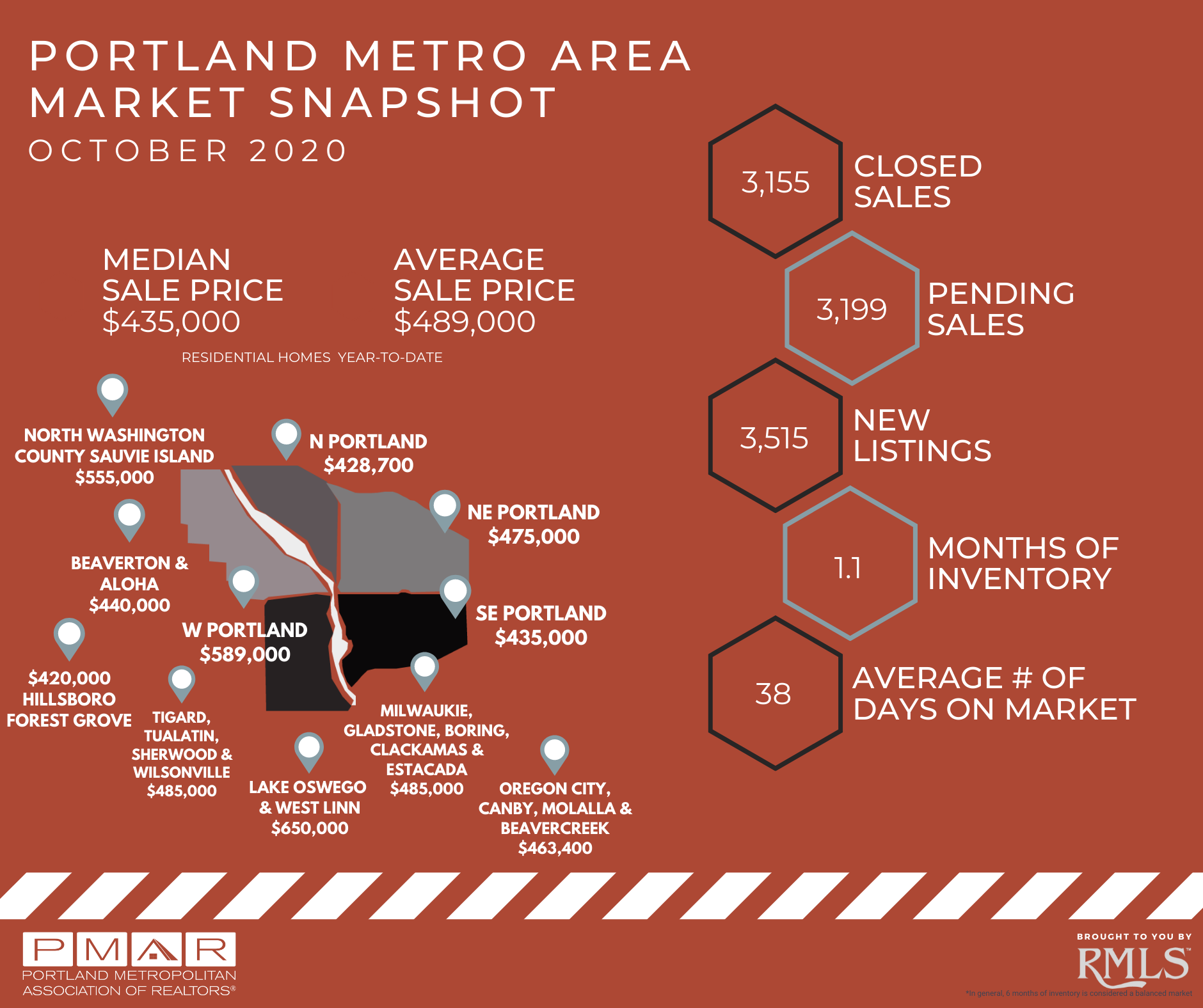

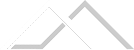

The Portland housing market is sizzling hot. Despite the economic slowdown caused by the pandemic, the Portland real estate market continues to connect buyers to sellers. In October, 3155 residential properties in Portland metro area changed hands, according to the latest report by the Portland Metropolitan Association of Realtors®.

The inventory is so tight in this housing market that the median sale price rose to $435,000, an increase of $1,500 from September 2020. There’s a lot of competition among real estate buyers in Portland due to the extreme shortage of available homes for sale. Although new listings were up from the previous month the coronavirus has also significantly reduced the number of homes for sale in the Portland metro area.

In a tight housing market like Portland, it can take some time to find a property that meets all of your criteria. According to Realtor.com, in October 2020, the median list price of homes in Portland, OR was $500K, trending up 8.7% year-over-year. The median sale price was $488,400. Ideally, a buyer would prefer a sale to list price ratio that’s closer to 90% but homes sold for approximately the asking price on average (Sale-to-List Price Ratio: 100%).

This shows that Portland is a seller’s real estate market, which means there are roughly more buyers than there are active homes for sale. The higher buyer turnout and low inventory is favoring sellers. On average, homes in Portland sell after 47 days on the market. The trend for median days on market in Portland, OR has gone up since last month, and slightly down since last year.

Here’s October’s housing data for the Portland Metropolitan Area released by the Portland Metropolitan Association of Realtors®. The rising prices and declining inventory show that Portland is a hot seller’s market. Inventory of available residential homes is enough to last for 1.1 months at the current pace of sales.

- The median sales price was $435,000, an increase from the previous month ($433,500).

- The average sales price was $489,000, an increase from the previous month ($485,200).

- No. of closed sales was 3155, a slight decrease from the previous month (3251).

- No. pending sales were 3199, a slight increase from the previous month (3152).

- New listings were 3515, an increase from the previous month (3264).

- Months of inventory equaled 1.1, no change from the previous month (1.1).

- The average no. of days on the market was 38, no change from the previous month (38).

Courtesy of Pmar.org

Courtesy of Pmar.org

For Tenants & Landlords: On September 28, the Governor extended the ban on eviction of residential tenants for non-payment of rent until December 31, 2020. The existing ban, enacted by the State Legislature in House Bill 4213, was due to expire on September 30 and has been extended by Governor Kate Brown. Late fees and other financial penalties for non-payment are also prohibited.

