Chicago Real Estate Market: Prices | Trends | Forecast 2021

Boise Real Estate Market Trends & Investment Overview

Housing data by Illinois REALTORS®. The forecast is an estimate based on data from multiple sources. While it is deemed reliable, it is not guaranteed.

We shall discuss the latest Chicago housing market trends and forecasts. Let’s first take a look at the statewide data released by Illinois REALTORS®. December is normally one of the slowest months of the year but strong buyer demand boosted by low-interest rates continues to drive prices and sales up. The Illinois housing market performed well in December with a surge in home sales and higher median prices.

The statewide home sales and prices were higher not just in December, but for 2020 as a whole. Statewide year-end 2020 home sales totaled 172,394, up 9.6 percent from 157,268 in 2019. The year-end 2020 median price reached $225,000, up 7.7 percent from $209,000 in 2019. Months Supply of Inventory in 2020 was 2.0, a decline of – 44.4% from the previous year.

Both median prices and sales experienced a positive annual change in the Chicago housing market as well. In the Metro Chicago Housing Market, which comprises the nine counties, the number of homes sold in the metro area during the year rose by 8.8 percent in 2020, to 120,256 sales. That’s the highest since 2012, according to the Illinois Realtors market report released in December.

Months Supply of Inventory in 2020 for the metro area was 1.8, a decline of – 45.5% from the previous year. This shows that it was a strong seller’s market in 2020. A seller’s market arises when demand exceeds supply. In other words, there are many interested buyers, but the real estate inventory is low. With continued record low-interest rates, there’s an increase in demand for properties as indicated by the year-over-year increase in closed sales of all properties.

In a seller’s market, real estate prices increase. The median home sale price in December 2020 was $266,250 in the Chicago Metro Area, an increase of 12.3 percent from $237,000 in December 2019. The year-end 2020 median price reached $268,000, up 8.1 percent from $248,000 in 2019.

Source: Illinoisrealtors.org

Source: Illinoisrealtors.org

City of Chicago Housing market Trends

The median price of a home in the city of Chicago in December 2020 was $307,500, up 11.4 percent compared to December 2019 when it was $276,000. The year-end 2020 median price reached $316,000, up 7.1 percent from $295,000 in 2019. Sales of both single-family homes and condos surged in December. Here’s the Months Supply of Inventory is 3.4, which is comparatively better than the metro area. If inventory levels are around 6 months, it is a balanced housing market.

Realtor.com’s latest report shows that in December 2020, the median list price of homes in Chicago, IL was $349.6K, trending up 9.3% year-over-year. The median listing price per square foot was $257. The median sale price was $304.4K — Homes in Chicago, IL sold for 1.8% below the asking price on average in December 2020. On average, homes in Chicago, IL sell after 72 days on the market. The trend for median days on market in Chicago, IL has gone up since last month, and slightly down since last year.

All these trends show that Chicago home prices are on the rise due to a very tight supply and low mortgage rates. More homebuyers are entering the bidding wars to scoop up their favorite deals. According to local realtors, the housing market will remain hot even when the weather is cooling. Stronger buyer activity will continue with speedy sales and multiple offers leading to price gains.

Chicago Metro Housing Market Report For December 2020

Below is the latest report of the “Chicago Housing Market.” The source of this report is the Illinois REALTORS® and the counties included are Cook, DeKalb, DuPage, Grundy, Kane, Kendall, Lake, McHenry, and Will. The report compares the Chicago metro and the city’s housing metrics from Dec 2020 with Dec 2019.

| Chicago Metro Area | City of Chicago |

| Closed Sales in the Chicago Metro Area were up by +32.0% to 10,530. | Closed Sales in the City of Chicago were up by +17.3% to 2,220. |

| In November, Closed Sales were up +33.3% year over year. | In November, Closed Sales were up by + 20.3% year over year. |

| Median Sales Price increased by +12.3% to $266,250. | Median Sales Price jumped by +11.4% to $307,500. |

| Inventory of Homes for Sale dropped by – 36.8% to 19,219. | Days on Market Until Sale dropped by – 19.1% to 38. |

| Days on Market Until Sale decreased by – 27.1% to 35. | Inventory of Homes for Sale increased by + 0.2% to 7,594. |

