15 Cities with the Highest Rents in the US in 2021

How to Calculate Your Future Airbnb Returns

When it comes to buying a rental property, the most important thing you need to focus on is location. One of the factors to consider when looking for the best places to invest in real estate is the potential rental income. High and growing rental prices could be an indication that the market has a high renter population and, consequently, a strong demand for rental properties. Investing in cities with the highest rents means that you’ll be able to earn high rental income. This increases your chances of finding a rental property that produces rental income that is high enough to cover rental expenses and bring positive cash flow. Therefore, if you are interested in buying rental property for cash flow, one strategy to adopt is to search for investment opportunities in cities with the most expensive rentals.

Related: How to Choose a Real Estate Market to Invest In

In this article, we review 15 cities with the highest rents in the US in 2021 to help make your property search even easier. We shall focus on traditional rental income but will also include a few other key metrics such as median property price, price to rent ratio, and cash on cash return as you shouldn’t select a location based on one number. The rental data is derived from reliable sources such as Zillow and the MLS and the projections are done using Mashvisor’s sophisticated algorithms.

With that in mind, here are 15 cities with the highest rents in the US in 2021:

15 Best Cities for Rental Income in 2021

1. San Francisco, CA

- Median Property Price: $1,484,192

- Price per Square Foot: $1,041

- Price to Rent Ratio: 29

- Monthly Traditional Rental Income: $4,262

- Traditional Cash on Cash Return: 1.2%

2. Santa Barbara, CA

- Median Property Price: $1,818,142

- Price per Square Foot: $899

- Price to Rent Ratio: 38

- Monthly Traditional Rental Income: $3,987

- Traditional Cash on Cash Return: 1.2%

3. Pasadena, CA

- Median Property Price: $1,181,791

- Price per Square Foot: $641

- Price to Rent Ratio: 25

- Monthly Traditional Rental Income: $3,890

- Traditional Cash on Cash Return: 1.8%

4. Long Beach, CA

- Median Property Price: $946,010

- Price per Square Foot: $529

- Price to Rent Ratio: 21

- Monthly Traditional Rental Income: $3,816

- Traditional Cash on Cash Return: 2.2%

5. Key West, FL

Pictured above are homes for sale in the Key West real estate market – one of the markets with the highest rents in 2021.