Moreover, the Order prohibits no-cause evictions through December 31 of residential tenants not otherwise protected by Oregon’s 2019 rent control law. And residential tenants in Multnomah County cannot be evicted for non-payment through January 8, 2020, under a County order. Until that date, evictions for nonpayment of rent are forbidden statewide.

The bill now creates an eight-month grace period for tenants to repay unpaid rent accrued during the emergency period. Any balance of unpaid rent and other charges amassed between April 1 and Dec 31 must be paid in full by March 31, 2021, and tenants are still required to pay rent as it comes due after Dec 31.

Of importance, the bill requires tenants to notify the landlord that they intend to utilize the grace period. The eviction ban on commercial tenants has not been extended. House Bill 4213 protected them from eviction for non-payment of rent also, but that moratorium has not been extended.

Landlords now can pursue evictions for nonpayment that occurred before April 1 and the statute of limitations will be paused so that landlords can pursue claims once the moratorium and grace period is over.

Table of Contents

Portland Real Estate Market Forecast 2021

What are the Portland real estate market predictions for 2020? In 2003, home prices began to grow at a significantly faster annual clip of 14.09% through mid-2006. This incredible growth ultimately proved unsustainable as home prices crashed in 2007, eventually bottoming out in 2012. Since then the Portland MSA has seen a strong average annual growth rate of 9.85%.

The hot Portland housing market of two years ago has cooled dramatically. Home price gains have been slowing since 2017. Two years back it saw an annual home price appreciation of nearly 10%. The pandemic has heated up the market gain.