Courtesy of llinoisrealtors.org

Courtesy of llinoisrealtors.org

Chicago Real Estate Market Forecast 2021 (Updated)

The Chicago housing market is shaping up to continue the trend of the last few years as one of the hottest markets in the United States. It is also one of the hottest real estate markets for investing in rental properties. What are the Chicago real estate market predictions for 2021?

In 2018, the Chicago real estate appreciation rate was running at about half the national rate; at a 3 percent range when the nation was at 6 percent. After cooling off, Chicago became the weakest housing market of 2019. The home prices grew by a mere 1.5 percent, lagging behind the nation.

Let us look at the price trends recorded by Zillow over the past few years. Since 2012, Chicago home values have increased from $190,000 to $278,816 — that’s an appreciation of nearly 47%. As you can see in the graph, the Chicago housing market was weak in 2019, essentially flat.

Similar growth has been recorded by NeighborhoodScout.com. Their data shows that over the last ten years the Chicago annual appreciation rate has been averaging at 2.30% — near the national average.

During the latest twelve months, the Chicago appreciation rate was 2.48%, and in the latest quarter, the appreciation rate was 0.04%, which annualizes to a rate of 0.15%. This figure is very less than Zillow’s positive forecast, which predicts that home prices in this region are expected to increase by at least 6-7% in the next twelve months.

The price forecast presented by the University of Illinois to Illinois Realtors indicates positive annual growth for January, February, and March in both Illinois and the Chicago PMSA. The median price forecast for Chicago MSA is 13.6% in January, 12.6% in February, and 9.5% in March.

Here is Zillow’s housing forecast for Chicago, Cook County, and Chicago MSA until September of 2021. Chicago is expected to see strong home price gains in 2021.

The typical value of homes in Chicago is $278,816 (seasonally adjusted and only includes the middle price tier of homes). In Cook Couty, it is $266,504 and in the Chicago-Naperville-Elgin Metro, it is $253,512.

- Chicago home values have gone up 4.1% over the past year and the latest forecast is that they will rise 6.7% in the next year.

- Cook County home values have gone up 2.9% over the past year and the latest forecast is that they will rise 6.5% in the next year.

- Chicago-Naperville-Elgin Metro home values have gone up 3.1% over the past year and Zillow predicts they will rise 5.3% in the next twelve months.

The chart below, created by Zillow, shows the growth of median home values since 2011 and their forecast until September 2021.

Courtesy of Zillow.com

Courtesy of Zillow.com

Here is another short and crisp housing market forecast for Chicago MSA for the 3 years ending with the 3rd Quarter of 2021.

- The accuracy of this forecast for Chicago is 84% and it is predicting positive growth in Chicago home values.

- LittleBigHomes.com estimates that the probability of rising home prices in Chicago-Naperville-Arlington Heights, IL is 84% during this period.

- If this price forecast is correct, the home values in Chicago MSA will be higher in the 3rd Quarter of 2021 than they were in the 3rd Quarter of 2018.

- The highest annual change in the value of houses was 21% in the twelve months ended with the 2nd Quarter of 1977.

- The worst annual change in home values in the Chicago Market was -11% in the twelve months ended with the 1st Quarter of 2010.

- The highest growth in home values in the Chicago MSA over a three year period was 35% in the three years ended with the 2nd Quarter of 1989.

- The worst performance over a three year period in the Chicago Market was -23% in the three years ended with the 2nd Quarter of 2011.

The question now is what happens moving forward. Is Chicago is going to remain a seller’s real estate market amid the ongoing Coronavirus pandemic, which no one knows when is going to end? These numbers can be positive or negative depending on which side of the fence you are — Buyer or Seller?