- Median Property Price: $1,103,559

- Price per Square Foot: $750

- Price to Rent Ratio: 25

- Monthly Traditional Rental Income: $3,745

- Traditional Cash on Cash Return: 2.9%

6. Los Angeles, CA

- Median Property Price: $1,209,782

- Price per Square Foot: $655

- Price to Rent Ratio: 27.15

- Monthly Traditional Rental Income: $3713

- Traditional Cash on Cash Return: 1.83

Related: Los Angeles Housing Market: Where to Invest

7. Glendale, CA

- Median Property Price: $1,077,681

- Price per Square Foot: $585

- Price to Rent Ratio: 25

- Monthly Traditional Rental Income: $3,601

- Traditional Cash on Cash Return: 2.0%

8. Great Neck, NY

- Median Property Price: $1,237,292

- Price per Square Foot: $554

- Price to Rent Ratio: 29

- Monthly Traditional Rental Income: $3,535

- Traditional Cash on Cash Return: 0.6%

9. Anaheim, CA

- Median Property Price: $778,374

- Price per Square Foot: $426

- Price to Rent Ratio: 19

- Monthly Traditional Rental Income: $3,504

- Traditional Cash on Cash Return: 2.7%

10. Irvine, CA

- Median Property Price: $1,024,747

- Price per Square Foot: $516

- Price to Rent Ratio: 25

- Monthly Traditional Rental Income: $3,437

- Traditional Cash on Cash Return: 1.6%

11. Jupiter, FL

- Median Property Price: $820,119

- Price per Square Foot: $357

- Price to Rent Ratio: 20

- Monthly Traditional Rental Income: $3,386

- Traditional Cash on Cash Return: 3.4%

12. Huntington, NY

- Median Property Price: $878,967

- Price per Square Foot: $413

- Price to Rent Ratio: 22

- Monthly Traditional Rental Income: $3,382

- Traditional Cash on Cash Return: 2.1%

13. Torrance, CA

- Median Property Price: $913,702

- Price per Square Foot: $551

- Price to Rent Ratio: 23

- Monthly Traditional Rental Income: $3,378

- Traditional Cash on Cash Return: 2.1%

14. Scottsdale, AZ

- Median Property Price: $994,334

- Price per Square Foot: $354

- Price to Rent Ratio: 25

- Monthly Traditional Rental Income: $3,339

- Traditional Cash on Cash Return: 3.2%

15. Middletown, NJ

- Median Property Price: $558,245

- Price per Square Foot: $266

- Price to Rent Ratio: 15

- Monthly Traditional Rental Income: $3,045

- Traditional Cash on Cash Return: 3.6%

Related: 50 Best Cities for Rental Income

How to Find the Best Rental Properties with the Highest Rents

Now you know the 15 most expensive cities in the US to rent that you can invest in in 2021. However, knowing cities with the highest rents in the US is not enough to find a profitable investment property. You need to do your due diligence to find rental properties for sale with the highest rents that provide good returns. Here are the steps:

#1. Select the Best City

First, you’ll need to narrow down this list by identifying cities with the most expensive rent that fit your budget. Check the median property price to ensure that it’s within your budget. From the remaining list, identify cities with the highest rents. Also, consider the traditional cash on cash return data as this shows the potential return on investment.

Is Buying a Tiny House a Good Investment in 2021?

For example, the Great Neck real estate market may provide a high rental income. But the average cash on cash return for the city is a mere 0.6%. So you may want to eliminate such a city at this stage.

#2. Find a Profitable Neighborhood

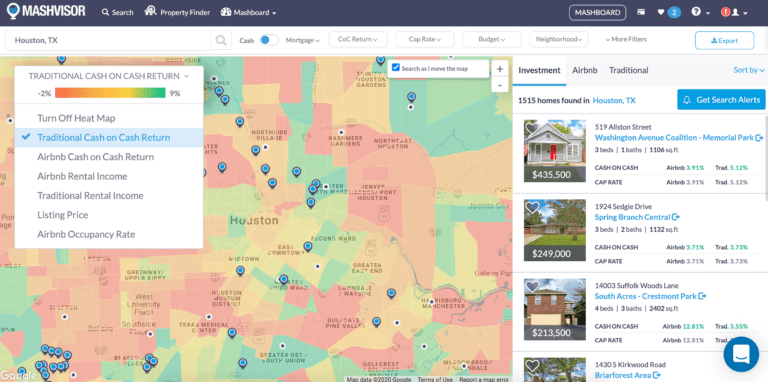

After you have identified the best city according to your budget and investment goals, the next step is to research the market to determine the best-performing neighborhood in the city. You can use Mashvisor’s Real Estate Heatmap to conduct a neighborhood analysis based on key real estate metrics such as rental income, listing price, and cash on cash return. The “rental income” filter should be your focus if you want to find neighborhoods with the highest rents. This will help you narrow down your target investment location even further.

#3. Narrow Down Your Options

With a profitable neighborhood in mind, you can begin your investment property search. Mashvisor’s Property Finder can help you to quickly find rental properties for sale that match your investment criteria and preferences. This search tool offers several interactive filters such as location, budget, property type, rental strategy, and the number of bedrooms/bathrooms.

#4. Conduct Rental Property Analysis

The final step to finding investment properties with the highest rents is to use Mashvisor’s Rental Property Calculator to calculate the potential rental income of investment properties for sale you’ve selected. This tool provides a full rental property analysis based on reliable rental comps. Apart from rental income, you will get accurate estimates of rental expenses, cash flow, cap rate, cash on cash return, and more.

When buying luxury real estate, it’s also important that you ensure it generates good cash flow and a good return on investment. The highest rents won’t always guarantee a positive cash flow and a good ROI. It’s recommended that you only invest in cash flow properties, especially if you are still a beginner real estate investor. Using Mashvisor’s Rental Property Calculator is the best way to ensure this.

Find a Profitable Traditional Rental Property

The Bottom Line

If you want to invest in real estate for cash flow in 2021, finding an investment property with a high monthly rental income is crucial. To increase the odds of finding such a property, you should consider investing in real estate markets with the highest rents. To make your property search easier, we have done all the leg work and provided you with a list of the most expensive cities to rent in the US in 2021.

However, you should keep in mind that the most expensive cities to rent don’t always guarantee a positive cash flow. You need to perform a thorough investment property analysis to ensure that the specific property you invest in has good cash flow and ROI. There’s no easier and more accurate way to do so than to use Mashvisor’s real estate investment property tools for your property search and analysis.

Start Your Investment Property Search!

Key West FLLong Beach CALos Angeles CARental IncomeSan Francisco CAScottsdale AZ

Key Metrics: Average Airbnb Daily Rate Explained

Recent Comments