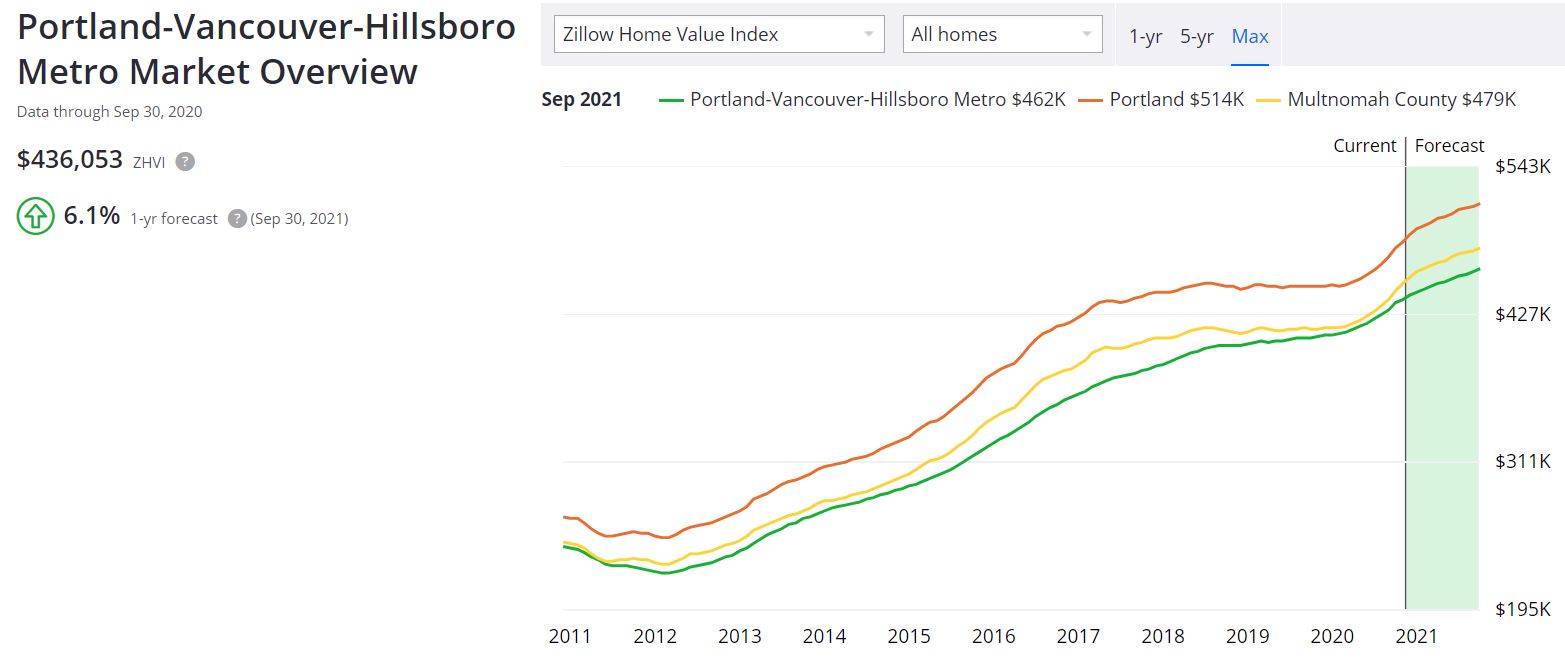

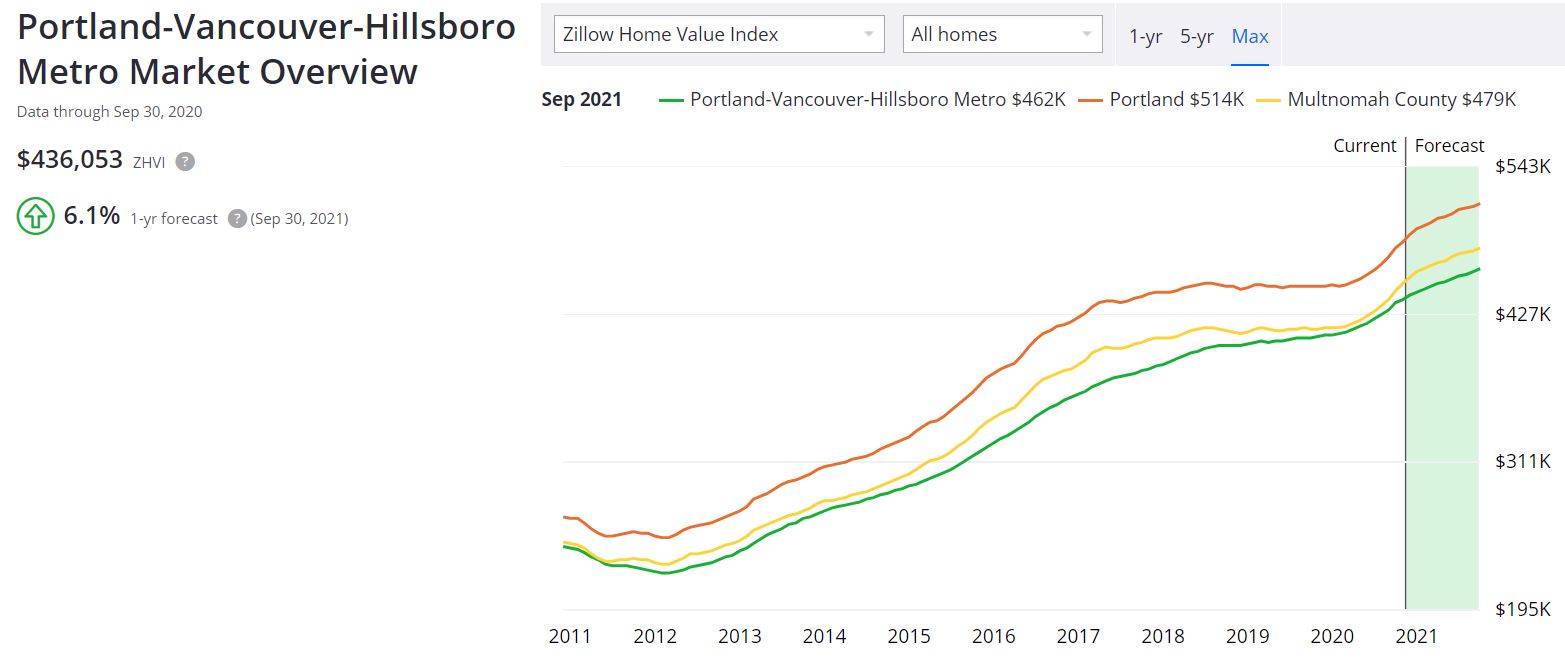

As of now, Zillow considers the Portland real estate market to be a “seller’s market” which means that there exists a limited supply of homes in Portland, and buyers are forced to compete often resulting in higher prices and/or quicker sales that tend to benefit sellers.

That’s the reason why Portland home values have gone up 6.7% over the 12 months and Zillow predicts they will continue to rise at the same pace in 2021. If we look at Zillow’s data since 2012, the Portland home values have increased from $251,000 to $479,166 — that’s an appreciation of nearly 91% and that’s despite the market cooling off from 2017 to 2019.

Similar growth has been recorded by NeighborhoodScout.com. Their data also shows that Portland real estate appreciated by nearly 70% over the last ten years. Its annual appreciation rate has been averaging at 5.45%. This figure puts Portland in the top 10% nationally for real estate appreciation.

During the latest twelve months, the Portland appreciation rate was nearly 2.79%, and in the latest quarter, the appreciation rate was 0.71%, which annualizes to a rate of 2.86%. This figure is a bit conservative from Zillow’s positive forecast, which also predicts that home prices in this region are expected to increase by nearly 7% in the next twelve months. In other words, if you buy a property now, then after twelve months, you can expect an ROI of anything between 3-7%.

Here is Zillow’s home price forecast for Portland, Multnomah County, and Portland Metropolitan Area. The forecast is until September of 2021 and you can expect to see very strong home price gains.

- Portland home values have gone up 6.7% over the past year and the latest forecast is that they will rise 7.3% in the next year.

- Multnomah County home values have gone up 7.2% over the past year and Zillow predicts they will rise 7.5% in the next twelve months.

- Portland-Vancouver-Hillsboro Metro home values have gone up 6.6% over the past year and the latest forecast is that they will rise 6.1% in the next year.

Courtesy of Zillow.com

Courtesy of Zillow.com

Portland-Vancouver-Hillsboro Metro Real Estate Appreciation Trends

Here is a short and crisp Portland housing market forecast by LittleBigHomes.com. It is for the 3 years ending with the 3rd Quarter of 2021. The accuracy of this forecast for Portland is 77% and it is predicting a positive trend.

They estimate that the probability of rising home prices in Portland is 77% during this period. If this price forecast is correct, the Portland-Vancouver-Hillsboro, OR-WA home values will be higher in the 3rd Quarter of 2021 than they were in the 3rd Quarter of 2018.

The historical change in home prices for Portland-Vancouver-Hillsboro, OR-WA are shown below for the three-time periods in the table below. The Portland Home Price Index has increased for the last 25 consecutive quarters. The highest annual change in the value of houses in the Portland Real Estate Market was 22% in the twelve months ended with the 2nd Quarter of 1978.

The worst annual change in home values in the Portland Market was -11% in the twelve months ended with the 3rd Quarter of 1981. The historical change in home values has been calculated until the 3rd Quarter of 2018. For the upcoming updates, you can visit LittleBigHomes.com.

| Time Period | Portland Area Real Estate Appreciation |

| Last 5 Years | 57% |

| Last 10 Years | 41% |

| Last 20 Years | 152% |

The question now is what happens moving forward. Is Portland going to remain a seller’s real estate market amid the ongoing Coronavirus pandemic, which no one knows when it is going to end? These numbers can be positive or negative depending on which side of the fence you are — Buyer or Seller?

The Portland real estate market had strong economic support coming into 2020 from nearly every angle. “Portland does better than average in booms, worse in recessions,” says Portland City Economist Josh Harwood. He expects this to be no different given Portland’s exposure to Asia, as they manufacture more things here and are, thus, more dependent on global markets.

While buyer activity continues to be robust, the decrease in the number of active listings indicates that new sellers are still not willing to put their homes on the market until the pandemic or its threat is completely over. Home sales have rebounded since June but inventory has decreased.

With sellers taking their homes off the market, it has led to an inventory crisis. The demand is rising again and the market is going to remain heated in 2021. In a balanced real estate market, it would take about five to six months for the supply to dwindle to zero. In terms of months of supply, the Portland housing market can become a buyer’s real estate market if the supply increases to more than five months of inventory.