While many have lost jobs, making them ineligible for a home mortgage, some sellers have taken their homes off the market. As expected by many analysts, prices have declined much less than sales, and forecasts point to slightly positive price increases over the next few months in Chicago.

The Illinois Department of Employment Security (IDES) announced that the unemployment rate increased +0.7 percentage point to 7.6 percent, while nonfarm payrolls were nearly unchanged, down -2,500 jobs in December, based on preliminary data provided by the U.S. Bureau of Labor Statistics (BLS) and released by IDES. The Illinois unemployment rate was up +3.9 percentage points from a year ago when it was 3.7 percent.

The November monthly change in payrolls was revised from the preliminary report, from -20,000 to -16,200 jobs. The November unemployment rate was unchanged from the preliminary report, holding at 6.9 percent. The state’s unemployment rate was +0.9 percentage point higher than the national unemployment rate reported for December, which was 6.7 percent, unchanged from the previous month.

The three industry sectors with the largest over-the-month gains in employment were: Professional and Business Services (+13,000), Trade, Transportation and Utilities (+10,100), and Construction (+8,300). The industry sectors that reported the monthly payroll declines were: Leisure and Hospitality (-40,900), Information (-1,300), and Other Services (-800).

The good thing for the real estate industry is that it is adapting to the current environment by conducting business using technologies such as virtual showings and e-signing to help buyers and sellers with their housing needs in the face of these challenges. Sellers, brokers, and homebuyers seem to be adjusting to restrictions imposed on the real estate industry because of the coronavirus pandemic.

Home sales have been climbing to the highest level in recent years as buyers moved quickly to snap up available homes amid historically low-interest rates. In a balanced real estate market, it would take about five to six months for the supply to dwindle to zero. In terms of months of supply, Chicago can become a buyer’s real estate market if the supply increases to more than five months of inventory.

And that’s not going to happen. This housing market is skewed to sellers due to a persistent imbalance in supply and demand. The sales forecast for January, February, and March suggests an increase on a yearly basis and a decrease on a monthly basis for both Illinois and the Chicago PMSA.

Annually for Illinois, the three-month average forecasts point to an increase in the range 17.1% to 23.2%; the comparative figures for the Chicago PMSA are an increase in the range 21.6% to 29.2%. On a monthly basis, the three-month average sales are forecast to decrease in the range -1.9% to -2.5% for Illinois and decrease in the range -1.3% to -1.8% for the Chicago PMSA.

For buyers in Chicago, the mortgage rates are at their lowest. Most buyers are driven by record-low mortgage rates, are eager to get into an increasingly competitive market to find their dream home. More home sellers listing their properties on the market. So what does that mean? Buyers have more options, and rates are insanely low.

Unless they have personal or financial reasons to hold off, now is a great time to buy a property in the Chicago housing market. With sales prices up and interest rates still low, buyers who are on the fence should make their move. Currently, the inventory remains relatively higher in the city of Chicago. Buyers may be in a better position to negotiate a deal and bring that seller down to a more workable price.

Please do not make any real estate or financial decisions based solely on the information found within this article. Real estate market forecasts given in this article are just an educated guess and should not be considered financial advice. Many variables could potentially impact the value of a home in Chicago in 2020 (or any other market) and some of these variables are impossible to predict in advance. Real estate prices are deeply cyclical and much of it is dependent on factors you can’t control.

Chicago Housing Market 2020 Summary: Prices And Trends

We shall now do a quick recap of how the Chicago housing market performed in 2020. We shall mainly discuss median home prices, inventory, economy, growth, and neighborhoods, which will help you understand the way the local real estate market moves in this region.

Chicago is the 6th most walkable city in the nation. Chicago metro area has a population of approximately 8,865,000, a 0.03% increase from 2019. It is the most populous city in the U.S. state of Illinois, and the third-most-populous city in the United States.

Chicago has a mixture of owner-occupied and renter-occupied housing units. According to Neighborhoodscout.com, a real estate data provider, one and two-bedroom large apartment complexes are the most common housing units in Chicago. Other types of housing that are prevalent in Chicago include single-family detached homes, duplexes, rowhouses, and homes converted to apartments.

