How to Rent Your House: The 8-Step Guide to Success

How to Make an Offer on a House That Is Overpriced

Not every landlord is in the rental property business by choice. Some become accidental landlords due to different reasons. Here are some of the situations which could cause you to become an accidental landlord:

- You’re relocating and can’t sell your home – You might be in a situation where you have to move due to family, work, or other circumstances beyond your control. If your home stays on the market for too long, then it might be wiser to rent it out instead of leaving it vacant.

- You’ve inherited a house – Homes come with a lot of emotional ties and memories. If the thought of selling an inherited property is too much, renting it out could be an ideal solution. However, you need to keep in mind the tax implications that come with an inherited home such as property taxes, inheritance taxes, and even estate taxes.

- You have extra space – If your house has a spare bedroom, you might consider finding a roommate or renting it out on Airbnb. The extra income could help pay off your mortgage faster or cover other residential expenses.

Whatever the circumstances, before you become a landlord, you need to learn how to rent your house in a proper and profitable way. While owning a rental property can be a great way to make money, it can also be very stressful and result in losses if not done correctly.

To help those accidental landlords out there, we’ve put together this 8-step guide to success when renting out a house.

How to Rent Your House in 8 Simple Steps

Here are the steps for renting a house successfully:

1. Understand Zoning Laws

You cannot talk about learning how to rent your house without mentioning zoning laws. Zoning refers to local or municipal regulations or laws that determine how a property can and cannot be used in a specific geographic area. For instance, some zoning laws will not allow you to rent your house on Airbnb. If you break any of these laws, you could be slapped with a fine or even be legally prosecuted. You must therefore take time to research the local zoning laws before making any decision concerning your rental. Remember that these laws can be changed at any time by the local government, so you should also keep up to date.

2. Crunch the Numbers

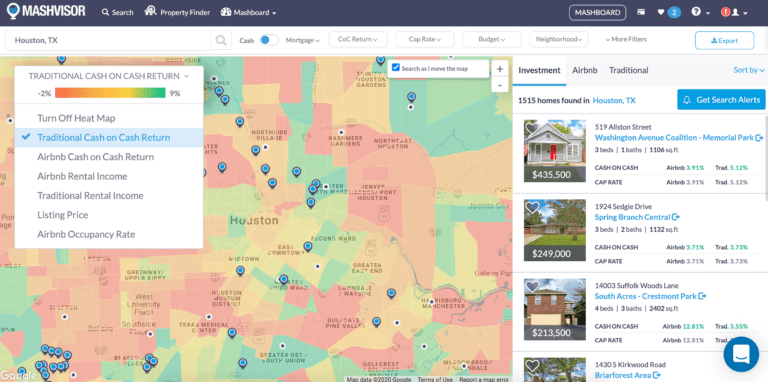

Before you rent out your house, find out the average return on investment for a rental property in the area where your home is located. The best way of doing this is by visiting Mashvisor’s Neighborhood Analytics Page for your neighborhood. Simply type in the name of your city and click on the name of your neighborhood on the real estate heatmap to reach the Neighborhood Analytics Page. There, you’ll find all kinds of valuable metrics, including:

- Median Property Price

- Average Traditional and Airbnb Cash on Cash Return

- Average Traditional and Airbnb Rental Income

- Airbnb Occupancy Rate

Mashvisor Neighborhood Analytics Page

Related: Neighborhood Analysis in Real Estate Investing

This info will help you conduct a quick rental market analysis (which usually takes weeks to complete) to determine if rental properties are profitable in your area as well as what rental strategy might work best for your area. As you will see, traditional rentals and Airbnb rentals provide drastically different rate of return within the same market.

When crunching the numbers in preparation to rent our your house, another important tool is Mashvisor’s investment property calculator. Also referred to as the rental property calculator, this tool estimates the expected rental income, ongoing monthly expenses, and gains from an investment property. A few key numbers generated by this real estate investment tool include cash flow, capitalization rate, and cash on cash return. In addition, the calculator will show you rental comps and suggest the best rental strategy to pursue based on traditional and Airbnb data. The metrics generated will also give you an idea of how much to charge for your rental property.