And that’s not going to happen. In October, the month’s supply of inventory for the Portland metro area dropped to 1.1 Months. Until sellers regain confidence, housing inventory will continue to be constrained during what is expected to be a slow-selling winter season. Due to an unprecedented pandemic situation, we conclude that the Portland housing market would remain a seller’s real estate market. This is also confirmed by the recent forecast given by Zillow which favors sellers.

But do buyers have any advantage? For buyers in Portland, mortgage rates are at their lowest. Therefore, this is a good time for them to enter the market. If buyer demand eases in the coming winter season, we could see a positive influence on the low houisng inventory while at the same time seeing a negative impact on sales. Also, if listings linger on the market for longer, buyers have a special edge in negotiating sales prices.

As a result, Portland homebuyers who enter the market at this should have more options than usual when it comes to choosing a property. So they should take advantage of scooping up their favorite deals which otherwise are taken away by seasoned investors in the bidding wars. Whether you’re looking to buy or sell, timing your local market is an important part of real estate investment.

Real estate market forecasts given in this article are just an educated guess and should not be considered financial advice. Real estate prices are deeply cyclical and much of it is dependent on factors you can’t control. Many variables could potentially impact the value of a home in Portland in 2020 (or any other market) such as big changes in the distressed, new-construction, or luxury home segments. There are also a wide variety of economic and political factors that can and do impact real estate markets. Most of these variables are difficult to predict in advance.

Portland Housing Market 2020 Summary

We shall now do a quick recap of how the Portland housing market has performed in 2020 so far. We shall mainly discuss median home prices, inventory, economy, growth, and neighborhoods, which will help you understand the way the local real estate market moves in this region.

The real estate trends from last year show us that Portland’s hot housing market has been cooling off. The supply of homes remains low by historic standards. Despite the slowdown or cooling off, the home prices are still rising but not like two years back. The price rise has mainly been supported by rising incomes as Portland has seen a lot of job growth.

The Portland housing market in Jan. and Feb. of 2020 was very strong, stronger than most had predicted. We saw an increase in inventory and an even great increase of buyers to purchase. All signs pointed to a Portland real estate market surpassing expectations in 2020 and the first potential signs that the Portland housing market would (soon) end its cooling off session.

The median home prices fell for the first time in nearly 7 years. The year-over-year median home sale price dropped in January 2020 for the first time since February 2012 in metro Portland. The month’s median sale price of $384,900 represented a 1.3 percent decline from a year earlier. It’s been nearly seven years since they fell on an annualized basis.

COVID-19 Pandemic Has Heated Up The Portland Housing Market

The pandemic affected the Portland real estate market as well but the impact was much lesser, and it is on the recovery. Portland’s strong economy kept it from crashing in the crisis. When COVID19 hit Oregon hard in March of 2020 the homebuyer turnout decreased massively. Starting in March, people began losing jobs at an alarming rate. Fewer homes went on the market.

In April, things improved a bit. Buyer activity increased backed by about 40% over the previous month. Portland buyer traffic increased about 40% from March but it was still down about 30% from April of the previous year. Things improved further in May when pending sales and new listings surged in the Portland housing market.

The average sale price in the Portland-area dipped by a mere 0.8% to $467,500 in May compared to April 2020′s $477,400. The median sale price held steady from April ($424,000) to May ($425,000). In May 2020, there was a 2.3 month supply of homes for sale, which was steady with April 2020′s 2.4 month supply but an increase from March 2020′s 1.8 month supply.

Housing prices remained nearly stable but there was a massive drop in homebuyers and available inventory (homes for sale). Both sellers and buyers remained out of the market which led to a decrease in overall real estate activity in the spring season. The latest report for October (give at the top) shows that prices are rising and inventory is declining. There aren’t enough homes on the market to meet the demand increased by the pandemic.

Portland Real Estate Foreclosure Trends

Here are some foreclosure statistics of the Portland real estate market. As per the Portland foreclosure data given by Zillow, in Portland 0.4 homes are foreclosed (per 10,000). This is lower than the Portland-Vancouver-Hillsboro Metro value of 0.8 and also lower than the national value of 1.2.

The percent of delinquent mortgages in Portland is 0.4%, which is lower than the national value of 1.1%. The percent of Portland homeowners underwater on their mortgage is 3.7%, which is higher than Portland-Vancouver-Hillsboro Metro at 3.4%.

There are currently 165 properties in Portland, OR that are in some stage of foreclosure (default, auction, or bank-owned) while the number of homes listed for sale on RealtyTrac is 1,134. In June, the number of properties that received a foreclosure filing in Portland, OR was 400% higher than the previous month and 71% lower than the same time last year.

Currently, the zip code with the highest foreclosure rate is 97218, where 1 in every 5957 housing units is foreclosed. 97206 zip code has the lowest foreclosure rate, where 1 in every 21153 housing units becomes delinquent.

| Potential Foreclosures in Portland | 165 (RealtyTrac) |

| Homes for Sale in Portland | 1134 |

| Recently Sold | 7672 |

| Median List Price | $449,500 (2% rise vs May 2019) |

Portland Real Estate Investment Outlook For 2021

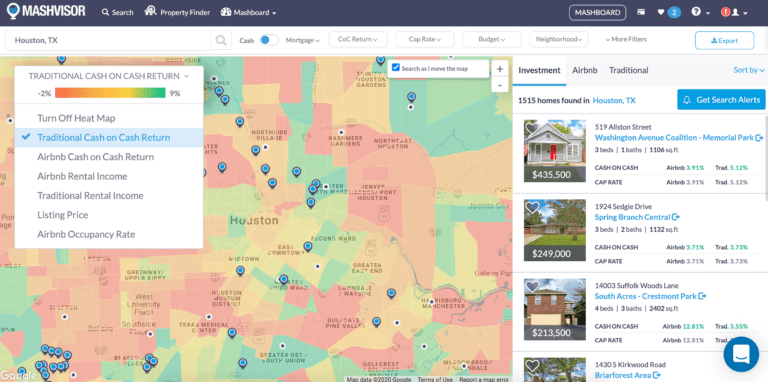

Should you consider Portland real estate investment? Many real estate investors have asked themselves if buying a property in Portland is a good investment? You need to drill deeper into local trends if you want to know what the market holds for the year ahead.