Single-family detached homes account for roughly 25.98% of Chicago’s housing units. Chicago has been one of the hottest real estate markets in the country for many years. In the past ten years, the annual Chicago real estate appreciation rate has amounted to 4.40%, according to NeighborhoodScout.com. Chicago metropolitan area or Chicagoland is an area that includes the city of Chicago and its suburbs.

The median home price in Chicago rose 9.2% year-over-year to $338,500 in April. The rolling 12-month median, which considers the whole year of sales up until April 30th, was $299,900, up 4.3 percent. The City of Chicago saw 2,039 homes sell in April – a steep 21.4% drop since last April.

Impact of COVID-19 on The Chicago Housing Market

The impact of the COVID-19 pandemic was evident in April and May, driving Chicago home sales and inventory lower even though median prices remained pretty much stable. Data from the Chicago Association of Realtors showed fewer buyers were willing to purchase a home from late March through mid-April.

Roughly 330 residential properties went into contract in each of the three weeks before April 18 compared to 674 homes that went into contract for the week ending March 7, before the falloff. New listings also declined by almost 50 percent. 588 homes hit the market in each of the three weeks before April 18.

That compared to 1,313 new listings that went on the market in the first week of March. COVID-19 and a stay-at-home order continued to have a significant effect on the Chicago housing market in May, disrupting spring home sales and driving down available inventory for buyers.

Home sales in May declined at a steeper rate than in April. However, the median price of homes sold was higher than the corresponding period in 2019. May 2020 data from Illinois REALTORS® shows that in the nine-county Chicago Metro Area, home sales (single-family and condominiums) there was a sharp decline in closed sales and inventory due to stay at home order.

Prices, however, remained steady from last year – a good indicator. Home sales totaled 7,710, down 37.3 percent from May 2019 sales of 12,291 homes. The median price in May was $260,000 in the Chicago Metro Area, an increase of 0.2 percent from $259,500 in May 2019.

The City of Chicago Market Snapshot represents the residential real estate activity within the 77 officially defined Chicago community areas as provided by the Chicago Association of REALTORS®.

- In May 2020, 1,679 properties were sold in the City of Chicago.

- This was a 43.1% decrease from May 2019.

- The median sales price in the City of Chicago for May 2020 was $312,500, down 0.8% from this time last year.

- The City of Chicago saw listings average 83 days on the market until contract, a 13.7% increase from May 2019.

- The City of Chicago’s housing inventory was down 22.1%, from 10,022 homes in May 2019 to 7,811 homes in May 2020.

- The month’s supply of inventory declined 15.2%, from 4.6 in May 2019 to 3.9 in May 2020.

Data by Illinois REALTORS® shows that home sales in Chicago Metro Area (single-family and condominiums) in July totaled 13,261, up 12.0 percent from July 2019 sales of 11,841 homes. The median price in July was $277,000 in the Chicago Metro Area, an increase of 6.9 percent from $259,000 in July 2019. Chicago prices continued their modest upward trend month over month.

The city of Chicago saw year-over-year home sales increase 0.6 percent with 2,725 sales in July, compared to 2,708 a year ago. The median price of a home in the city of Chicago in July was $330,000, up 7.5 percent from July 2019.

The Chicago market was hot in August as homebuyers took advantage of record-low mortgage rates. The metro area recorded positive month-to-month and year-over-year increases in both prices and sales.

Home sales (single-family and condominiums) in August totaled 13,360, up 19.6 percent from August 2019 sales of 11,169 homes. The median price in August was $280,000 in the Chicago Metro Area, an increase of 11.6 percent from $251,000 in August 2019.

The city of Chicago saw year-over-year home sales increase 8.2 percent with 2,813 sales in August, compared to 2,601 a year ago. The median price of a home in the city of Chicago in August was $335,000, up 15.6 percent from August 2019.