Sign Up for Mashvisor

With regards to market coverage, you can quickly and easily analyze the rental income potential of any residential property in the US market by entering the address. Our real estate investment software platform is not limited to MLS listings and foreclosures only.

Multifamily Syndication: The Beginner Real Estate Investor’s Guide

To try the power of Mashvisor yourself, sign up for a 7-day free trial now.

3. Prepare the Rental for Tenants

Once you get familiar with the zoning laws and possible returns, you can now start preparing your rental property for tenants. This could include fixing any known issues and upgrading the home to make it more aesthetically pleasing. Here is a list of what you could do to get your investment property rent ready:

- Test carbon dioxide detectors and smoke detectors

- Give the walls a fresh coat of paint

- Check all appliances and ensure that they are working

- Clean or replace the flooring

- Repair any problems such as pests, water leaks, holes in the roof, etc.

- Hire a professional to ascertain that all plumbing, heating, and electricity is working well

- Ensure that all windows, gates, and doors have working locks

- Landscape the front and back yards

- Get rid of any bad smells

- Clean all rooms thoroughly

4. Get Property Insurance

While home insurance might not be a must, you should not even think about renting out a property before getting it insured. It’s no secret that tenants – and even more so Airbnb guests – come with extra wear and tear which can easily turn a perfectly positive cash flow property into a negative cash flow one. In brief, property insurance will protect you against loss of or damage to your rental property. Such policies typically cover things that are ‘sudden or accidental’ such as:

- Windstorm or hail

- Fire or lightning

- Theft

- Explosion

- Vandalism or malicious theft

- Volcanic eruption

- Damage caused by vehicles or aircraft

5. Prepare a Lease Agreement

The next in the process of how to rent your house successfully is to prepare a written lease agreement. The lease agreement should outline the rental policies that tenants are expected to adhere to. This includes policies about pets, maintenance of common areas, unacceptable behavior, and late rentamong others. The lease term, also stipulated in the rental agreement, could be a fixed-term tenancy or an automatic renewal lease term. It is crucial that you get a lawyer to look at the lease agreement before using it. This will ensure that the legal document is valid when you might need to stand up in court.

Related: 9 Things Every Tenancy Agreement Should Include

6. Find Tenants

You can market your vacancy for free on rental sites such as Craigslist, Cozy, Trulia, Hotpads, Doorsteps, and Avail. Social media platforms like the Facebook Marketplace can also be very effective for attracting tenants. However, don’t overlook traditional rental marketing strategies like a yard sign, newspaper ads, local bulletin boards, and word of mouth.

Though it is possible to rent your house yourself without an agent, working with an agent could make your work much easier and faster. Keep in mind that in real estate investing, vacancy is equivalent to losing money. Besides getting your property listed by an agent working with tenants can save you the hassle that comes with handling potential tenants yourself.

7. Screen Prospective Tenants

Before allowing anyone to live in your rental property, you must do your due diligence. Here are some of the things you should check on when screening potential tenants:

- Employment (with proof such as pay stubs)

- Gross monthly income

- Credit score

- References from previous landlords

- Any history of crime

However, during the screening process, be sure not to violate the Fair Housing Act. This is a law that prohibits landlords from discriminating against tenants based on religion, race, sex, disability, or age.

Related: How to Screen Tenants for a Rental Property: 7 Steps

8. Sign the Lease Agreement

Once you’ve found the ideal tenant, it is time to sign the lease agreement. Give the tenant one copy of the signed document and retain a copy for your records.

Conclusion

The work of a landlord doesn’t finish with renting out the house. Managing a rental property can be a very time-consuming and stressful affair. If you need help with how to rent your house, consider hesitate to hire a property manager. This professional will handle everything from advertising the rental and finding and screening tenants, through preparing lease documents and record keeping, all the way to arranging for repairs and maintenance and handling move-in and move-out. Though you will pay a fee for the services, it is worth the money.

Meanwhile, to get access to the Mashvisor rental property analysis platform to ensure that you end up with positive cash flow, sign up now with a 15% discount.

Start Your Investment Property Search!

Investor ToolsLandlordRental ManagementRental Strategies

2021 Price to Rent Ratio in the US Housing Market: What Should Investors Expect?

Recent Comments