For a long time, we’ve been hearing how the major housing markets in the Pacific Northwest (like Seattle and Portland) have been on fire with fierce competition and limited supply of properties. The question is whether Portland would continue to be one of the hottest markets in the U.S. for real estate investment?

Well, the Portland housing market is currently undergoing some changes. Property appreciation had slowed considerably since 2017 but the pandemic has turned things back to the fast pace of appreciation.

Portland is a very ethnically-diverse large city and home to around 600,000 people. However, the Portland housing market, in reality, includes more than two million people who live in the Portland Metropolitan Area or Greater Portland—comprising Clackamas, Columbia, Multnomah, Washington, and Yamhill Counties in Oregon, and Clark and Skamania Counties in Washington.

The Oregon portion of the metropolitan area is the state’s largest urban center. That makes Portland the second largest city in the Pacific Northwest. The real estate trends from 2017 show us that Portland’s hot housing market has been cooling off. Despite the slowdown or cooling off, the home prices were still rising but not like three years back.

The price rise has mainly been supported by rising incomes as Portland has seen a lot of job growth. The pandemic has heated up the market again. The supply of homes remains low by historic standards. It has reached critically low levels in 2020 leading to a price appreciation forecast of 6-7% in 2021.

Although this article alone is not a comprehensive source to make a final investment decision for Portland, we have collected evidence-based positive things for those who are keen to invest in the Portland real estate market in 2021.

Let’s take a look at the number of positive things going on in the Portland real estate market which can help investors who are keen to buy an investment property in this city. And no, we’re not going to cite things like the TV show “Portlandia” or vague things like “it’s hip and diverse!”

Portland is a “Hot” Real Estate Market for Millennials

One of the major factors driving the Portland real estate market is the fact that the city is hot with Millennials. Nor is it just students coming to Portland driving up prices in the Portland housing market. They want to buy homes in a family-friendly, cultural city, something many cannot afford to do in California.

When a city sees people move there for work, this could include everyone from 25-year-old grads to 50-year-old mid-career professionals. The fact that the Portland real estate market is especially attractive to young adults trying to buy houses, means there will be a strong demographic momentum into the future as they start families, increasing the local population and the odds they’ll stay.

Portland Lacks Room to Grow Which Drives The Home Prices Up

One of the beautiful things about Portland is its proximity to the ocean and the mountains, while much of the area is covered in protected forests. The downside of this is that the city lacks room to grow the way many inland real estate markets do. Developers could tear down older buildings and build skyscrapers, but that’s expensive compared to going five miles down the highway and building a new suburban neighborhood.

Relative to the strong migration and income-driven demand, the supply is lagging in the entire Portland MSA. New housing permits have been among the slowest recovering economic indicators in the Portland MSA after bottoming out in 2012. Not only is the Portland MSA producing new buildings at a relatively slow rate, but also fewer homes are

available for sale than ever before.

The relative lack of room to grow keeps rents high in the Portland real estate market for both residents and commercial firms. While Portland residents complain about the rent, Silicon Valley’s insane rents are pricing firms out of San Francisco Bay Area, and enough have moved north to get the area called Silicon Forest. Google’s moved both people and jobs here.

Other tech firms followed suit, opening offices here, or simply relocated. Increased demand for housing guarantees higher rental rates and property values. Considering the affordability problems in San Francisco and Seattle, Portland’s relative cheapness is leading people to migrate from those cities—which has contributed to the population growth of Portland MSA.

Portland’s Relatively Affordable Housing Market

Work-life balance is better in Portland. An estimated 7% of the population in Portland telecommutes compared to 2.6% nationally. The city’s high walkability score and somewhat better traffic than California’s cities are other pluses, though many love the fact you can bike to work.

Despite the recent surge in home prices, Portland remains among the cheapest major West Coast cities to buy a house. This is partly because home price levels have historically been lower in Portland than its neighbors, but also because Portland’s growth in home prices is average for these cities since 2010.

Places like San Francisco have had significantly higher rates of growth until 2015. With the combination of a strong job market with relatively lower house prices, Oregon, and the Portland MSA has among the nation’s highest rates of in-migration – which in turn increases the demand for housing.

And the music scene and art museums – and the time and money to visit them – and it is no wonder so many Silicon Valley refugees move to Portland. That’s driving up rents and property prices in the Portland real estate market.

Portland’s Strong Economic Factors

Two of the most fundamental economic indicators are employment and income. In terms of home prices, income, and employment indicate whether people can afford current and future increases. A report by Northwest Economic Research Center (NERC) forecasts employment in the Portland MSA will continue its strong recovery until reaching the rate of full-employment indicating that buyers will continue to enter the housing market (assuming home prices are correctly valued).

Portland may have a growing tech sector, but the overall job market is growing rather quickly, too. Oregon experienced the fifth fastest-growing job market in the country between 2017 and 2018. When you look at only private employers, it came in second. Furthermore, most of those jobs are in big cities like Portland.

For example, when you look at logging and mining – traditional rural employers – Oregon only came in 9th in the U.S. This means many people are moving to Portland for work, whether or not they’re in the tech pool. In short, the wide range of jobs and growth in demand for labor are powering the Portland real estate market.

Portland’s Massive Student Market For Rental Property Investment

There are more than three dozen private and public universities within 150 miles of Portland. The University of Oregon and Oregon Institute of Technology both have massive campuses here. Student enrollment for the STEM and IT programs is exploding because graduates are entering the hot tech market created by Silicon Valley refugee firms.

Atlanta Real Estate Market: Prices | Trends | Forecast 2021

This means there is a strong Portland housing market for students in the vicinity of multiple campuses. Compare that to places like College Station, Texas – your property values and rents depend on the attractiveness of the one main school to students.

Portland Rental Market Statistics: The average size for a Portland, OR apartment is 765 square feet. Studio apartments are the smallest and most affordable, 1-bedroom apartments are closer to the average, while 2-bedroom apartments and 3-bedroom apartments offer more generous square footage.