Courtesy of Ilinoisrealtors.org

Courtesy of Ilinoisrealtors.org

The latest report for December 2020 (give at the top) shows that prices are rising and inventory is declining. There aren’t enough homes on the market to meet the demand increased by the pandemic.

Chicago Real Estate Foreclosure Trends

Here are some of the foreclosure statistics of the Chicago real estate market. There are 2,996 properties in Chicago, IL that are in some stage of foreclosure (default, auction, or bank-owned) while the number of homes listed for sale on RealtyTrac is 6,918. In August, the number of properties that received a foreclosure filing in Chicago, IL was 6% lower than the previous month and 88% lower than the same time last year.

Currently, the zip code with the highest foreclosure rate is 60633, where 1 in every 2655 housing units is foreclosed. So, you’d find a lot of distressed sellers in this area and get some discounted off-market deals. 60637 zip code has the lowest foreclosure rate, where 1 in every 4884 housing units becomes delinquent.

| Potential Foreclosures in Chicago | 2996 (RealtyTrac as of Aug 2020) |

| Homes for Sale in Chicago | 6918 |

| Recently Sold | 12,105 |

| Median List Price | $349,888 (1% rise vs July 2019) |

Chicago Real Estate Investment: Should You Invest or Not?

Is Chicago a Good Place Real Estate Investment? You need to drill deeper into local trends if you want to know what the market holds for the year ahead. We have already discussed the Chicago housing market 2020 forecast for answers on why to put resources into this market. Chicago is a strong renter’s market. Over 50% of the population rents in this city.

So if you buy a Chicago real estate investment to use as a rental property, you could benefit in this market. Although the recent population loss has been a concern for real estate investors, Chicago is still the most populous city in the Midwestern United States. About three million people live in Chicago and another ten million in the surrounding metro area. Chicago MSA is the third-largest metropolitan area in the U.S.

It has a large population, a diverse economy, and a stable market. It is home to 32 Fortune 500 companies, with a very high private sector employment. Chicago’s 58 million domestic and international visitors in 2018 made it the second most visited city in the nation, as compared with New York City’s 65 million visitors in 2018. These are just some of the highlights that make Chicago a great place to live and invest in real estate. The list can go on and on. Chicago is also a major world financial center, having the second-largest central business district in the United States.

Los Angeles Real Estate Market & Investment Overview 2021

| Top Reasons To Invest In The Chicago Real Estate Market? | |

|

|

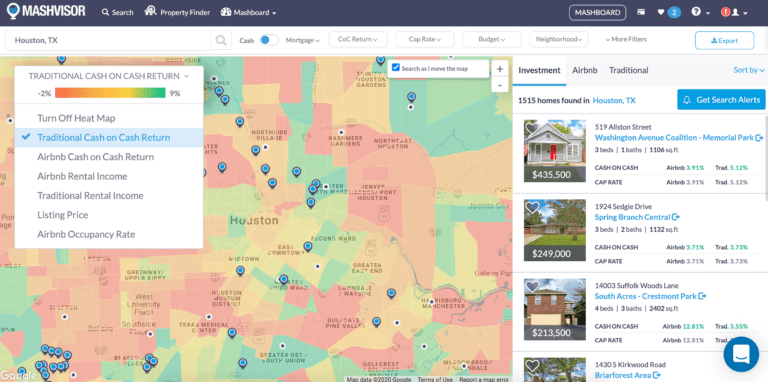

Let’s take a look at the number of positive things going on in the Chicago real estate market which can help investors who are keen to buy an investment property in this city.

Chicago Rental Market Is Very Strong

What makes Chicago such a hot market for rental real estate? Over 50% of the population rents. The large population of renters means that rental income for properties is far better than you’d see if you invested elsewhere in the country. Luxury Rentals Are a Profitable Niche in Chicago.

Many people know that there are solid blue-collar areas with high rents, but it isn’t just the working class that rents townhomes and condos. According to Crain’s, the number of upper-income households in Cook County that rent has nearly doubled over the past ten years.