According to RentJunge, as of June 2020, the average rent for an apartment in Portland, OR is $1544 which is a 4.53% decrease from last year when the average rent was $1614, and a 1.42% decrease from last month when the average rent was $1566.

- One-bedroom apartment in Portland rent for $1452 a month on average (a 2.62% decrease from last year).

- Two-bedroom apartment rents average $1704 (a 7.81% decrease from last year).

- The average apartment rent over the prior 6 months in Portland has increased by $100 (6.9%).

- One-bedroom units have increased by $114 (8.5%).

- Two-bedroom apartments have increased by $105 (6.6%).

Note that the decreasing rents are due to a sudden economic slowdown caused by the pandemic this year. Before the impact of the pandemic, the average rent for an apartment in Portland was $1,499, a 1% increase compared to the previous year, according to RENTCafé.

More than 50% of the apartments can be rented for $1,500 or less while about 26% fall in the range of $1,500 t0 $2,000. 48% of the households in Portland, OR are renter-occupied while 51% are owner-occupied. That makes a huge population of renters.

The median rent is close to $2,000 but only 12% of the apartments fall in that price range. The most expensive Portland neighborhoods to rent apartments in are Pearl District, Downtown, and Corbett-Terwilliger-Lair Hill.

Some of the most affordable neighborhoods where the average rent is below $1,500/mo:

- Powellhurst, where the average rent goes for $1,087/month.

- Parkrose, where renters pay $1,107/mo on average.

- Bridlemile, where renters pay $1,153/mo on average.

- Wilkes, where the average rent goes for $1,198/month.

- Center, where the average rent goes for $1,217/month.

- Reed, where renters pay $1,237/mo on average.

Portland’s Better Business Climate

If you ask people and businesses why they relocated to Portland, one answer is the lower cost of living. Oregon is one of only five states in the nation that levies no sales or use tax. State government receipts of personal income and corporate excise taxes are contributed to the State’s General Fund budget, the growth of which is controlled by State law.

Oregon has property tax rates that are nearly in line with national averages. The effective property tax rate in Oregon is 1.04%, while the U.S. average currently stands at 1.08%. Oregon is ranked number fifteen out of the fifty states, in order of the average amount of property taxes collected. It is ranked 16th of the 50 states for property taxes as a percentage of median income.

Oregon’s median income is $73,097 per year. The average home price in Portland Oregon is much lower than the average house costs in nearby cities like Seattle. The median property tax in Oregon is $2,241.00 per year for a home worth the median value of $257,400.00. Counties in Oregon collect an average of 0.87% of a property’s assessed fair market value as property tax per year.

The exact property tax levied depends on the county in Oregon the property is located in. Oregon’s Multnomah County, which encompasses most of the city of Portland, has property taxes near the state average. The county’s average effective tax rate is 1.07%.

To understand why Portland property taxes go up every year nearly regardless of real estate values, let’s take a quick look at how taxes are usually calculated. The standard way is to multiply the value of your home by the property tax rate for your area of the county—which is estimated by county assessors through in-person inspections and comparisons to similar, recently sold homes.

But Oregon’s system of property taxes was modified by a 1997 bill that uncoupled property taxes from the actual value of homes. Now, Oregon pegs the taxable value of a property to its 1995 property values, plus 3 percent a year thereafter. In 2019, we had a cooling real estate market but now the market conditions are neutral amid the pandemic.

That means that your home’s value may stay the same this year, or even go down a little bit, as per the Oregon property taxation system, the value is still going up 3%. In many areas, real home values have risen much faster but the assessed property value still has a long way to go to catch up to them.

The caps have succeeded in keeping property taxes relatively predictable and far lower than if they rose in sync with their home value — the price homeowners could fetch for their house. According to Metro, the current average assessed value of a Portland home is just $231,000.

In 2019, Oregonlive.com ranked Oregon counties by their effective tax rates — the amount of tax imposed per $1,000 of real market value across the entire county. This is an average, and individual homeowners within those counties might have dramatically different rates. Also, These numbers reflect the previous tax year (2018), the most recent for which figures were available from the Oregon Department of Revenue.

Portland metropolitan area comprises Clackamas, Columbia, Multnomah, Washington, and Yamhill Counties in Oregon and Clark and Skamania Counties in Washington.

In Multnomah County, the average tax rate is $20.12 per $1,000 of assessed value, but the average homeowner is taxed $9.87 per $1,000 of real market value.

In Clackamas County, the average tax rate is $16.00 per $1,000 of assessed value, but the average homeowner is taxed $10.60 per $1,000 of real market value.

In Columbia County, the average tax rate is $13.32 per $1,000 of assessed value, but the average homeowner is taxed $9.40 per $1,000 of real market value.

In Washington County, the average tax rate is $17.07 per $1,000 of assessed value, but the average homeowner is taxed $10.88 per $1,000 of real market value.

In Yamhill County, the average tax rate is $15.21 per $1,000 of assessed value, but the average homeowner is taxed $10.52 per $1,000 of real market value.

Caveat: On Nov. 6, 2018, voters approved a million dollar general obligation bond to create affordable housing for approximately 12,000 people in the greater Portland region. The total amount to be raised through property taxes is nearly $653 million over 30 years. Due to this property owners in the tri-county Portland area would pay the bond back through higher property taxes over the next 30 years.

In 2019, property taxes to pay for this bond went up by 24 cents per $1,000 in assessed value for Portland homes in each of the three counties. That comes out to about $60 for a home with an assessed value of $250,000. Although the region’s average home market value is far higher than $250,000, the average home’s assessed value was $231,000 in 2018.

Now coming to its business friendliness, various national surveys put Oregon in the middle of the pack. However, business friendliness is relative. Forbes Magazine came out with an article in mid-2018 describing how California is unsustainable. Infrastructure is crumbling, and they build trains to nowhere instead of roads and dams people need.

It is hard to run a water-dependent industry when they’re rationing water for homeowners soon. We already addressed taxes, but regulations are insane. The new California rule mandating that businesses have at least one woman on the board by the end of 2019 is merely the camel’s nose under the tent; they could start mandating ethnicity-based board membership, union or employee representation on boards and board membership based on sexuality.

A business could try to solve this by going private, or they can move their headquarters to Oregon. It is certainly easier to move a business and team north to Portland where their salaries go further since the Portland real estate market is so much more affordable.

Portland is Relatively Landlord Friendly – For Small Landlords

There’s an interesting situation in the Portland real estate market. If you own a large apartment building, you’ll find the Portland area difficult to manage because it is so tenant-friendly. A small landlord with a single home for rent, though, is in a different category. People buying and renting out a single home in the Portland housing market will have a much easier time.

They don’t have to follow the same rules on renter protection like rental assistance payments if you evict someone without cause (like you’re going to rehab or sell the property). Rental rates for smaller landlords can go up more in accord with market rates instead of being capped around 5%. Regardless of how many properties you own, Portland has only discussed rent control – and seen significant opposition to it.

Portland Investment Properties: Where To Invest?

In any property investment, cash flow is gold. The Portland real estate market is booming because the economy is doing well on its own and the area is head and shoulders above California’s deteriorating situation. The Portland housing market has experienced double-digit annual price growth in recent years.

Home values rose 11.4% in 2016 alone, according to a report from the real estate data company Clear Capital. The home prices in the Portland, Oregon housing market have slowed considerably over the last few months. And that’s a good thing, from a sustainability standpoint.

Good cash flow from Portland investment property means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding the best investment property in Portland in a growing neighborhood would be key to your success. If you invest wisely in Portland’s real estate, you could secure your future.

The less expensive the Portland investment property is, the lower your ongoing expenses will be. When looking for the best real estate investments in Portland, you should focus on neighborhoods with relatively high population density and employment growth. Both of them translate into high demand for housing.

The neighborhoods should be close to basic amenities, public services, schools, and shopping malls. A cheaper neighborhood in Portland might not be the best place to live in. A cheaper neighborhood should be determined by these factors – Overall Cost Of Living, Rent To Income Ratio, and Median Home Value To Income Ratio. It depends on how much you are looking to spend and if you are wanting smaller investment properties or larger deals in Class A neighborhoods.

Portland home prices are some of the most expensive in all of the United States. According to Realtor.com, there are 83 neighborhoods in Portland. Southwest Hills has a median listing price of $995K, making it the most expensive neighborhood. Powellhurst-Gilbert is the most affordable neighborhood, with a median listing price of $340K. Centennial is also an affordable neighborhood having a median listing price of $339,000.

Some of the most popular neighborhoods in Portland are Bethany, Southwest Hills, Hazelwood, Multnomah Village, Raleigh Hills, St. Johns, Eastmoreland, Lake Oswego, Laurelhurst, Downtown Portland, Tigard, Alameda, Cedar Hills, Montavilla, Hillsdale, Lents, Woodstock, and Kenton.

We recommend taking the help of the local real estate agents to find neighborhoods with an affordable entry price of homes, high appreciation forecast, and growing rent prices so that as an investor you can enjoy positive cash flow and nice profits. If housing supply meets housing demand, investors should not miss the opportunity since entry prices of homes remain affordable. Find neighborhoods that are most popular among renters.

Here are some of the best neighborhoods for buying Portland investment properties.

Portland’s Downtown is the most popular neighborhood for renters. Portland’s compact, walkable downtown offers easy access to great food, green spaces, cultural offerings, and tax-free shopping. It has everything residents could need or want. According to RentCafe, downtown rents are lower than those in some of the more upscale neighborhoods in the city but the average apartment rate still hovers around $1,656, above Portland’s $1,431 average.

Goose Hollow is a neighborhood in southwest Portland, and it borders both the downtown area and Washington Park. Niche.com ranks it #6 in the list of “Best Neighborhoods to Live in Portland.” Living in Goose Hollow offers residents a dense urban feel and most residents rent their homes. There are a lot of bars, restaurants, coffee shops, and parks. Goose

It has a mixture of beautiful historic buildings and modern condos, plus a tried-and-true hub for sports fanatics and college students alike. The public schools are also highly rated. The median list price per square foot in Goose Hollow is $356, which is higher than the Portland average of $288. Apartments here go for $1,657 on average and the share of renters is about 67%.

University Park is another great neighborhood in Portland for investing in rental properties due to a large student population. It is located in North Portland and is bordered by Linton, Cathedral Park, and St. Johns neighborhoods. University Park is home to one of the oldest schools in the area. There are beautiful homes and buildings and old-growth trees that make this a stunning neighborhood as well. It’s an excellent location for those looking to get away from the hustle and bustle of Portland.

According to Realestateagentpdx.com, homes in this neighborhood are more modest than in many other parts of the city, have fewer improvements, and are often cited as being among the least affordable locations in the city. Perfect for first-time homebuyers. The median home value in University Park is $474,950 (Zillow), and home values have gone up 1.4% over the past year.

Pearl District is expensive or a high-end area but the population of renters is more than 70%. It is Portland’s most desirable neighborhoods with virtually no crime. It features galleries and cultural institutions, as well as stylish shops and acclaimed eateries. It is Portland’s top shopping destinations. As the neighborhood is the priciest in the city, the apartments here rent for $1,911 on average, according to RentCafe. The median list price per square foot in Pearl District is $520 (Zillow), which is higher than the Portland average of $288.

St. Johns is one of the most popular neighborhoods in Portland for nature-lovers. It is a nature lover’s paradise, located in North Portland, on the western tip of the peninsula formed by the convergence of the Willamette and Columbia Rivers. St. Johns is described by locals as “extremely friendly.” It has several parks including Cathedral Park, Columbia Slough, Kelley Point Park, and Smith and Bybee Wetlands. All are within walking distance for residents. Like much of Portland, this is also an up-and-coming neighborhood that it’s still developing,

The median home value in St.Johns is $375,730 (Zillow), and home values have gone up 2.1% over the past year. The median list price per square foot in St.Johns is $258, which is lower than the Portland average of $288. The average rent in St. Johns is $1,359 (RentCafe), below both the national and city averages.

Here are the ten neighborhoods in Portland having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- N Williams Ave / N Alberta St

- N Killingsworth St / N Interstate Ave

- SW Naito Pky / W Burnside St

- N Vancouver Ave / N Beech St

- N Lombard St / N Interstate Ave

- N Ainsworth St / N Interstate Ave

- N Interstate Ave / N Going St

- NE 15th Ave / NE Alberta St

- Piedmont

- N Vancouver Ave / N Lombard St

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Portland.