The Institute for Housing Studies at DePaul University found that the number of rental households among those earning at least $132,000 a year nearly doubled, while those earning $80,000 to $132,000 saw the number of renting households increase by just over 50%. Chicago has a booming supply of high-end rentals, especially luxury apartments downtown.

Home prices in the Chicago area are low compared to regional income. Yet economic uncertainty and shifts in the employment market are leaving many who want to live in a single-family home unable to afford to buy one. This is causing many to rent single-family homes instead.

Crain’s last year’s April report found that the hottest areas for detached single-family homes were in Calumet Heights, Gage Park, and West Ridge. However, home prices are low compared to rents almost everywhere in the Chicago metropolitan area.

The workforce in Chicago is shifting from high paying but slow-to-no growth manufacturing jobs to lower-paying and less stable retail, business services, and healthcare jobs. This is causing many who would have been able to afford a middle-class home to rent apartments instead. Crain’s last year’s April report stated that the hottest Chicago markets for condos and townhomes were Grand Boulevard, Kenwood, and Lincoln Square.

Chicago Rental Trends: As of January 2021, the average rent for an apartment in Chicago, IL is $1826 which is a 1.15% increase from last year when the average rent was $1805, and a 0.16% increase from last month when the average rent was $1823.

- One-bedroom apartments in Chicago rent for $1639 a month on average (a 1.28% increase from last year).

- Two-bedroom apartment rents average $2192 (a 0.59% increase from last year).

- The average apartment rent over the prior 6 months in Chicago has decreased by $86 (-4.5%)

- One-bedroom units have decreased by $80 (-4.7%).

- Two-bedroom apartments have decreased by $94 (-4.1%)

According to RENTCafé, the average size for a Chicago, IL apartment is 749 square feet, with studio apartments are the smallest and most affordable, 1-bedroom apartments are closer to the average, while 2-bedroom apartments and 3-bedroom apartments offer more generous square footage.

490,497 or 46% of the households in Chicago, IL are renter-occupied while 565,621 or 53% are owner-occupied. The most expensive neighborhoods in Chicago are River West ($2,557), Streeterville ($2,566), and River North ($2,600).

The most affordable neighborhoods where the asking prices are below the average Chicago rent of $1,943/mo:

- Austin, where the average rent goes for $562/month.

- The Island, where renters pay $562/mo on average.

- Cottage Grove Heights, where the average rent goes for $612/mo.

- Fernwood, where the average rent goes for $612.

- Longwood Manor, where the average rent goes for $612.

- Princeton Park, where the average rent goes for $612.

Screenshot Courtesy of RENTCafé.com

Screenshot Courtesy of RENTCafé.com

Chicago Real Estate Prices Are Reasonable

Because households at all income levels choose to rent instead of buy, they are reducing demand for houses for sale, slowing the rise in home prices. This also explains why housing prices haven’t skyrocketed despite limited supply. Chicago’s inventory of homes for sale is very tight. Both attached and detached single-family home inventory has been declining since 2012.

At the end of 2017, potential buyers in Chicago had about five thousand fewer properties on the market to select from than if they’d been shopping at the end of 2016. This contributed to homes closing five days faster than the year before. If you start shopping for rental real estate, you could find something and rent it out.

Chicago’s real estate market has been one of the slowest to recover since the housing bubble burst at the start of the Great Recession. Home prices were 19% below their pre-crash levels in 2017, and they aren’t expected to hit peak values yet. This means that the Chicago real estate market is likely going to continue its slow, upward market trend.

Chicago Rehabbed Homes Are Readily Available

Chicago is seeing a surge in fully renovated single-family homes. The Chicago Association of Realtors’ data found that most of the strong suburbs are on the south side of Chicago, and this is where many homes are being rehabbed and sold. Calumet Heights is in this category; a quarter of properties sold were either rehabbed or candidates for rehabilitation. These properties are ideal for investors who want to buy a property to rent out.

Chicago’s Job Growth Keeps People Coming

Chicago is not only home to several corporate headquarters; there has been a recent trend of companies moving their headquarters to Chicago as well. The steady increase in jobs has contributed to a slow but steady increase in rents. Many businesses are attracted by Chicago’s labor pool, the largest in the nation.

As these businesses move into the area and attract relocating professionals, many are forced to rent because they can’t find houses fast enough in the areas they want to live in or simply choose to rent upon relocation in one of the luxury apartments downtown. The Chicago metropolitan area is made up of four metropolitan divisions—separately identifiable employment centers within the larger metropolitan area.

In the greater Chicago metropolitan area, education and health services had the largest employment gain from November 2018 to November 2019, adding 15,600 jobs. The Chicago area’s 2.1-percent rate of job growth in education and health services was lower than the nationwide advance of 2.9 percent.

Chicago’s government supersector added 10,800 jobs from November 2018 to November 2019. Local job growth was concentrated in educational services, which added 10,600 jobs. The 2.0-percent increase in Chicago’s government employment compared to a gain of 0.7 percent nationally.

The churn also keeps people renting in Chicago. Chicago’s unemployment rate has gone up while dropping in other cities as jobs shift from Chicago to the suburbs. This economic uncertainty keeps many who can afford to buy a home renting. It also keeps the rental market itself strong, since many want to remain free to follow their jobs as required.

Where to Invest in Chicago Real Estate Market?

In Chicago, arts and culture abound at top institutions like The Art Institute. Although the winters can test anyone’s resolve, Chicago summers are among the best in the world, with things to do every weekend, outdoor festivals, and Lake Michigan at your doorstep. Chicago has an incredibly deep pool of potential renters at all levels of the market. Several factors guarantee that they’re not going to turn into new home buyers any time soon.

Chicago real estate market is a prime destination for investors who would like to buy where the ROI is going to be high and likely to improve over time. It won’t be long before Chicago makes you feel right at home. Good cash flow from Chicago rental property means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding the best investment property in Chicago in a growing neighborhood would be key to your success.

When looking for the best real estate investments in Chicago, you should focus on neighborhoods with relatively high population density and employment growth. Both of them translate into high demand for housing. If housing supply meets housing demand, real estate investors should not miss the opportunity since entry prices of homes remain affordable.

The neighborhoods should be close to basic amenities, public services, schools, and shopping malls. A cheaper neighborhood in Chicago might not be the best place to live in. A cheaper neighborhood should be determined by these factors – Overall Cost Of Living, Rent To Income Ratio, and Median Home Value To Income Ratio. It depends on how much you are looking to spend and if you are wanting smaller investment properties or larger deals in Class A neighborhoods.

There are 76 neighborhoods in Chicago. Lincoln Park has a median listing price of $649.9K, making it the most expensive neighborhood. Auburn Gresham is the most affordable neighborhood, with a median listing price of $189.9K (on Realtor.com).

Some of the popular neighborhoods in Chicago, Illinois are Near North Side, Lakeview, West Town, Andersonville, South Loop, Bronzeville, Norridge, Logan Square, Old Town, Wicker Park, Bridgeport, Irving Park, Norwood Park, Bucktown, West Loop, and Hyde Park.

Chicago’s North Side is the city’s most densely populated residential section. In the $200,000 price, you can purchase properties with one or two bedrooms and one or two baths. Chicago’s West Side is home to the University of Illinois at Chicago. With a $200,000 budget, you can buy condos that typically offer one to two bedrooms and one or two baths.

You can buy Chicago investment properties in the Pilsen neighborhood. Pilsen is a great area for those who want a diverse portfolio of investment properties without having to run all over the city. Pilsen is located on Chicago’s Lower West Side. It features a mix of condos, apartment buildings, and single-family homes. The area is suburban enough to attract families. Its schools are a C+, which is close to the Chicago average. Parks and other amenities explain why Niche.com gave the area a B- for families.

CHECK OUT → Best Neighborhoods in Chicago Where You Can Buy Investment Properties.