Consult with one of the investment counselors who can help build you a custom portfolio of Portland turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Portland.

Not just limited to Portland or Oregon but you can also invest in some of the best real estate markets in the United States. All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete Portland turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

Apart from Portland, you can also invest in many other real estate markets which are equally good for investors. Bend is a small city in Oregon. It is nestled on the edge of the Cascade Range and the shore of the Deschutes River. It is a verdant spot in the High Desert. It sounds like a wonderful place to visit. Home prices in the Bend real estate market have gone up by 5.7% over the past year. The median home value is $475,132.

Oregon is bounded to the north by Washington state, from which it receives the waters of the Columbia River; to the east by Idaho, more than half the border with which is formed by the winding Snake River and Hells Canyon; to the south by Nevada and California.

If you head to the south, go for the Las Vegas real estate market. It is as hot as the desert heat in Nevada. Las Vegas is in the top 10% nationally for real estate appreciation. Las Vegas real estate has appreciated by 99.29% over the last 10 years. The Las Vegas real estate market is entirely brimming with new businesses. It isn’t just about casinos, medicine is a growing industry as well.

The University of Las Vegas and Zappo’s, the internet shoe store, is also based in Vegas. Its friendly business environment is propping up the economy and helping towards the positive Las Vegas real estate trends. The new businesses are propping up at a much faster rate than the national average.

Investing in a Las Vegas Property is a great option as Las Vegas has very low investment property taxes and no personal income tax. The average effective property tax in Las Vegas (Clark County) is 0.70%, slightly higher than the statewide average, but still significantly lower than the national average. The state’s average effective property tax rate is just 0.69%, which is well below the national average of 1.08%.

If you choose the nearby state of Washington, then we’d recommend the Spokane real estate market. Spokane is the second-largest city in Washington State. It is sited on the Spokane River in the foothills of the Rocky Mountains. The population of Spokane is around two hundred thousand.

However, the Spokane real estate market includes the broader metropolitan area that is home to nearly 600,000 people. There is a high housing demand in the market and the current supply equals 1.2 months. The median home value in Spokane is $264,212 and home values have gone up 13.1% over the past year.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

Is It The Right Time To Invest In Real Estate? – The national homeownership rate is on the decline for the first time since 2017. As demographics change and baby boomers retire, you’re seeing Millennials who may not be ready to buy houses. In 2018, Millennials made up about 22 percent of the population in the United States. They’re choosing to rent over buying a single-family home or an apartment. Rising home prices and shortage of starter homes have not left Millennials many choices but to delay homeownership. Moreover, it’s even harder to take out a mortgage for those who have student loan debt.

Let us know which housing markets you consider hot for real estate investing?

Please do not make any real estate or financial decisions based solely on the information found within this article. Some of the information contained in this article was pulled from third party sites mentioned under references. Although the information is believed to be reliable, Norada Real Estate Investments makes no representations, warranties, or guarantees, either express or implied, as to whether the information presented is accurate, reliable, or current. All information presented should be independently verified through the references given below. As a general policy, the Norada Real Estate Investments makes no claims or assertions about the future housing market conditions across the US. This article aimed to educate investors who are keen to invest in Portland real estate. Purchasing an investment property requires a lot of studies, planning, and budgeting. Not all deals are solid investments. We always recommend doing your research and take the help of a real estate investment counselor.

References:

Market Data, Reports & Forecasts

https://pmar.org/shareables/

https://www.oregonlive.com/

https://realestateagentpdx.com/category/portland-real-estate-market-news

https://www.littlebighomes.com/real-estate-portland-or.html

https://www.realtor.com/realestateandhomes-search/Portland_OR/overview

Impact of Covid-19 & Recovery

https://realestateagentpdx.com/portland-real-estate-market-spring-2020-covid-19-update/17320

https://www.oregonlive.com/realestate/2020/06/portland-area-housing-market-pending-sales-new-listings-surge-in-may.html

Rental Statistics for apartments

https://www.rentcafe.com/average-rent-market-trends/us/or/portland/

https://www.rentjungle.com/average-rent-in-portland-or-rent-trends/

Best Neighborhoods

https://www.neighborhoodscout.com/or/portland/real-estate

https://www.rentjungle.com/portland-or-apartments-and-houses-for-rent/

https://www.rentcafe.com/blog/apartment-search-2/neighborhood-guides/portlands-best-neighborhoods-for-renters/

Foreclosures

https://www.realtytrac.com/statsandtrends/or/multnomah-county/portland

Oregon Tax Rates & Way of Computing

http://www.tax-rates.org/oregon/property-tax

https://smartasset.com/taxes/oregon-property-tax-calculator

https://realestateagentpdx.com/portland-property-taxes-to-rise-in-2020/16247

https://www.oregonlive.com/news/erry-2018/10/7273fa75401636/property-tax-rates-in-oregons.html

Top Reasons to Invest in Portland

https://www.entrepreneur.com/article/273822

https://www.oregonbusiness.com/article/item/16045-is-oregon-good-for-business

https://www.cnbc.com/2015/05/14/water-millennials-drive-portland-oregon-housing.html

https://www.oregonlive.com/politics/index.ssf/2017/02/portlands_tina_kotek_explains.html

https://www.oregonlive.com/portland/index.ssf/2014/07/how_friendly_is_oregon_portlan.html

https://www.pdx.edu/nerc/sites/www.pdx.edu.nerc/files/The%20State%20of%20the%20Portland%20Housing%20Market.pdf

https://www.business2community.com/brandviews/upwork/why-silicon-valley-techies-are-rushing-to-the-pacific-northwest-02076366

https://www.forbes.com/sites/thomasdelbeccaro/2018/04/19/the-top-four-reasons-california-is-unsustainable/#6f1366cd3a23

https://www.portlandmercury.com/news/2018/01/24/19626335/portlands-small-time-landlords-dont-have-to-follow-renter-protections

Dallas Real Estate Market: Prices | Trends | Forecast 2021

Recent Comments