Humboldt Park is another good neighborhood to buy investment properties in Chicago. The home prices in Humboldt Park peaked in 2006 but fell dramatically during the Great Recession. Home prices here hit a record low in 2012. Humboldt’s housing prices are on the rise again, though they remain below their 2006 peak. The average home price is around 300,000 dollars, while rents are around 1700 dollars a month. The area is notable for the number of foreclosed and distressed properties available to investors, and this helps pull the average rental rate down.

Highest Appreciating Chicago Neighborhoods Since 2000 (By Neighborhoodscout.com)

- N Whipple St / W Bloomingdale Ave

- N Campbell Ave / W Fullerton Ave

- W Diversey Ave / N Pulaski Rd

- W Armitage Ave / N Whipple St

- N California Ave / W Wabansia Ave

- N Francisco Ave / W Bloomingdale Ave

- N California Ave / N Milwaukee Ave

- N Maplewood Ave / W Wabansia Ave

- N California Ave / W Division St

- W Armitage Ave / N California Ave

Illinois is in the midwestern United States. Surrounding states are Wisconsin to the north, Iowa and Missouri to the west, Kentucky to the south, and Indiana to the east. Illinois also borders Michigan, but only via a northeastern water boundary in Lake Michigan.

Apart from the Chicago real estate market, you can also invest in the housing market of Indianapolis. The median sales price in Indiana saw a year-over-year increase of 9.7 percent to $170,000. Not surprising is the fact that Indianapolis house prices are also on the rise in the year 2020. Demand is still outpacing the supply, the new construction is slow, and competition for quality homes remains tough.

Like most cities nationwide, Indianapolis has experienced real estate appreciation over the last couple of years. The real estate appreciation rate in Indianapolis in the last quarter was around 0.81%, which amounts to an annual rate of 3.3%. However, it is quite unclear whether the rate of appreciation would remain steady or not due to the short term effects of the ongoing pandemic.

Economic uncertainty might hold back sales volume for a short period in 2020. Most housing analysts expect Indianapolis house prices to remain flat or drop by a small fraction for the remainder of the year 2020.

If you head towards the west of Illinois, you should consider investing in Kansas City, MO. There is probably no hotter market right now than Kansas City, Missouri. A large, prosperous, self-sufficient, and culturally-rich city, it is no wonder why it has seen a continuous rise in its employment, directly impacting the local real estate.

The Kansas City real estate market is very hot, and in many ways the envy of housing pundits on both coasts. It is the largest city in the U.S. state of Missouri, famous for its distinct barbeque cuisine and jazz heritage. Also nicknamed the City of Fountains, Kansas City is now emerging as a growing market for real estate investments. High demand and low inventory are driving up both home prices and the speed of home sales in the Kansas City Housing Market.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Chicago.

Consult with one of the investment counselors who can help build you a custom portfolio of Chicago turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Chicago.

Not just limited to Chicago or Illinois but you can also invest in some of the best real estate markets in the United States. All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete Chicago turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

Is It The Right Time To Invest In Real Estate? – The national homeownership rate is on the decline for the first time since 2017. As demographics change and baby boomers retire, you’re seeing Millennials who may not be ready to buy houses. In 2018, Millennials made up about 22 percent of the population in the United States. They’re choosing to rent over buying a single-family home or an apartment. Rising home prices and shortage of starter homes have not left Millennials many choices but to delay homeownership. Moreover, it’s even harder to take out a mortgage for those who have student loan debt.

Let us know which real estate markets in the United States you consider best for real estate investing!

Remember, caveat emptor still applies when buying a property anywhere. Some of the information contained in this article was pulled from third party sites mentioned under references. Although the information is believed to be reliable, Norada Real Estate Investments makes no representations, warranties, or guarantees, either express or implied, as to whether the information presented is accurate, reliable, or current. All information presented should be independently verified through the references given below. As a general policy, the Norada Real Estate Investments makes no claims or assertions about the future housing market conditions across the US.

Recent Comments